My Swing Trading Approach

I will look to add 1-2 new long positions today once the market gets past the first 30 minutes of trading, and if it can hold on to its early morning gains. Raise the stop in my existing long, profitable trades.

Indicators

- VIX – Still, on the daily chart, VIX remains directionless. Dropped 9% yesterday down to 16.24.

- T2108 (% of stocks trading below their 40-day moving average): Remains a very bulllish indicator, and providing a reading at 54%. Higher-highs and higher-lows remain in place.

- Moving averages (SPX): Broke back above the 10-day and 20-day moving aveages. The 5 and 50-day moving aveages are in play today.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Technology was the strong sector yesterday, but the trading pattern doesn’t look nearly as it did a few weeks ago. A lot of chop here. Healthcare forming a cup and handle pattern in the short-term. Industrials becoming the weakest of all the sectors here. Hasn’t broken down yet, but should this market start to sell-off again, I suspect Industrials will lead the way lower.

My Market Sentiment

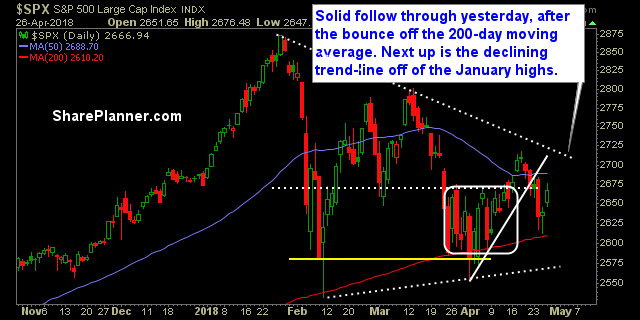

That was the follow-through the market needed yesterday, after the previous day’s bounce off of the 200-day moving average. Watch to see whether the bulls can break last week’s highs, and then then declining trend-line off of the January highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Positions