My Trading Journal for the Stock Market Today:

When the market has a long one-day pullback that is 6 points in total, and for once in the past 13 trading sessions, the Dow Jones Industrial Average fails to rally at all, traders have to go back to their playbook and pull out the Trump Stock Rally play yet again. With the speech well received by anyone not wearing white in the audience last night, the stock market is ready to rally again… Bigly!

Even the biotechs, which Trump was not too kind to, is trying to stage a rally of its own this morning. Steel companies like US Steel (X) are rallying no doubt on the pipeline comments from last night as is Harley-Davidson (HOG) over fair trade.

Interesting side note in regards to the S&P 500 (SPX) is that it has literally traded in less than a 1% trading range now for 50 straight trading sessions. The previous record was 35 straight. Today it has a chance to end this streak. I mean think about that, for almost a quarter of a year, the stock market hasn’t even had a low-to-high range of more than 1%. Unheard of!

Also, worth pointing out is that Stocks, Bonds and Volatility all finished higher in February. If you have a stock in the portfolio that hasn’t moved in the last 30 days, or hasn’t been trending higher, you have to ask yourself why your are still holding the stock?

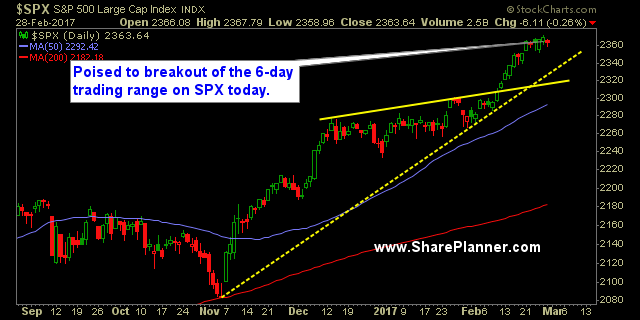

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 5 long positions, continuing to tighten the stop-losses on them all.

Recent Stock Trade Closeouts:

- JP Morgan Chase (JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

- Chevron (CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

- SPXU: Long at $17.31, closed at $17.22 for a 0.5% loss.

- Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Broadcom (AVGO): Long at $208.30, closed at $210.89 for a 1.2% profit.

- Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

- SPXU: Long at $17.58, closed at $17.24 for a 1.9% loss.

- Gold Miners ETF (GDX): Long at $25.22, closed at $25.04 for a -0.7% loss.

- Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

- Microsoft (MSFT): Long at $63.45, closed at $64.09 for a 1% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.