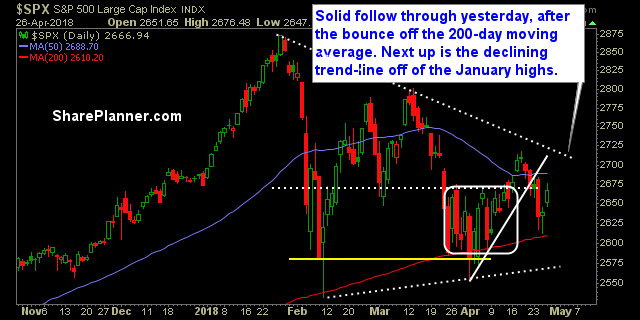

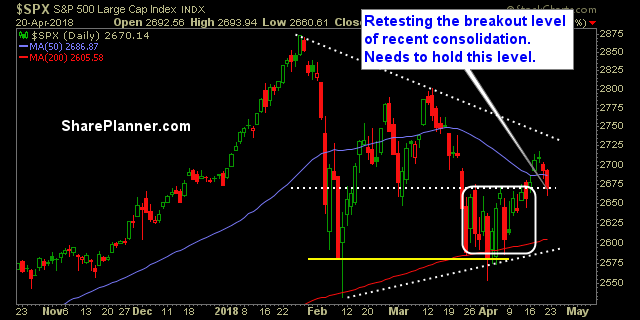

My Swing Trading Approach I remain cautious here, as the bulls are struggling to rally the market substantially higher. Plenty of choppiness in the market. I don’t see myself adding any more than 1-2 new positions to the portfolio if conditions permit. Indicators

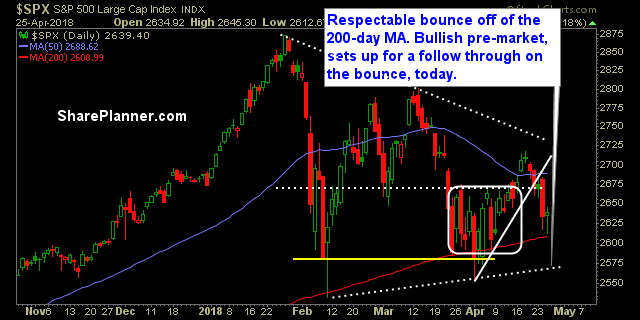

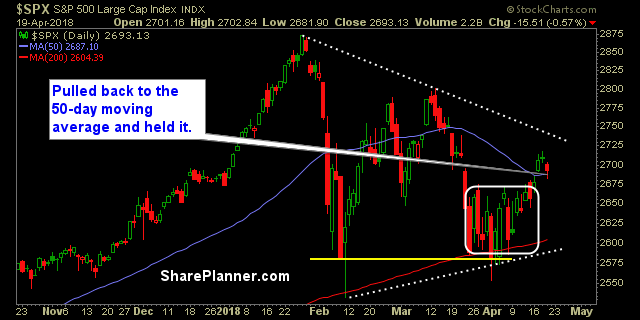

My Swing Trading Approach Caution is warranted here, as the market may give up the gains of the past three days. It is important to make the market prove itself here to you, and not front run any anticipated market bounce. Let the market show you it wants to bounce first. Indicators

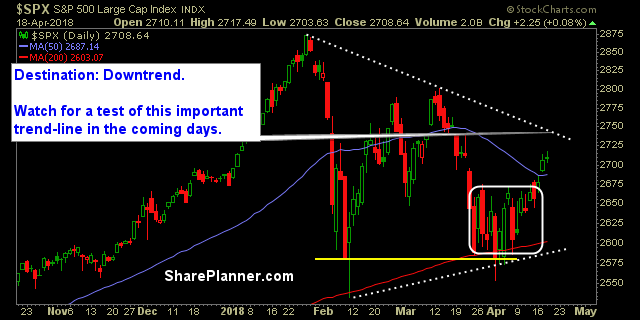

My Swing Trading Approach I expect to add some additional long exposure today, as long as the early gains can remain intact in the early going. I may also add some short exposure if the market closes the gap, and continues to establish new lows . Indicators

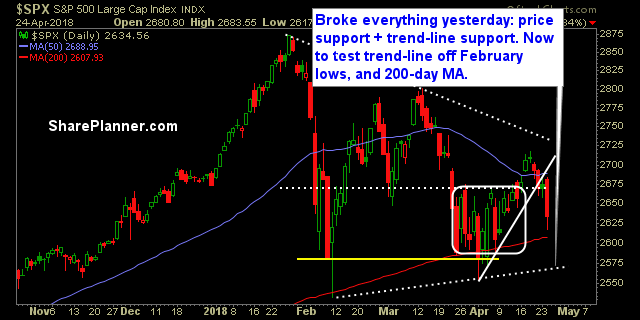

My Swing Trading Approach I will look to add 1-2 new long positions today once the market gets past the first 30 minutes of trading, and if it can hold on to its early morning gains. Raise the stop in my existing long, profitable trades. Indicators

My Swing Trading Approach I have one long position coming into today. I covered my short position yesterday on SPY for a 3.1% profit. Looking to add additional long positions, as the market allows for, today. Indicators

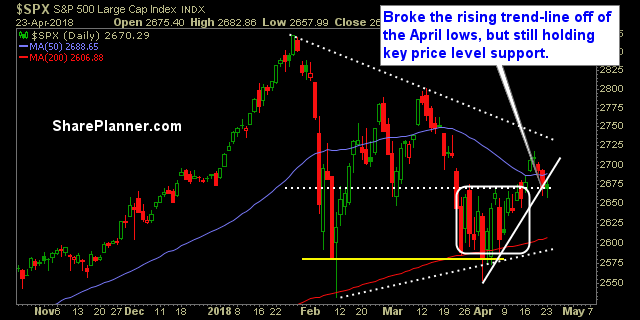

My Swing Trading Approach Flexibility over conviction. I want to play the market whichever direction it decides to take me. I don’t hold a strong conviction about this market either way, and as a result, I don’t want to have too much of my capital committed at once. Indicators

My Swing Trading Approach Gap ups of late have been difficult to hold, but nonetheless, should it do so, I will look to cover my one short position, and add to my long positions. Indicators

My Swing Trading Approach The 10-year rate is increasing, which is cause for concern. Also, a slew of earnings reports this week, to keep a close eye on. Lighter in the portfolio, is better, until there is some trading clarity. Indicators

My Swing Trading Approach I lightened up my portfolio yesterday, following the pullback, and booked 5% in my trade in Anadarko Petroleum (APC). The market remains bullish overall, and will look to add 1-2 new positions today Indicators

My Swing Trading Approach I am not opposed to adding more trades to the portfolio today, but the market needs to be favorable for it to happen. We could see a pullback, and I don’t want to buy ahead of that, even if it is likely to be just temporary. Indicators