Things have no doubt turned drastically bearish in the past week. Whether the sentiment remains is anyone’s guess. However, it doesn’t hurt to begin preparing for what could be a major correction. I mean let’s face it, it is not like we are in the best of economic environments right now, so there is no

One of the popular rages in the market today are the ultra leveraged ETF’s. They have them for almost every type of commodity and index and sector. Last November we informed our readers that coming onto the scene were 3x Ultra ETFs. We told our subscribers at that time to be weary of trading in

This is an excerpt from Elliot Hue Published June 12 in the Personal Finance Weekly ” Green Shoots Must Bloom” describing where the markets stand today. I couldn’t have said it better myself so I won’t try. “Two basic fundamental factors have driven the 40 percent run-up in the S&P 500 off its March lows.

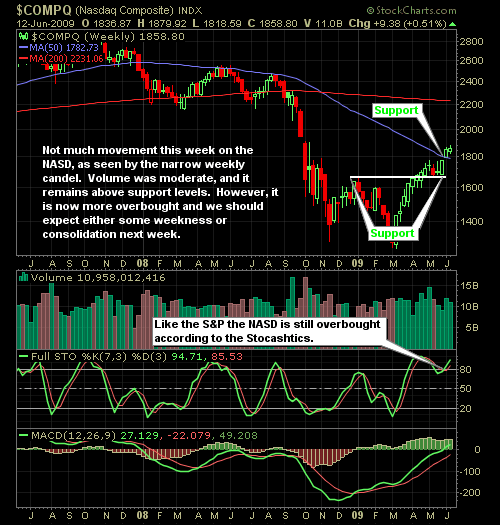

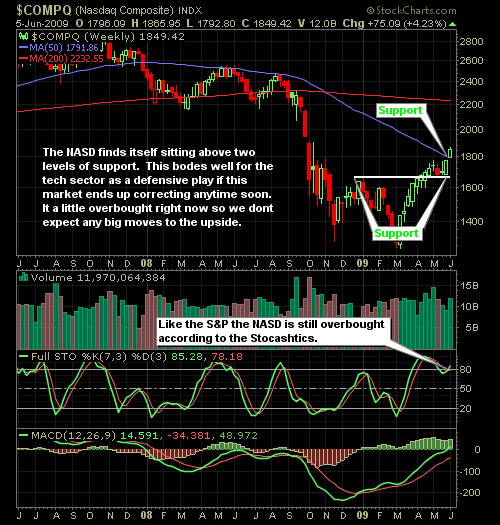

The market indices moved higher this week. The Dow Jones Industrial Index gained 3.09 percent. The S&P 500 rose 2.28 percent, while the Nasdaq finished 4.23 percent higher. So where do we go from here? There is all this chatter of “Green Shoots” coming from the mouths of the talking heads seen on CNBC

Here’s a nice little cheat sheet to find the ETF to meet your investing and trading needs. While there are thousands of ETF’s out there, these are the ones that are most often traded in. We have them broken down by category so you find exactly what you need very quickly. Broad Market | Large-Cap

July 2, 2008 The selloff today coincided with a spike in oil prices, like we have begun to get used too, which closed at a new record high once again. As for now this market is being held captive by oil prices and will not rally until crude sells off. In fact the bear market