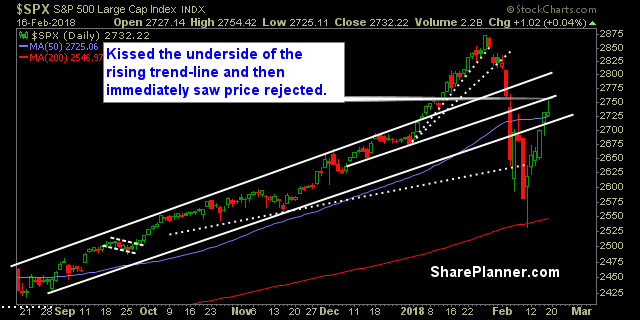

My Swing Trading Approach There is a solid possibility that I put a couple of short positions to work today. Plenty of trade setups to the downside are out there, and bears may be hitting the end of this dead cat bounce. If not, then I will look to continue playing the long side.

My Swing Trading Approach Three day weekend ahead of us, where I will likely take a more passive approach to trading today, while raising my stop losses on all the positions in my portfolio to protect profits. Indicators

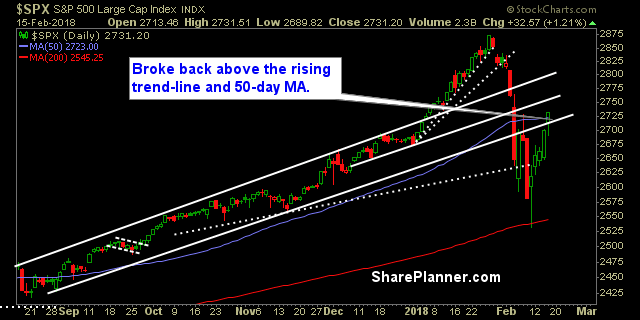

My Swing Trading Approach I have large gains in Bank of America (BAC), Apple (AAPL) and Amazon (AMZN) after buying the dip last Friday, and have added a few more positions since. Will look to add more if there are more opportunities that arise. Indicators

My Swing Trading Approach Right now, I want to increase my stop-losses and maintain flexibility with the market by not overloading my portfolio with long positions. CPI report will greatly influence whether I am going to be adding any short positions in the future. Indicators

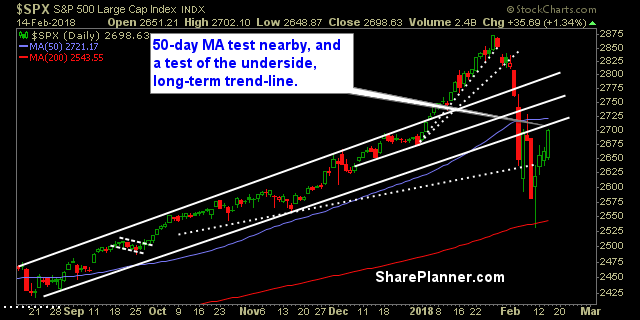

My Swing Trading Approach Right now, I have plenty of trades to work with in the portfolio. I may still add more to the portfolio, but I want to see how this morning’s weakness plays out. If necessary, I will begin booking gains, and even consider a short position if this market decides to roll

My Swing Trading Approach I am looking to add 1-2 new long setups to the portfolio today, if the market rally can continue, targeting large cap, quality stocks that are bouncing off of key support. Indicators

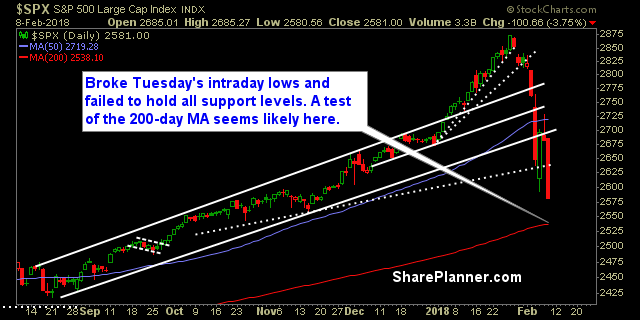

My Swing Trading Approach I am 100% cash right now. I am willing to play the bounce, but will likely only add a couple of positions in the early going. Watch for a possible market fade of the early gains ahead of the weekend, just as we saw last week. Indicators

My Swing Trading Approach I’m not looking to add new positions to the portfolio unless this market can show itself capable of sustaining a bounce. Indicators

My Swing Trading Approach Wait and see if the market wants to continue with the bounce off of the morning lows. If not, it will be a time to sit on my hands and watch. Indicators

My Swing Trading Approach There will be a substantial bounce to play at some point in the future. I will sit on the sidelines until that time is unveiled. Indicators