My Swing Trading Approach

The 10-year rate is increasing, which is cause for concern. Also, a slew of earnings reports this week, to keep a close eye on. Lighter in the portfolio, is better, until there is some trading clarity.

Indicators

- VIX – Small increases in VIX over the last three days – nothing shown that would render support for an increasingly emotional market. I can see the VIX quickly getting sold off again.

- T2108 (% of stocks trading below their 40-day moving average): A 7.5% decline yesterday, still keeps the T2108 above 55%, which constitutes a healthy market at this juncture.

- Moving averages (SPX): Broke the 5, 10 and 50-day moving averages. Very possible that there is a retest of the 20-dayy moving average, even though it has done much better acting as resistance than as support.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Staples continues to sell off hard and should be avoided at all costs. Technology, yet again, sold off for a third straight day. Unlike staples, tech hasn’t been compromised by a breakdown. Financials has held up well over the last two days, and the recent bearishness is quickly disappearing.

My Market Sentiment

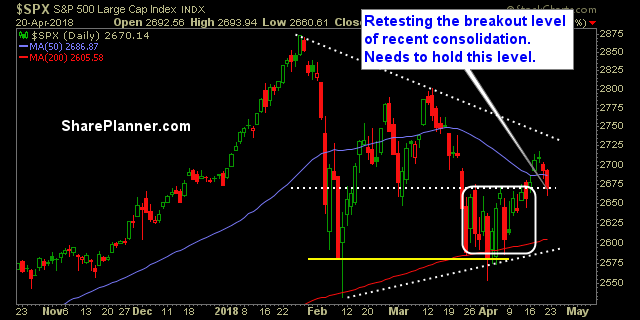

Two straight days of solid selling has brought price on SPX back to the rising trend-line that started when the market bottomed on April 2nd. The market must bounce today, if it has any plans of holding that trend-line. Also, note that the breakout of consolidation last week, is being retested again today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.