Strong potential with Meta Platforms (META) and Alphabet (GOOGL) earnings out of the way, for a pullback to the rising trend-line on Communications Sector (XLC). Ideally, I'd like to see Healthcare Sector (XLV) spend a few more days inside of this bull flag before attempting to breakout. Worth watching this one. McDonalds (MCD)

I'm leery of these breakout attempts on $XLV, like the one seen today, as the last three have all resulted in head fakes. $DXY descending triangle confirmed to the downside. $JETS fighting for a second straight day to get back above broken trend-line resistance. $PRMW price bounce off the lower descending channel band, and following

$BTC.X remains in the early stages of its breakout. Really nice base breakout that goes back over a year. $XLV (healthcare) struggling to hold Friday's breakout above the declining trend-line. Watch for a break above $133.04 to resume the uptrend. $NIO inverse head and shoulders pattern, with multiple layers of resistance overhead that needs to

Episode Overview Step-step directions on how I use the Top Down Trading Strategy in my swing trading. This trading strategy guides my decisions and how I analyze stocks and choose which stocks to trade. In this strategy I connect the overall stock market direction with sector strength and industrial technical analysis to help find the

Episode Overview What's the differences, advantages and disadvantages of swing trading vs day trading vs position trading, and what does it mean to be either of them? Also in this episode, Ryan explores one trader's questions about trading index funds only and provides the bigger questions that this person should be asking himself. 🎧 Listen

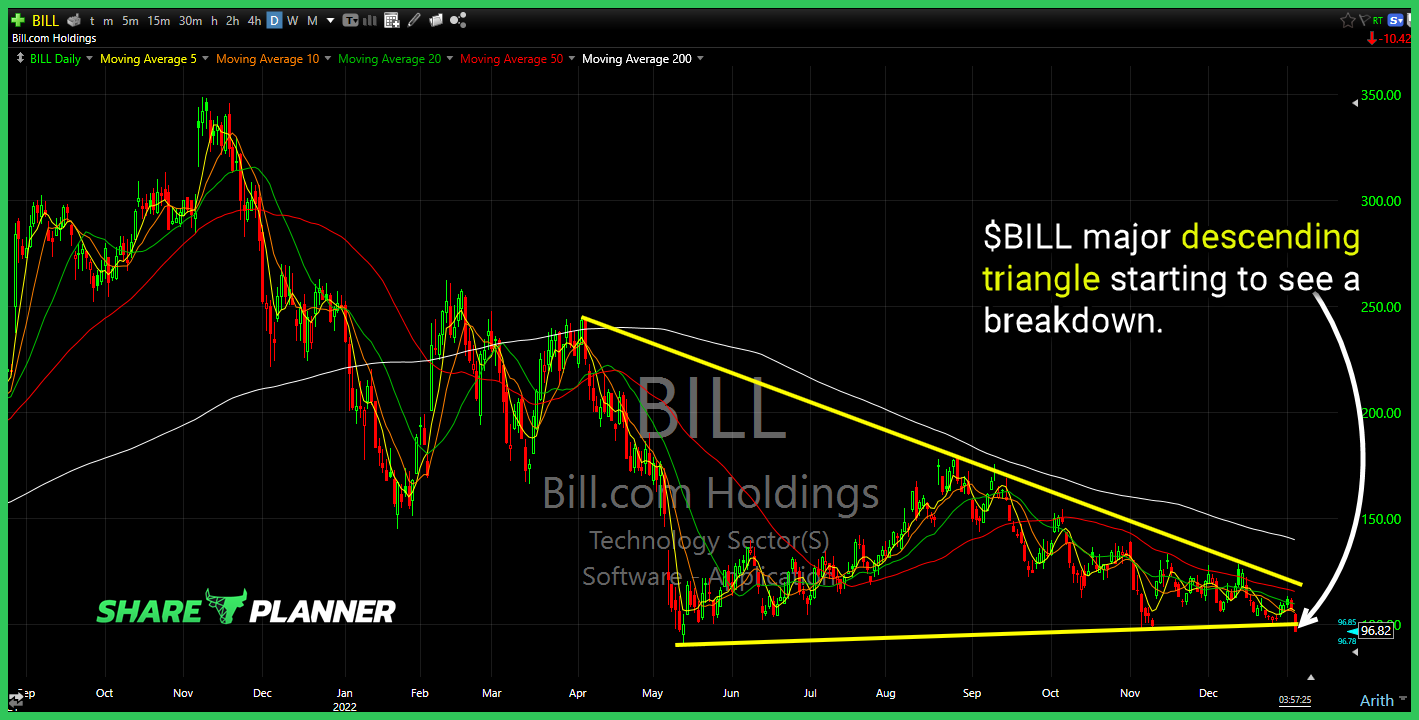

$BILL major descending triangle starting to see a breakdown.

Nice consolidation from $CSIQ after confirming the cup and handle pattern.

Here's why I try to avoid trading the moves that come from FOMC day. Tons of reversals. SPY & SPX Airbnb (ABNB) confirming the wedge pattern with a breakdown today. Converging support levels to watch on a pullback in Healthcare ETF (XLV). Watch declining resistance on DraftKings (DKNG). Big test here for the stock.

Episode Overview For working traders or those with a heavy family load, it can be difficult combing through hundreds if not thousands of stocks looking for that one quality swing trade setup. In this episode I talk about how one can trim down the stocks that they have to follow as well as trading off

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading