Netflix (NFLX) – Major Rally After Dropping Warner Bros Bid

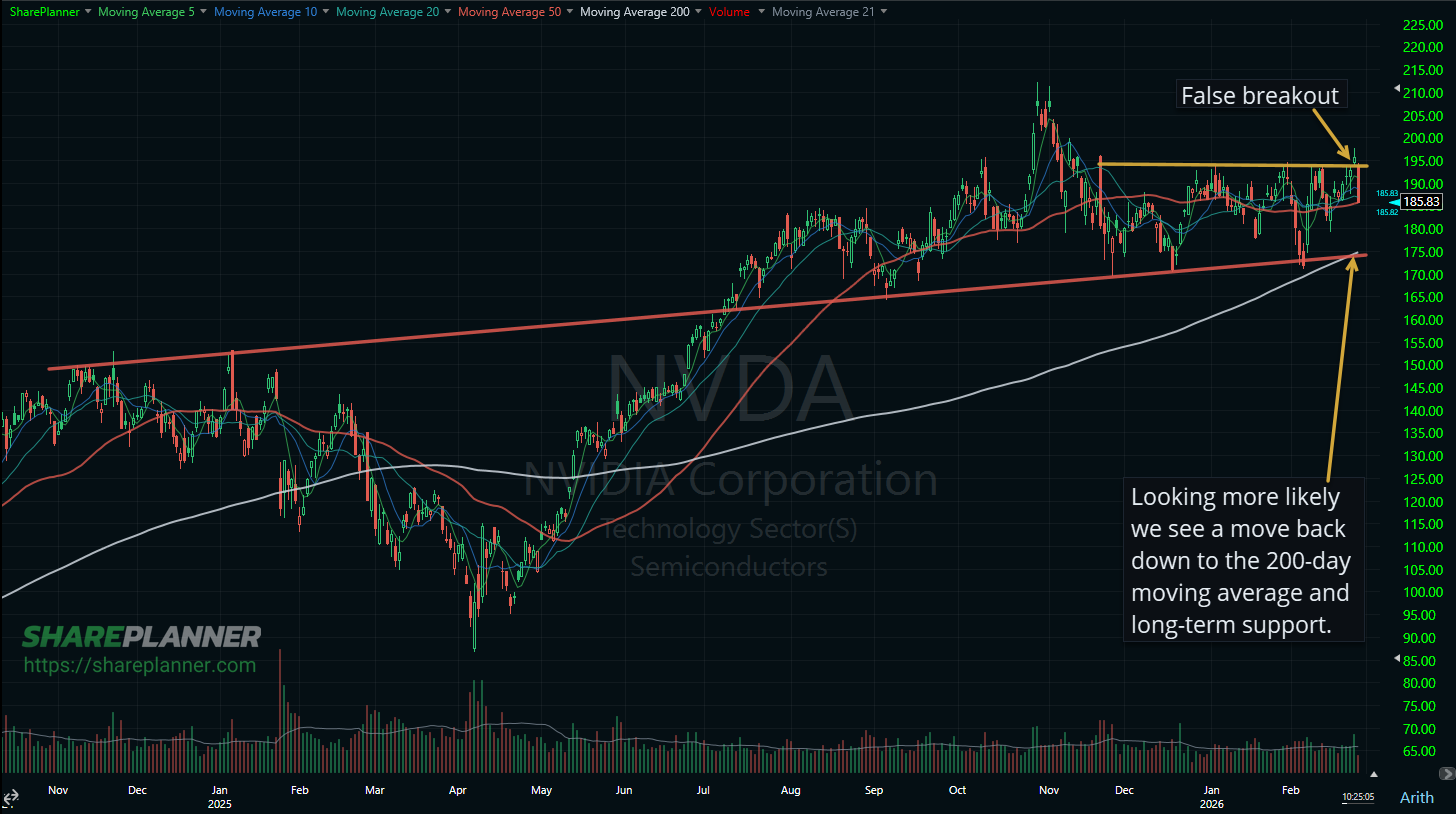

NVIDIA (NVDA) delivered another market-moving earnings report. The stock

PayPal (PYPL) is catching attention again as buyout rumors

If we were truly honest with ourselves, I think

Livestream Mon-Thurs 9am ET

– Coming Soon! –

Latest Video

My Podcast

More Posts

Alphabet (GOOGL) is presenting an interesting technical setup that has me watching closely. There are bullish elements developing on the chart, but several factors still give me pause before committing capital to the long side. The Bullish Case: Support and Pattern Development The stock has found support at previous lows, which is encouraging. When price

Sandisk (SNDK) has been one of the biggest stories of the stock market over the last six months, running over 1,500% higher, seemingly out of nowhere. But now we're seeing the first consolidation out of the stock, since the initial run began and in the process some bullish technical patterns have emerged. But is it worth

Broadcom (AVGO) has been trading in a choppy, sideways pattern for months now. With a head and shoulders pattern having formed, is this stock ready to sell-off, or fake the bears out and bounce off the neckline? In this video, I'm going to dissect the AVGO chart and determine whether this is a buy, hold

CRWV Technical Analysis and Trade Outlook CoreWeave (CRWV), a fast-growing player in the AI infrastructure space, has been on many traders’ watchlists and CRWV’s recent price action shows volatility and indecision that traders should approach carefully. In today’s video, I break down: The CRWV daily chart trend Major support zones where demand may re-enter Resistance

Charles Schwab (SCHW) – Massive Sell-Off & What Traders Should Do Now SCHW dropped roughly 15% in a sharp move lower that caught many traders off guard. Large sell-offs like this tend to raise the same question: is this a buyable dip or a sign of real technical weakness? In today's video, I break down:

The overall market continues to frustrate traders with choppy, directionless price action. All three major index ETFs - SPY, QQQ, and IWM - remain range-bound, making it difficult to capture momentum or follow-through in either direction. In today’s video, I dive into each chart and examine: Where major support and resistance levels are forming How