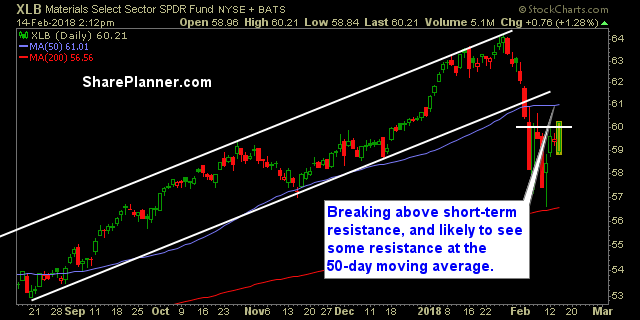

There are a lot of positives and a lot of negatives in this market right now. Not all sectors are soaring as you might think. A lot of them are downright miserable. There are also a lot of failed patterns breakouts as you will see below. Those lead the way in terms of worst sectors

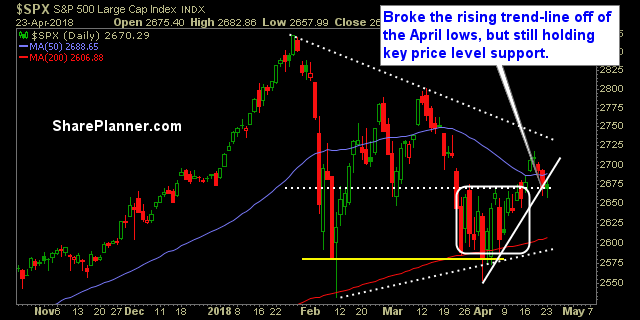

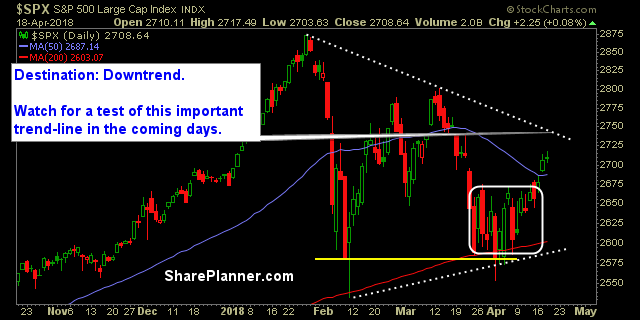

Sectors losing their long-term trend and have been extremely choppy When you have a market that isn’t establishing new highs, nor is establishing any new lows on the charts, mix that with huge price swings for the past three months and you have some very confused, and in some cases, directionless sectors.

My Swing Trading Approach Gap ups of late have been difficult to hold, but nonetheless, should it do so, I will look to cover my one short position, and add to my long positions. Indicators

My Swing Trading Approach I am not opposed to adding more trades to the portfolio today, but the market needs to be favorable for it to happen. We could see a pullback, and I don’t want to buy ahead of that, even if it is likely to be just temporary. Indicators

Some good and bad in the market right now. Despite some willingness by the market to try and rally in recent days, there is still a lot of pressure weighing on the sectors across the board. The headline risk is at extreme levels, and that is keeping me from being too aggressive on the long

