The stock price range continues to narrow across the board This market can’t move. Little faith can be put into a gap up, because with stock’s narrowing price range, you know that the market has to fade every opening move whether it be to the upside or downside. In the midst of all of this,

Stock Market Analysis: The world survived the weekend If the world was able to get through the weekend without any major conflicts, or the Fed further weighing in on how overpriced stocks were, the market would probably be in good shape right? Well, so far that seems to be true. Futures are relatively flat, with

Missile Strikes, Employment and the Stock Market Yesterday SPX bounced off of that 50-day moving average but overnight you had some pretty intense news coming out of Washington that they launched missiles into Syria. You can find the details everywhere about the strike, but how that affects the market is that initially the market traded

Fed offers up a stock market beatdown I don’t get all the annoyed by the stock market all that much. Sure it can do things that will make you scratch your head, but yesterday’s manufactured afternoon sell off coming from the Fed proclaiming that stock prices were a bit too high, was not something I

My stock market trading plan today Bears had the opportunity to really drive this market lower. It was right in their hands. The result? Same as 99% of the other instances. They get the charts to line up for them, make the market look top heavy and ready to rollover and then they disappear. The

My stock market trading plan today Another dose of “Buy the Dip”. At one point it was down as much as 18 points. I kid not, but once the afternoon rolled around, that 18 points shrank to just under 4 points by the close of business. In the meantime, that kind of price action leaves

April Stock Market If you believe in old stock market cliches, then you’ll know that April represents, in theory, the last good month of trading for the bulls before they “Sell in May and Go Away!”. But lets face, it, yes, the volume in the summer is lower, and sell-offs tend to happen more often

Trading Calendar Quarter End in Sight Slight open lower yesterday quickly evaporated as the market engaged in its normal morning routine – rally higher and into the green before the market closes, and usually much sooner. The biggest risk these days tends to be a gap higher which has the highest chance of being faded

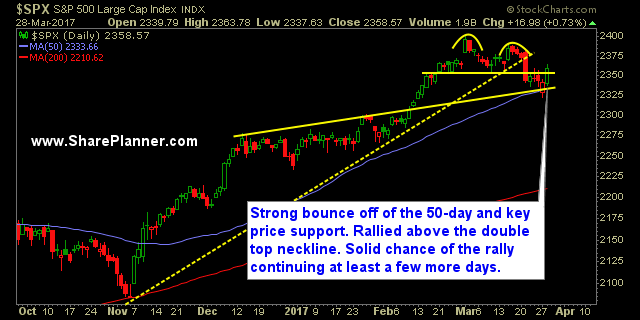

Dead cat bounce until proven otherwise. It’ll probably take the market establishing new all-time highs in order for me to not view this market rally the last two days from a dead cat bounce perspective. There has been some technical improvements, but even still, the downtrend off of the March highs are still in

Solid bounce yesterday, but can the markets today follow through? For many years now, when we see the dead cat bounce come about, stocks overall will look to continue the bounce for several days going forward. For the markets today, will that ring true yet again? The futures are slightly down, but that has