My Trading Journal for the Stock Market Today:

Higher, higher, and higher. I mean, whats to say the Dow doesn’t keep this going to infinity and beyond, to borrow from Buzz Lightyear. With seven seconds left of the trading session, the Dow pulled off a miraculous pop to push the Dow from red to green on Friday. Nothing is off the table with this market when it comes to buying the dip.

And on Friday, SPX was down more than it has been in sometime when the opening bell rung. But nonetheless, it clawed its way back to profitability by day’s close. Oil despite being down on Friday, is still in a sideways trading range. The VIX, despite repeated attempts to break over resistance at the 13 level was smashed yet again to finish 2% lower on the day. T2108 (% of stocks trading above the 40-day moving average) dropped another 2.8% and down to 61.2%. That means, stocks as a whole aren’t showing the same kind of bullishness as the overall market is exhibiting. Something to be concerned with right there.

I’m still trading long, and will do so, until the market shows some sign of weakness. I’ll still attempt to hedge some of my existing profits with ETFs like SPXU, and may do so again today, if the market warrants it. The forthniess in this market is unparalleled to anything I’ve seen over the last couple of years and is in desperate need to digest its current gains.

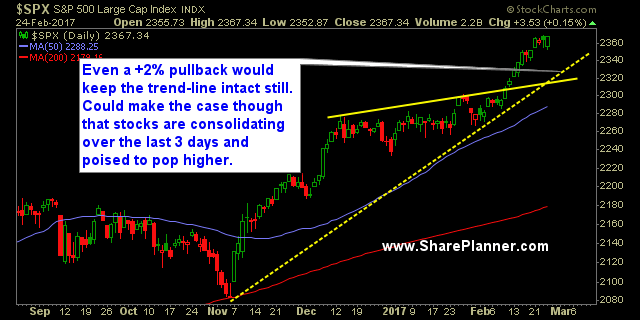

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 4 long positions, 1 short position.

Recent Stock Trade Closeouts:

- SPXU: Long at $17.31, closed at $17.22 for a 0.5% profit.

- Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Broadcom (AVGO): Long at $208.30, closed at $210.89 for a 1.2% profit.

- Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

- SPXU: Long at $17.58, closed at $17.24 for a 1.9% loss.

- Gold Miners ETF (GDX): Long at $25.22, closed at $25.04 for a -0.7% loss.

- Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

- Microsoft (MSFT): Long at $63.45, closed at $64.09 for a 1% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.