My Swing Trading Approach

Gap ups of late have been difficult to hold, but nonetheless, should it do so, I will look to cover my one short position, and add to my long positions.

Indicators

- VIX – Dropped 3.2% yesterday, and snapped the 3-day rally. Look for a retest of last week’s lows and then a test of the March lows.

- T2108 (% of stocks trading below their 40-day moving average): Remained flat yesterday, and signs that the market is trying to stabilize after the selling in recent days.

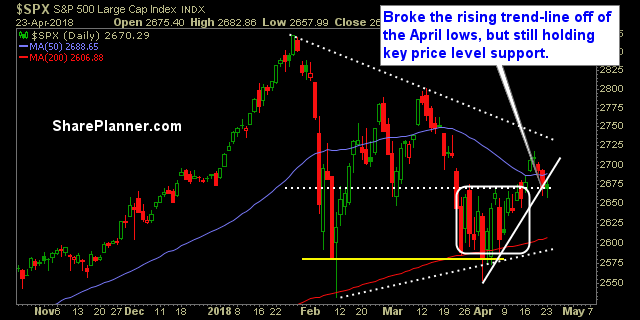

- Moving averages (SPX): Look for an attempt today, to recapture the 5, 10 and 50-day moving averages.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Energy bounced back yesterday and was the strongest sector once again. Its strong uptrend continues. Discretionary remains in a solid uptrend off of the April lows. Technology was one of the weakest sectors, and must bounce today.

My Market Sentiment

Earnings season is in full swing. The bulls need to take full advantage of it, in order to keep the market momentum going. Today we have a gap higher at the open, but of late we have seen numerous gaps fade at the open. I expect to remain light in my portfolio, and trade the market what ever direction it decides to take me.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Positions, 1 Short Position