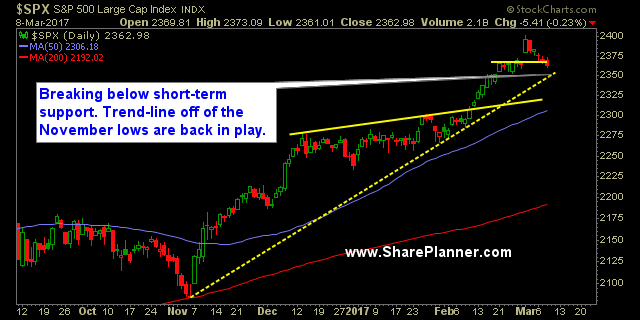

Trading the 3:30 Ramp Okay so the headline might be a bit of an exaggeration but the past two trading days, when 3:30pm eastern typically triggers an end of day run, the exact opposite has happened where stocks start to slide out of absolutely nowhere. Perhaps it is just a temporary thing, but one can’t

My Trading Journal for the DJIA Today: Nasdaq still doesn't look so bad, Russell index does look pretty rough, the S&P 500 is giving up all of Wednesday's market rally, but the DJIA today managed to hold that 10-day moving average with a three day pullback that was quite shallow in nature. If it holds tomorrow,

My Trading Journal for the Stock Market Today: SPX did what it does best following a morning sell-off, and that is, to buy the freakin’ dip. (‘BTFD’ for those looking to add another acronym to their life). Support that I marked in the chart below on yesterday’s trading plan identified this as a potential bounce area.

My Trading Journal for the Stock Market Today: Futures pointing lower, markets like the dip still. It seems like a recipe for a buying opportunity, but remaining disciplined in an undisciplined trading environment still requires that you maintain stops, keep them manageable, and don't come unglued when the market does not act the way you expect

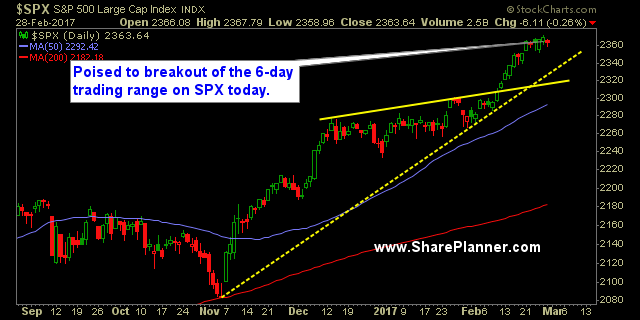

My Trading Journal for the Stock Market Today: I’m not talking about the speech itself, though I did think the speech was a pretty darn good one, and blew away everyone’s expectations. But I am talking about whether the Trump Rally itself can follow through into additional gains tomorrow. History says, “Sure”. I mean C’mon, the

My Trading Journal for the Stock Market Today: When the market has a long one-day pullback that is 6 points in total, and for once in the past 13 trading sessions, the Dow Jones Industrial Average fails to rally at all, traders have to go back to their playbook and pull out the Trump Stock Rally

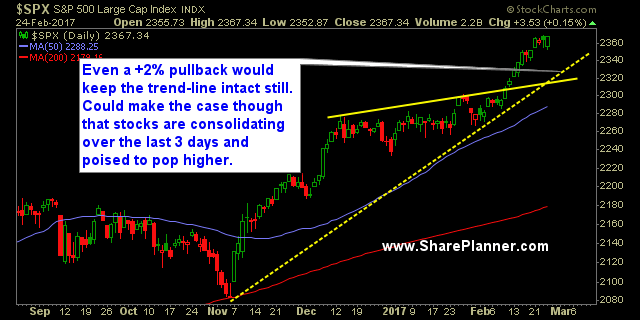

My Trading Journal for the Stock Market Today: I'm pretty sure we are at that point where, "how many days can the Dow push higher", has become irrelevant. Lets just admit it, we are in the Phantom Zone at this point. We can decline 1% today is probably less likely than us running higher for another

My Trading Journal for the Stock Market Today: Higher, higher, and higher. I mean, whats to say the Dow doesn't keep this going to infinity and beyond, to borrow from Buzz Lightyear. With seven seconds left of the trading session, the Dow pulled off a miraculous pop to push the Dow from red to green on

My Trading Journal for the Stock Market Today: And by force, I actually mean dip buyers. They buy on the dip every single, freakin', time. It is fascinating really. Every-time there is a sell-off, the market immediately responds before the market closes the day. For the bears, they are literally being plagued with Jedi mind tricks

My Trading Journal for the Stock Market Today: Is there anything worse than buying stocks near or at their all-time highs? Seriously, I hate it. The game has become a bit of a joke here, as the market has become the place where bad trading practices are rewarded. People are comfortable. They are content. They don't