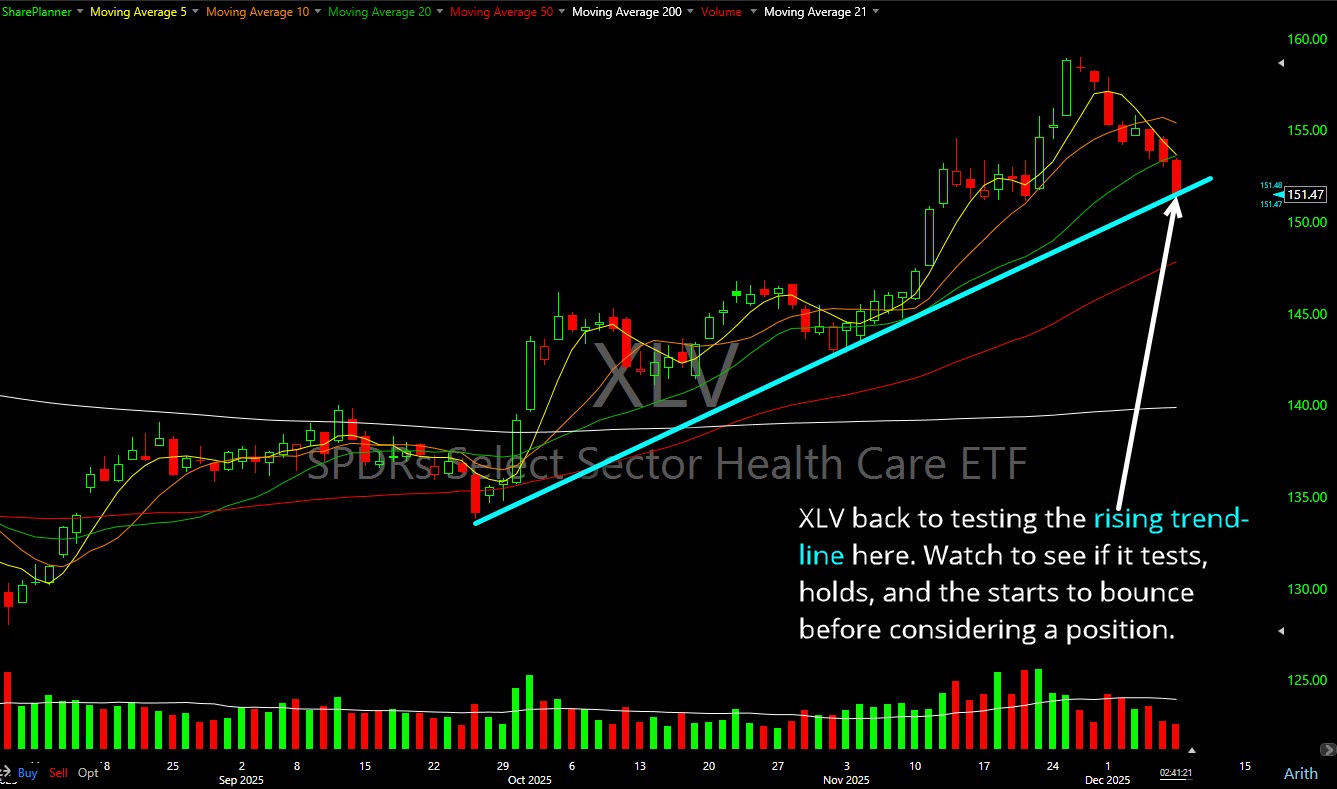

XLV breaking below its rising trend-line and failing to bounce off support.

The Healthcare Sector (XLV) has pulled back to its rising trend-line in the short-term. It'll be interesting to see whether this can materialize into an actionable setup.

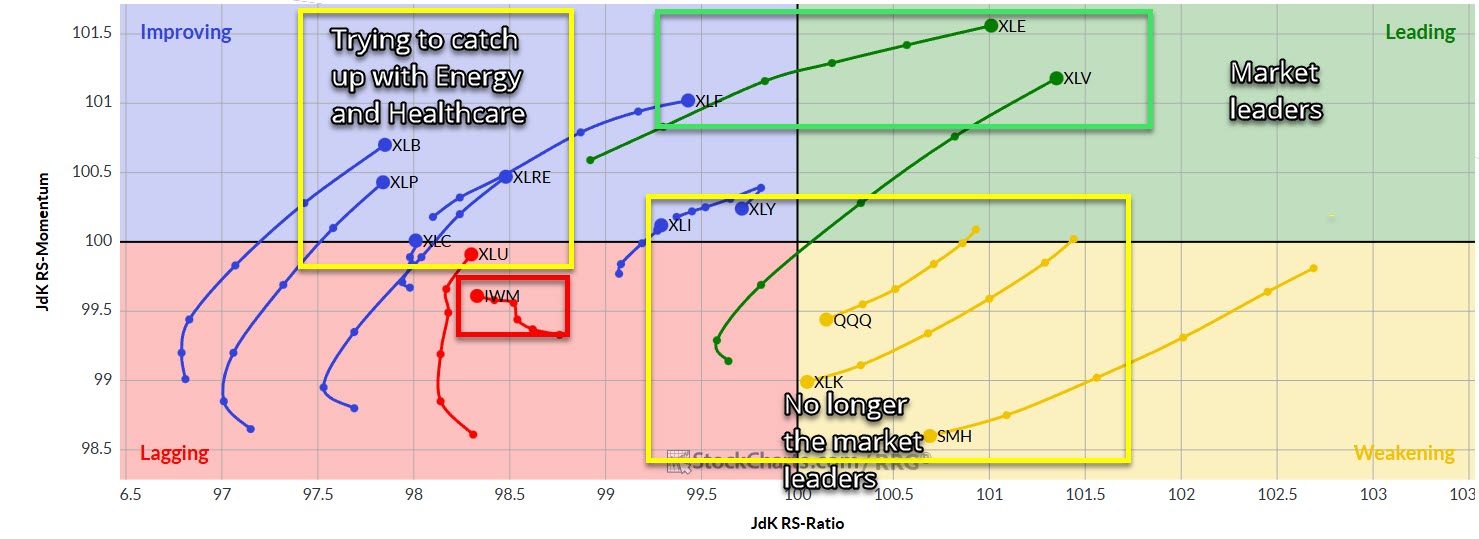

Healthcare Sector (XLV) and Energy Sector (XLE) leading the way right now, while Semiconductors (SMH) and Technology Sector (XLK) are the new laggards.

