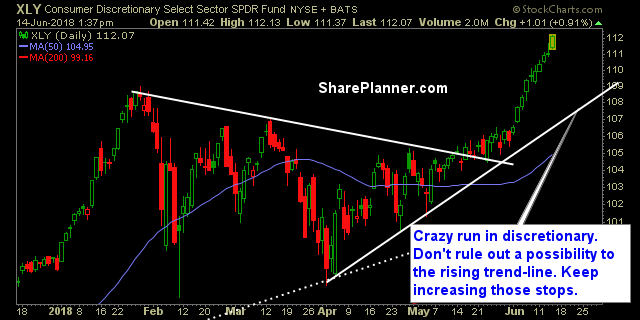

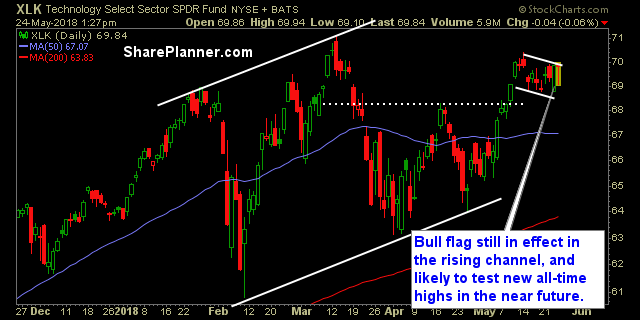

The Leaders of this market still leading In fact if you look at my top three sectors below the only difference is I have swapped out Industrials for Healthcare. Otherwise, the 1-2 punch of this market still remains Technology and Discretionary.

My Swing Trading Approach At this stage of the game, I am weary of how much more the bulls have left in the tank before we see some kind of pullback. More than likely, I will play it safe here, and let the existing positions do the work, while tightening my stops. Indicators

My Swing Trading Approach With the FOMC Statement coming out today, I will likely stay on the sidelines until it is released. Indicators

My Swing Trading Approach Ahead of the FOMC Statement tomorrow, I suspect the price action to be contained and lacking conviction. I may add an additional position to the portfolio today, but will only do it under strong, bullish conditions. Otherwise, it is more important to focus on raising stops and protecting profits. Indicators

My Swing Trading Approach As the market continues to make its run off of the May lows, I am not opposed to adding more positions to the portfolio, but it is more important at this point to be protecting profits, and dramatically increasing existing stop-losses. Indicators

My Swing Trading Approach With futures trading lower again, and with some of the profit-taking seen in technology, I am still looking at taking a cautious tone, coming into today. Adding another position to the portfolio will likely result in my closing out another, in order to avoid additional long exposure. Indicators

My Swing Trading Approach I have been a little more conservative with my approach here. I have plenty of swing-trades in the portfolio – all with profits, but am somewhat hesitant to add more to the portfolio with as overbought as this market currently is. Not that I won’t going forward, but it needs to

My Swing Trading Approach At this stage, I am quite happy with the stocks I have in the portfolio. I am looking to play it cautious here, as I do not want to stock pile too many positions here. I’ll raise my stop-loss on existing trades. With low volume market conditions, I’m not

My Swing Trading Approach Follow through hasn’t been the market’s strong suit of late. I may add another position today, but I will not be extremely aggressive in doing so. I have a great set of long positions, will only add more if this market shows that it wants to build upon yesterday’s breakout. Indicators

Most of the sectors are in good shape right now. This bodes well for the overall direction that the market has been on this month. Yes, there are some obstacles for it to overcome, in forms of strong price resistance overhead, but we are seeing the typical market resiliency that we saw during much of