Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

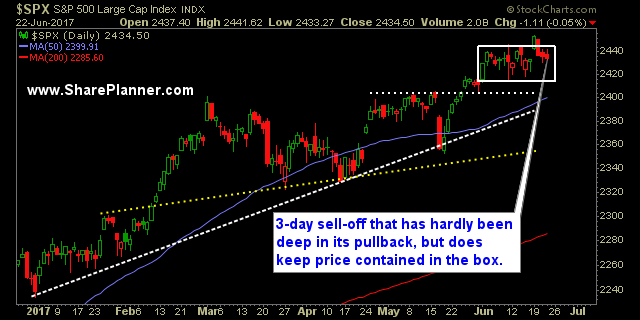

Stocks and Indices continue to trend sideways Outside the first trading day of the month, the market has absolutely gone nowhere. Stock trends in general have been totally sideways or in more technical terms, “consolidating”.

Prepare for the funds to start window dressing their quarterly and 6 month reports This is one of those points in the year, where the funds become very concerned by their performance. So much so, that they’ll start what is commonly known as ‘window-dressing’ their portfolios with all the right stocks so that they can

The latest episode of “wild ramps” at market close, saw 10 straight 5 min red bars. The S&P 500 and the market as a whole was holding steady for the entire trading session until about 40 minutes remained and then that is when we saw another example of how wild ramps into the close can

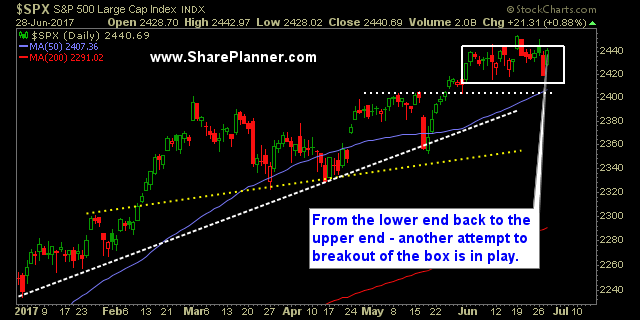

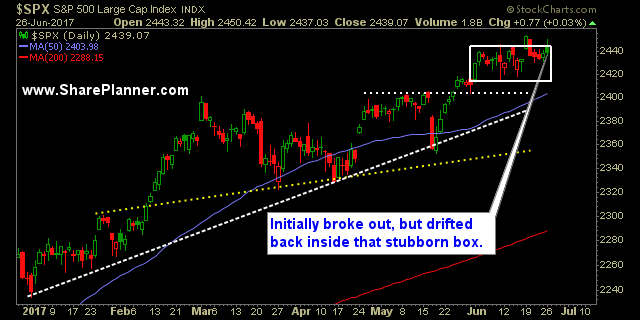

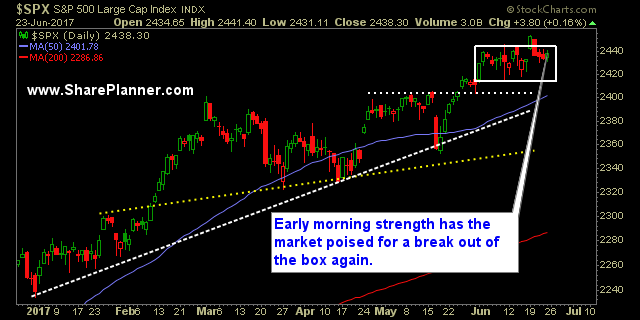

On Monday, it looked like the market was prime for a breakout in trading Since then it has only resulted in a head fake kind of maneuver. I'm glad to be back after a short summer vacation over the last week. But when it comes to trading, there isn't much time off, so while I

The famous Darvas Box Breakout setup is back at it again. But trading Darvas’ box breakout doesn’t mean you ignore the downside risk either, because if the market breaks down and out of the box, it becomes just as legitimate of a trade setup as the breakout would be.

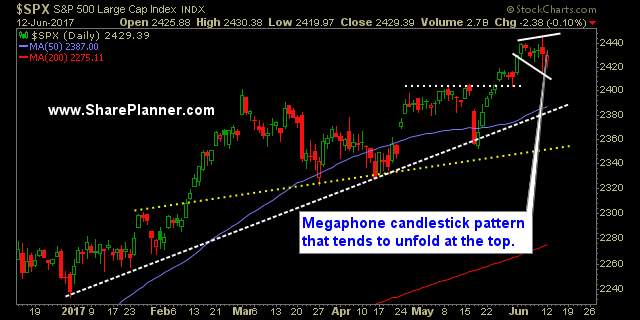

Current Megaphone Price Pattern Starting to Favor Bulls The bears are letting yet another opportunity to correct this market slip through their hands. It is quite astounding really. I mean, you have a solid opportunity with last Friday's sell-off to put the bulls against the ropes, and they do, but along the way, they let

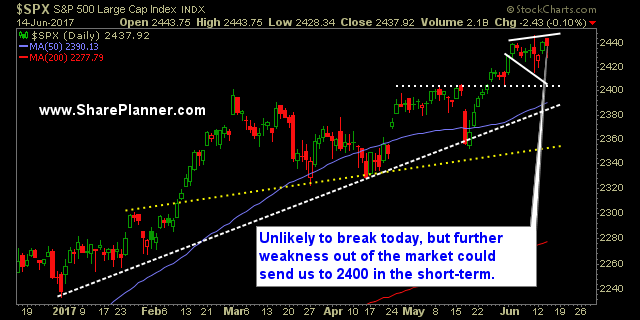

‘Hawkish Rate-Hike’ Gets the market in a tizzy But lets not kid ourselves, all this talk about a ‘hawkish rate hike’, whatever that means, probably gives the bulls another opportunity to by the dip. If the bears can pull it together today, it could be a very nice for their short positions. But it is

Megaphone trading pattern being tested by the dip buyers Of course, you get the feint scent of a sell-off or down day of any kind in the stock market, the bulls will buy the dip as fast as they possibly can, which makes trading patterns like the megaphone, difficult to realize its full potential. That

Short-term bearish megaphone pattern showing itself. Much of it comes from the fact that Friday’s crazy doji pattern has created this megaphone pattern, but nothing happened today to change the look of it either.