My Swing Trading Approach I will look for opportunities in tech stocks today, if the early gap higher shows that it wants to hold. If not, I will look to play the market with a much more cautious approach. Indicators

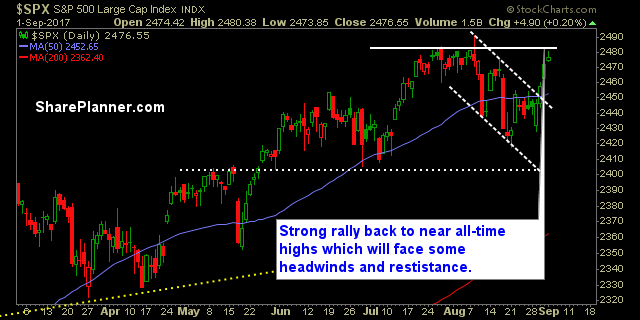

My Swing Trading Approach New day, new month, I’ll be looking to add 1-2 new trades to the long side today, while also moving up the stops in my existing positions. Indicators

My Swing Trading Approach I’ll be looking to add 1-2 new trade setups to the portfolio today. Right now, I am at 70% cash. I want to increase that some today. Indicators

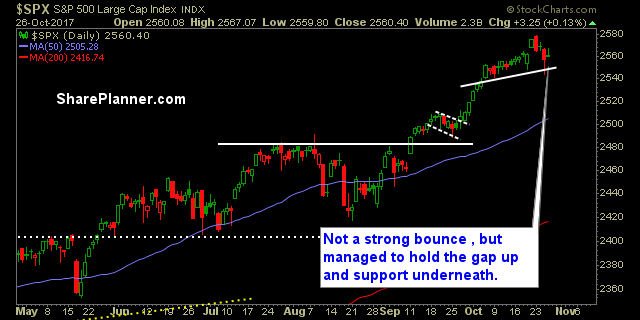

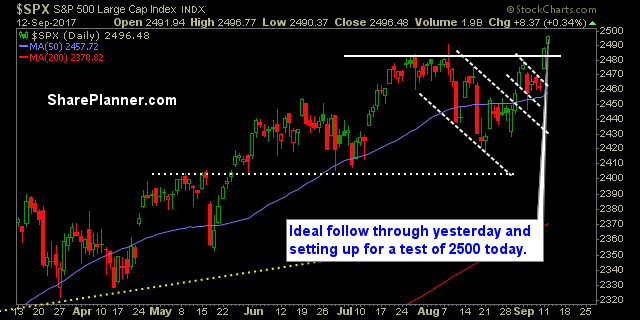

My Swing Trading Approach I want to see whether the S&P 500 can at least consolidate the gains from Friday. If so, I will look to adding another position to the portfolio. Indicators

My Swing Trading Approach Strength in the pre-market, will look to add another position to the portfolio today. Indicators

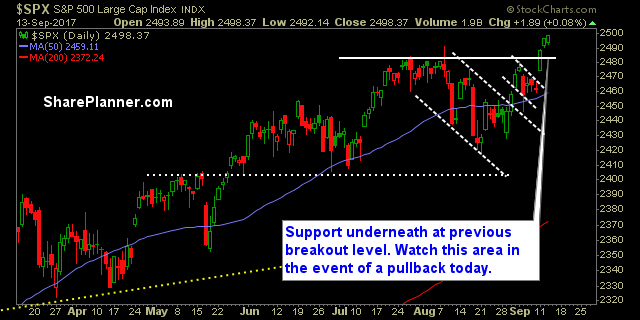

My Swing Trading Approach I won’t rule out adding additional position or two to the portfolio today, but I’m not looking to pile on in this market. Manage the trades that I have, trim the ones that don’t provide a solid reason to keep, and raise the stops on the rest. Indicators

My Swing Trading Approach Looking to manage the current positions I have, raise the stop-losses, and curb some of my long exposure following the rally that we have seen this week. Indicators

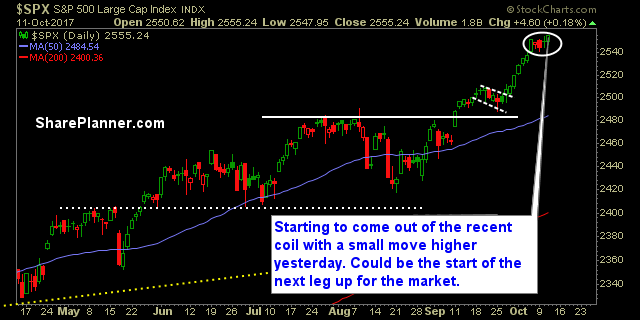

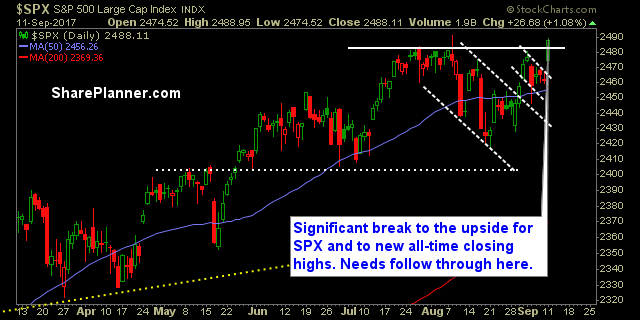

My Swing Trading Approach Looking to ride my current positions. Will look to add a few more positions while increasing my stop-loss along the way. Indicators

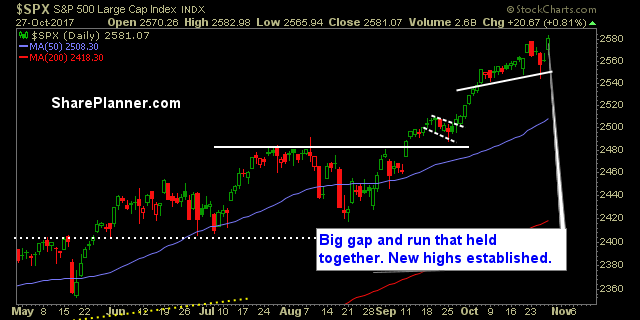

My Swing Trading Approach I’ve taken on a much more bullish posture to this market given that it broke out above the all-time high resistance level that had formed over the last two months. That area has broken, so being bullish here only makes sense. Indicators

My Swing Trading Approach I’m concerned about the weakness coming into today, and may curb my long exposure while adding some short exposure. Indicators