June saw continued success for traders in the Trading Block.

I was quite satisfied with my swing trading results, especially when you consider just how mundane the overall market was. There was plenty of ‘back-and-forth in the stock market.

There were two critical moments for the stock market:

-

The first was the false breakout on June 19th

-

The second was the false breakdown and intraday bounce on June 29th.

The former led traders to believe the market was breaking out in a substantial way – starting the next leg higher for stocks overall, while the latter caused traders to scale back in their long positions and get net short.

Both scenarios had the potential to trap traders and that’s never good. In the end, the market was range bound trading in a tight 2% range and only 12 points higher on the S&P 500 or 0.5% from the month prior.

But for me and traders in the Trading Block it was a success. Here is how we did:

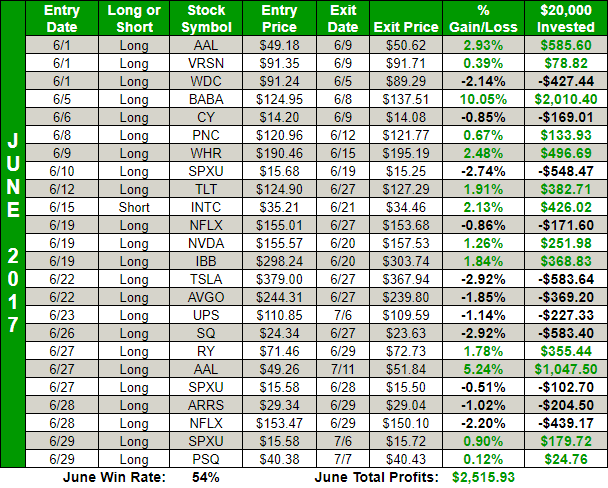

The win rate was a respectable 54% on 24 trades. Let’s breakdown the winning percentage further:

-

I was profitable on 13 out of 24 (54%) of my trades.

-

10 out of 19 (53%) trades were profitable that were focused on bullish/long setups.

-

3 out of 5 (60%) trades were profitable that were focused on bearish/short setups.

-

4 out of 6 (67%) trades were profitable using exchange traded funds (ETFs).

-

9 out of 18 (50%) trades were profitable that were equities.

For one, half of the trading sessions last month (out of 22) were days in which the S&P 500 finished lower. Which matches up well with the sideways narrative of the stock market that month.

When you look at my swing trading results, I was best served when I traded short and when I traded with ETFs.

Much of the reason for this was that there was big moves in the broader market to the downside. When the market rallied, outside of the first two days of the month, it was barely worth yawning at. It was dull. Very dull.

If it wasn’t for those two days at the beginning of the month and the rally on the 19th, the stock market would have royally sucked for the bulls.

My best moment came when I bought Alibaba (BABA) on the 5th of June at $124.95 and sold it on the 8th at $137.51 for a 10.1% PROFIT.

Alibaba continues to be one of the best stocks to trade right now. The chart patterns are crisp, they have been reliable and the follow through, day-to-day, has been amazing.

It reminds me of the success with trading Netflix (NFLX) last year when we had a +90% win rate with it. Of course NFLX sucks big time when it comes to trading this year. I yearn for the days when it traded in the 90’s – full of life, with the world at its fingertips. Today it only moves if you trade its earnings report [rant over].

But BABA – that stock has become my jam in 2017. Even now I am in it, and up over 7.5% on it in the past week.

The Stock Market’s Ugly Sell-Off

The 20th of June was brutal, because the sell-off was so unconventional. The day before, the stock market had rallied hard and was impressive at doing so. The 16 point sell-off on SPX and the follow through the next two days was not typical for a market that made convincing new all-time highs just the day before.

That bull trap sucked in a lot of traders the day before and made them pay for it dearly I had added three new positions and two out of three of them held strong – Nvidia (NVDA) and iShares Biotech ETF (IBB). On the other positions I was holding at that time, I was consistently moving my stop-loss up along the way, so that the sell-off from that day, did not send us spiraling downward.

Speaking of IBB though, that is one stock, that I misread. The stock did fine on 6/20 when the market sold off, but the massive amount of volume that suddenly poured into it, and the afternoon decline, gave the illusion of a blow-off top. I couldn’t be more wrong in that regard as the next two days it continued to rally hard and fast to the upside with continued volume pouring in.

What worked for my swing trading results and what didn’t work:

With any track record, it’s important to evaluate the trends of worked best and what I should have avoided all together.

Here is what worked best for me:

-

Airlines

-

Short Semiconductors

-

Consumer Cyclicals (i.e. Retail)

-

Banks

-

Bonds

The airlines were all phenomenal trading setups. American Airlines (AAL) was traded twice – both times for solid profits. Banks were also pretty good to, with PNC Financial Services (PNC) and Royal Bank of Canada (RY). JPMorgan Chase (JPM) and Citigroup (C) would have been better in hindsight, but the banks I traded didn’t hurt me at all either.

Finally, I don’t usually trade the bond ETFs, but I did in June, and it was a boring yet profitable trade as well. I held it for about two weeks, bringing in almost 2% in profits.

RELATED: Swing Trading Stock Market Performance for May

Being long on the Semiconductors had mixed swing trading results. I was profitable on NVDA, but missed the mark on Broadcom (AVGO) and Cypress Semiconductor (CY). My short on Intel (INTC) though turned out quite nicely and was my best trade among all the semis that I traded. Ideally, I probably should have held on to my INTC short a bit longer, but with the market behaviors we have seen of late, I underestimated just how great the INTC trade really was by avoiding the possibility of one of those God-forsaken dead cat bounces.

Here is what didn’t work well for me:

-

Shorting the S&P 500

-

High beta fad stocks

-

Long Semiconductors

In 2016, Netflix was an AMAZING stock to trade. Absolutely fabulous! This year though, I can’t get on the right side of the that trade to save my life.

Unless it is earnings day for NFLX, the stock is an absolute bore. Otherwise it just trades sideways from one earnings report to the next.

On to more important things though – shorting the S&P 500 – 1 out of 3 successful trades. The dead cat bounces were so hard and fast, that it was very difficult to hold on to profits in those bearish ETFs.

For a month that was as sideways as a stock market could possibly be, it was still a good month for my swing trading results.

There are definitely positions that I would have liked to have held onto longer. Trades that I wish I could rode even higher. But a sideways market is probably one of the worst markets to trade because that is when the market lacks conviction and doesn’t provide clear direction.

That is when you have to be a good stock picker. Play both sides of the market, and when you get a good winner, whether it be AAL or BABA, you let it run as long as you can. If the stock isn’t going anywhere for you, cut the losses and move on.

It is much easier to get more out of the market whether it be to the upside or downside to profit from in bigger chunks. Sideways markets, like what was seen in June – not so much.

But you can still profit like we did in the Trading Block.

If you don’t force your will or desire for what you want the stock market to be, and instead take the market for what it currently is and then manage the risk governing your trades, the winners will come and when they come, you ride those winners as long as you possibly can.

Become part of the Trading Block and get my trades, and learn how I manage them for consistent profits. With your subscription you will get my real-time trade setups via Discord and email, as well as become part of an incredibly helpful and knowledgeable community of traders to grow and learn with. If you’re not sure it is for you, don’t worry, because you get a Free 7-Day Trial. So Sign Up Today!

Hope to see you in there!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.