My Swing Trading Approach

Flexibility over conviction. I want to play the market whichever direction it decides to take me. I don’t hold a strong conviction about this market either way, and as a result, I don’t want to have too much of my capital committed at once.

Indicators

- VIX – Sizable pop of 10% yesterday. But remains range bound over the last two-plus months. Very possible we see another move into the mid-20’s again, in the weeks ahead.

- T2108 (% of stocks trading below their 40-day moving average): Broke back below 50% yesterday, and a 12% one-day decline. Upward trend remains in place

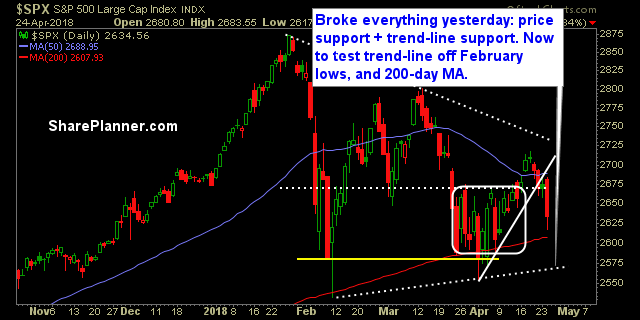

- Moving averages (SPX): Failed to hold the 5 and 10-day moving averages early on, and then broke the 20-day moving average thereafter. Likely to test the 200-day MA in the coming days, possibly today.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Energy remains the strongest sector still. Despite the sell-off yesterday, it is consolidating near the top of its rally highs. Utilities holding the line, not blasting higher, but holding strong despite the recent selling. Technology showing considerable weakness, and a possible head and shoulders pattern forming.

My Market Sentiment

Based off the chart below, I have a hard time believing we won’t re-test the 200-day moving average and even support underneath, before ultimately bouncing yet again.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Short Position

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.