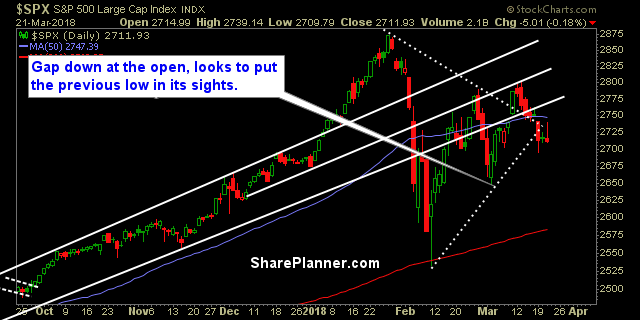

My Swing Trading Approach With the large gap down this morning, the market is in dangerous territory, and risks breaking Monday’s lows and eventually the February intraday lows. As a result, I will stay put in my trading, until the market has provided me with a more definite trading edge to work with. Indicators

My Swing Trading Approach Today, I will look to add 1-2 new long positions, if the bulls can squeeze the bears and drive this market higher. Indicators

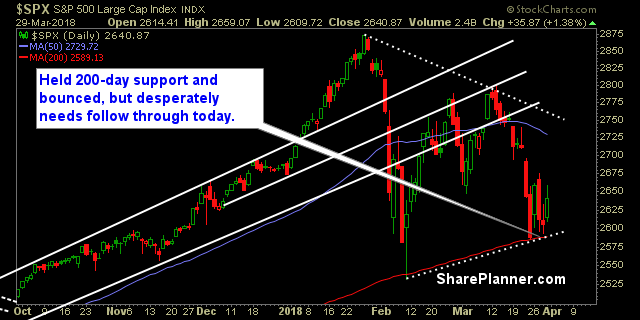

My Swing Trading Approach Wait and see for this market. I have some long exposure, but the market has to show that it can sustain this bounce from Friday, in order for me to add more swing-trades to the portfolio. Indicators

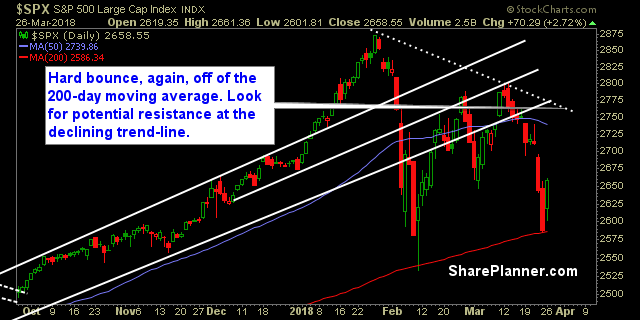

My Swing Trading Approach I am looking to play the bounce this morning. Will look to add 1-3 new positions to the portfolio today, should the bounce hold. Clear risk/reward setup with this market going forward. Indicators

My Swing Trading Approach I am looking to play the bounce this morning. Will look to add 1-3 new positions to the portfolio today, should the bounce hold. Clear risk/reward setup with this market going forward. Indicators

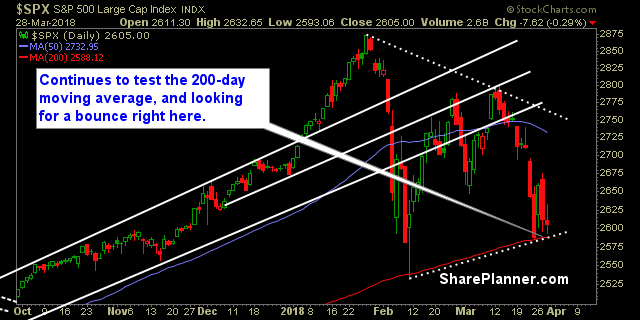

My Swing Trading Approach I will look to remain light today, while waiting to see whether the bears can break the 200-day moving average on SPX. At which point, I may add some more short exposure. Indicators

My Swing Trading Approach I will look to add another 1-2 positions should the rally sustain itself today, along with increasing my stop-losses as well. Indicators

My Swing Trading Approach Still 100% cash, but will look to add 2-3 positions in the early going on this market rally. Indicators

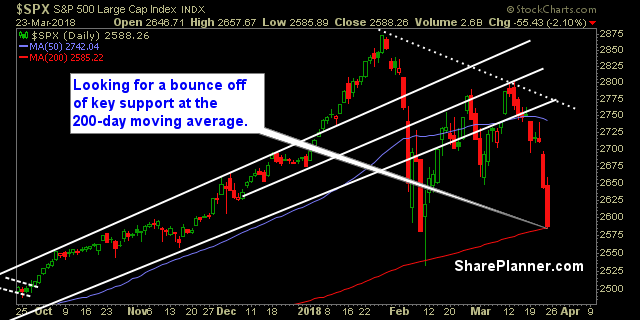

My Swing Trading Approach Currently, I am 100% cash and will stay that way, until there is a definable edge in this market. Indicators

My Swing Trading Approach I am only 30% to the long side. I will manage the risk on those three positions and likely be back all in cash early on. I may short the market today, but the large gap down makes it quite difficult to do so. Indicators