Dow Jones Chart has not been down 9 straight days since 1978 That is quite a run, to not have a sell-off of nine straight days since Jimmy Carter was president. But the Dow Jones chart is finding some support at the 50-day moving average as is the S&P 500 chart. I suspect that we’ll

Not a stock market crash based on historical sell offs Obviously! But the sell-off that we are seeing this morning before the equity market has even opened, is far greater than what we have become used to seeing. One thing I will add here is that, based on my experience and years of observations, the

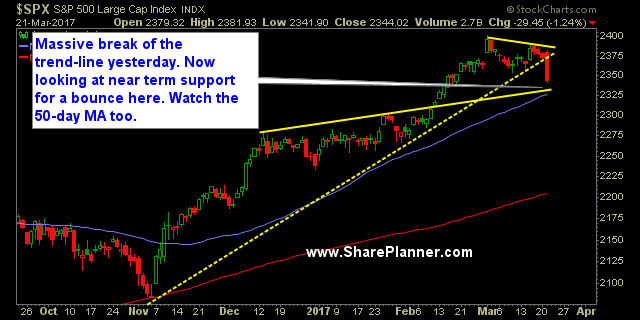

That’s why I say managing risk is so important Yes, it not a fun subject to talk about, but it is not something you cannot afford to ignore. From the highs to the lows of the day, SPX sold off 40 points and broke its key trend line. That is a massive swing considering

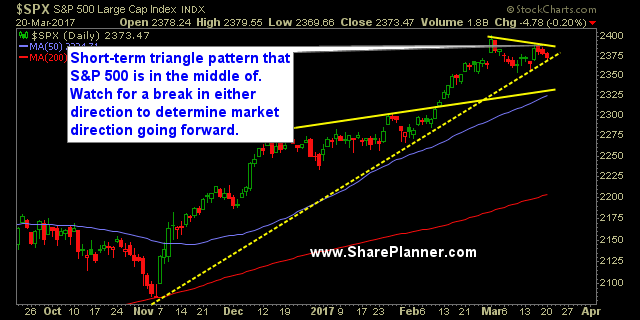

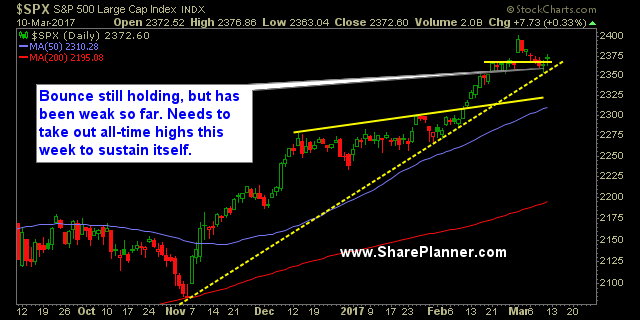

Short-term triangle pattern on SPX SPX has been coiling in a triangle pattern the past three weeks now, or essentially, this entire month of trading. It has pulled back to the rising trend-line that forms the bottom half of the triangle pattern. However, it has only experienced a mild, light volume pullback over the past

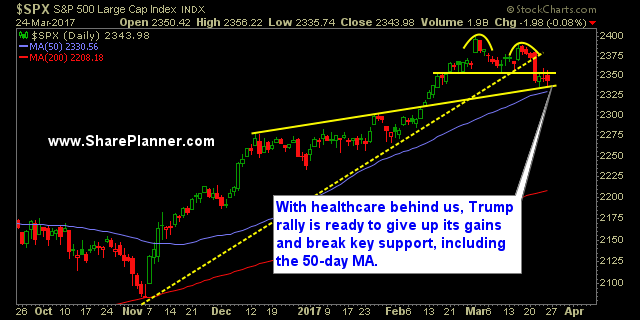

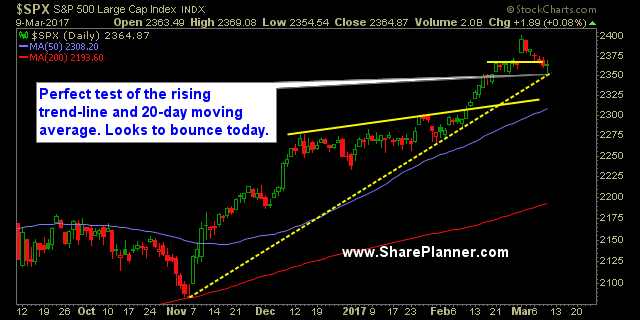

Watch the trend-line on the chart of the S&P 500 A lot can change here today or this week if the rising trend-line as noted in the chart of the S&P 500 below fails to hold. You have a potential topping pattern – emphasis on “potential” – with a new all time high that was

The Fed Up Rally Takes Price Back to Almost All-Time Highs Of couse I am using a play on words as this Fed Up Trump Rally is hated and despised by most and defies the logic of investing in general. I mean, c'mon it has been since last October - almost a half of a

Technical Analysis of the S&P 500's current stock trend remains in tact That doesn't necessarily mean that all the stocks out there are holding it together because most of them are not. But the large caps, the ones that really drive the market's direction, like Apple (AAPL) for instance, is still holding it together and

Stock TA Diverging Hard from Market Price Action The price action is dull in the overall market, and while the price on the indices still hovers at the all-time highs, the TA of stocks (technical analysis) continues to falter under the surface. Breadth is dismal, and without a catalyst to continue pushing the market higher

A lethargic S&P 500 Index Chart The S&P 500 Index chart (SPX) is holding true to the rising trend-line and is holding the 20-day moving average as well. The FOMC is also upon us. This is the week that they are likely to raise rates, and if you remember, I've been saying for a couple of

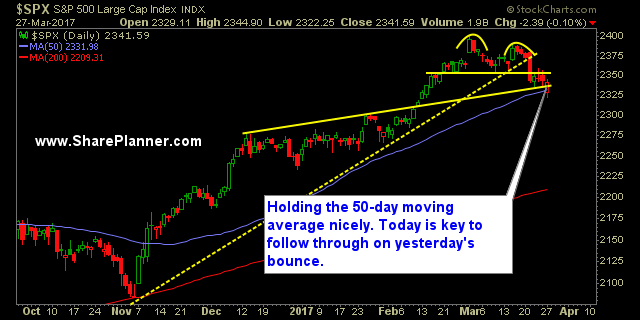

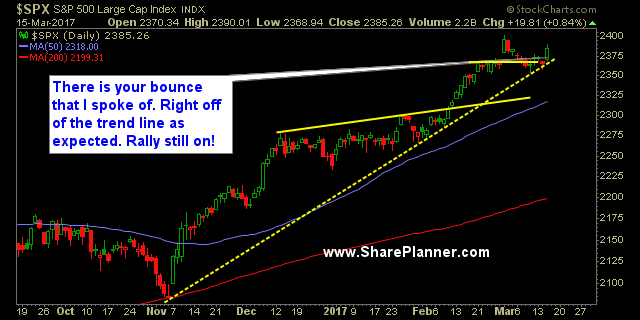

Trading Journal Notes Talked yesterday about the 20-day moving average being in play for the bulls and that is exactly what happened. Practically as perfect of a test as you could possibly have on a moving average, we then saw a hard and fast bounce into the close. I bought UPRO off of the MA