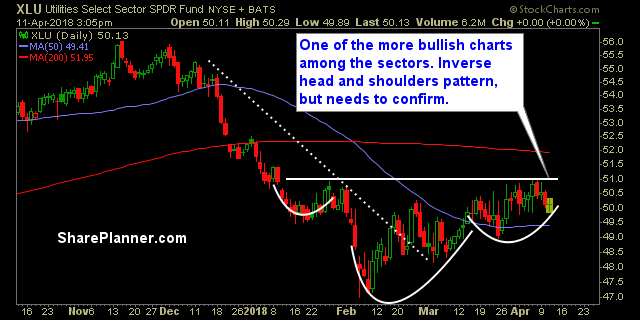

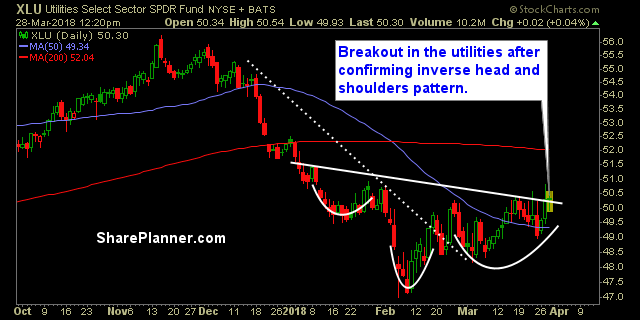

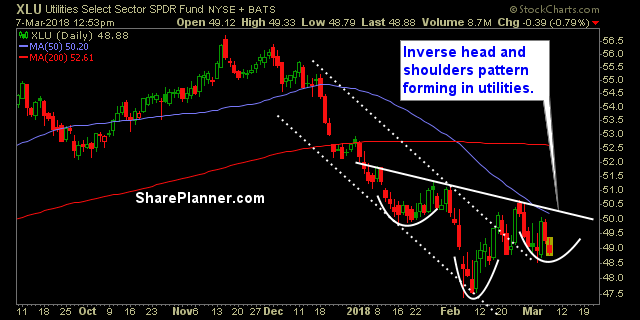

There are drastic differences in each of the sectors That is usually not the case. They tend to represent some off-shoot of the S&P 500, or in the case of Technology, as resemblance of the Nasdaq chart. But now, each chart has a different look. obviously the majority of them are trending downwards, but still

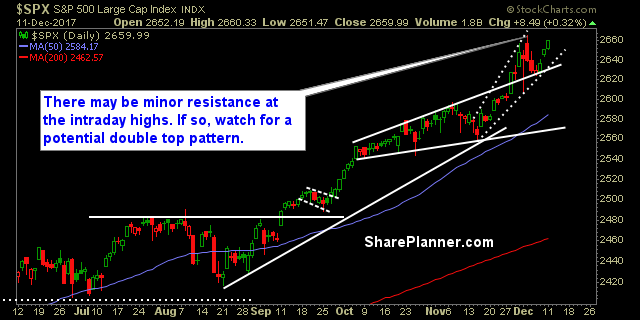

Stock Market is on shaky ground here. Direction is Uncertain. So lets take a deeper look at the sectors themselves. Which ones are most favorable and the ones that are not.

Market’s have rebounded well since the sell-off that led to a test of SPX 200-day moving average. Following today’s CPI report in the pre-market, and the subsequent sell-off, I was ready for the market to begin its selling yet again, so I raised my stops to protect all profits.

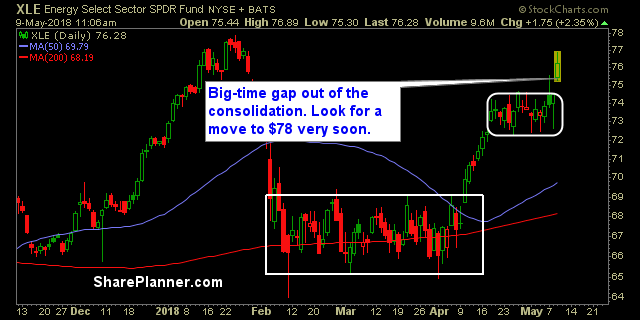

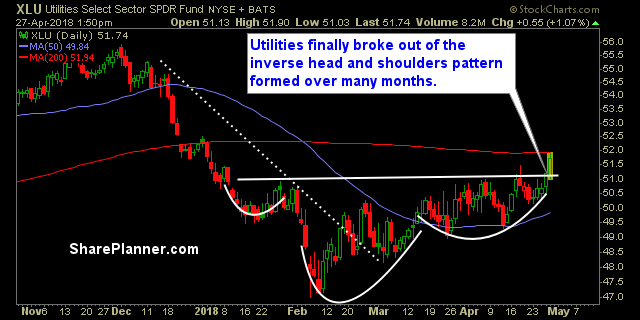

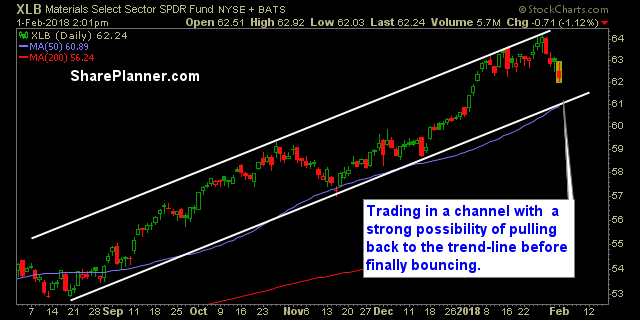

Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

My Swing Trading Approach Stocks have rallied for a good three days, at this point, I want to move my stops up while being careful about how much additional exposure I take on right here. Indicators