Semis and tech losing the leadership mantle and handing it over to Energy and Healthcare.

Semis and Energy are holding firm to this market. Healthcare and real estate trying to make a play here, but I'm not sure it lasts.

With the exception of Healthcare and Semiconductors, everything else seems bent on reflecting overall price action on SPY.

Episode Overview Ryan goes over one listener's swing trading journey, analyzes the trading strategy being employed, and answers questions on everything from short squeezes and short floats to insider and institutional buying and sector rotations. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by explaining why he

$SHOP trading inside a megaphone, but very little else to comment on, not even crazy about what could be a bullish wedge that is forming. Chart is a complete mess, and half expect it to move back to $71 to test support. . $XLV pulling back to the rising trend-line from the October lows. Potential

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

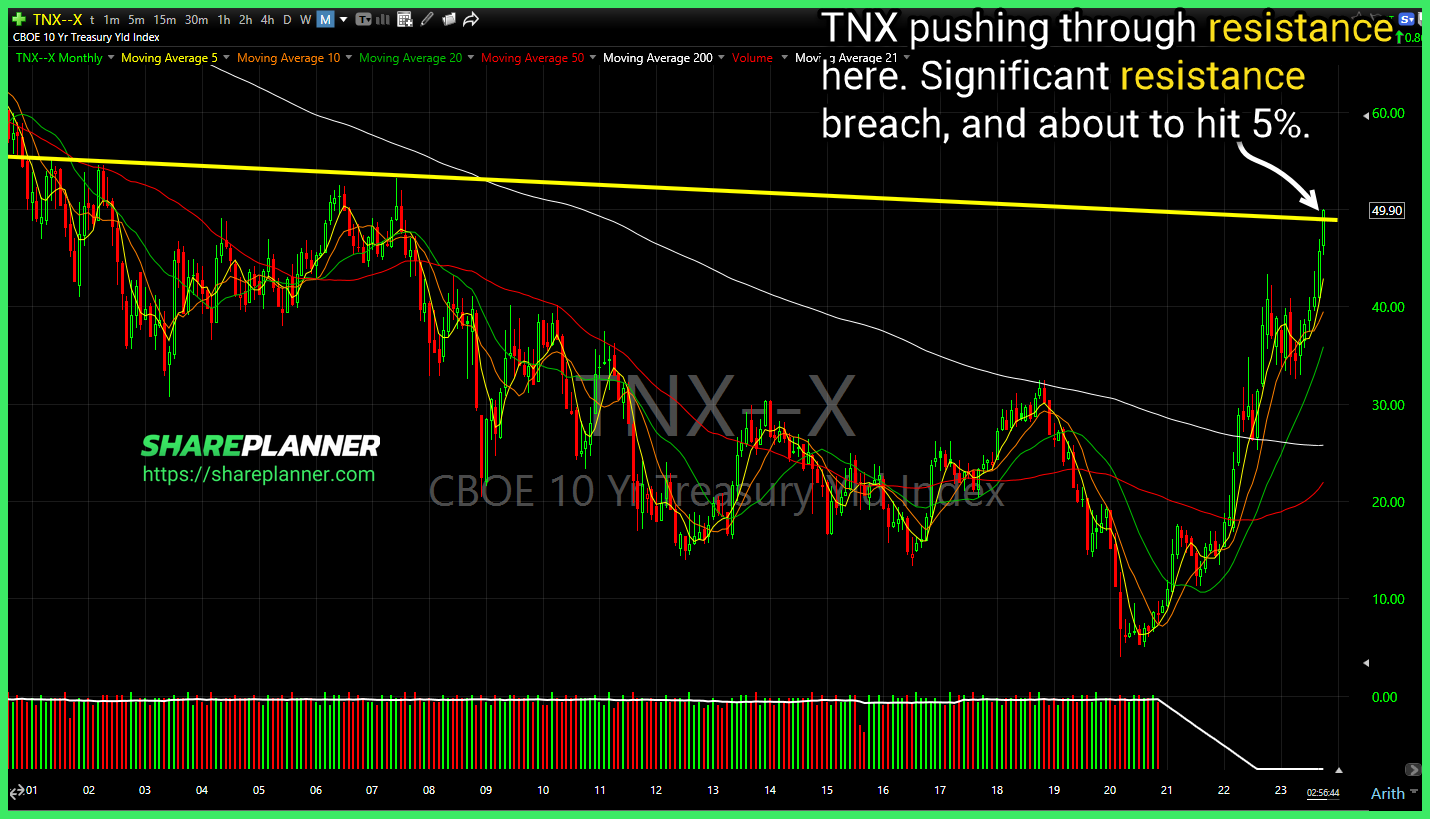

CBOE 10-year Treasury Yield Index (TNX) pushing through resistance here. Significant resistance breach, and about to hit 5%. SoFi Technologies (SOFI) Price breaking back below major support levels. A significant market sell-off could take SOFI back below $5. Triangle pattern in Healthcare Sector (XLV) nearing a break to the downside. Bounce play if