Swing Trading Strategy: Market Reality Check… Last three weeks the market has been riding the hope train and now suddenly price action is bleeding red across the board. Is this simply a buy the dip opportunity like March 23rd was, but to a lesser extent? Or are we jump starting the next leg lower? The

Swing Trading Strategy: Kicking off Earnings… The earnings weren’t good at all from the banks, and while no one really expected them to be, they were even worse than expected. JPM’s EPS came in at $0.78/share despite analysts expecting $2.16/share. However the market was not phased by this at all. The market right now is

No volume = No Sell-off The volume is the biggest issue for the market right now. It isn’t because there is this incredible euphoria taking place with the bulls and that as a result is just overwhelming the sellers, instead it is because there is no volume at all, and when that happens, the market

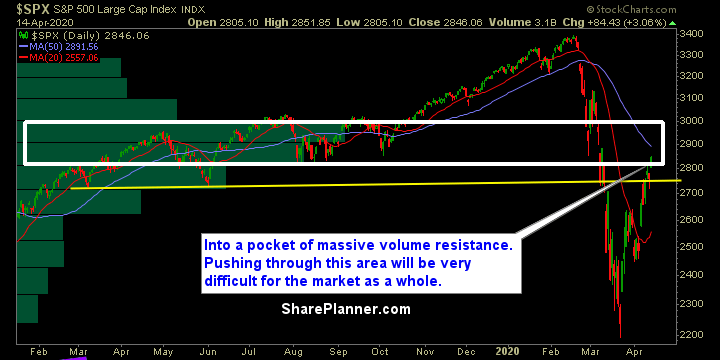

Market rally is impressive, but are we really dead set on a market bottom? Goldman Sachs (GS) is out there telling you that the bottom is in, so is Morgan Stanley (MS). But should they be trusted? Could there be ulterior motives at play there? I’m just not buying this hype that suddenly all

Swing Trading Strategy: Best week since 1938… Last week’s shortened trading week capped off the best week for the Dow since 1938. A truly impressive week for the bulls despite a number of wild swings intraday. You have to be incredibly cautious in this market here. A lot of people are trading full tilt to

Swing Trading Strategy: Jobless Claims Bad, But Fed Trumps All… While people praise the actions of the Fed for their intervention in the economy to provide some stabilization, I have to say, it has certainly kept the selling at bay of late. However, this is such a dangerous move as the Fed is simply printing

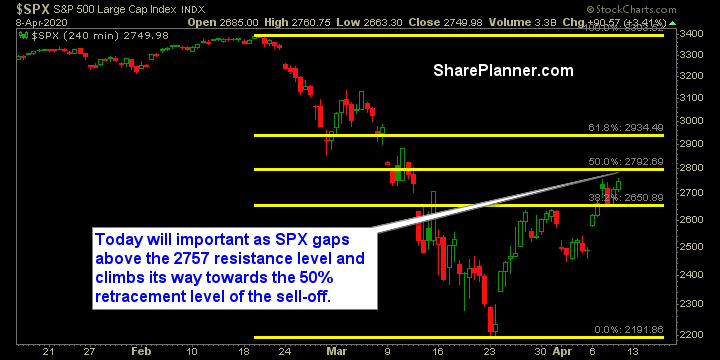

Swing Trading Strategy: Big Gaps are dangerous… C’mon, two back to back days of 100 point gaps, and you think we are going to gap and run each time? Sure it isn’t impossible for the market to do that, but the odds of that aren’t strong, and instead of a bullish posture for the market

I haven’t bought into this rally at all. First of all, it is a crazy thing to go chasing these massive gaps higher. “Buy hundred point gaps higher”…Sure – no problem! I’ll pass. Now you have a potential pain trade, because a lot of shorts have probably been squeezed out of their positions. No doubt

Swing Trading Strategy: Futures are rocketing… Perhaps it is because New York is seeing a drop in the number of deaths, or maybe it is because Trump said a few optimistic words at a press conference yesterday. Either way, the stock market is attempting one of its biggest rallies ever this morning with a monstrous

Swing Trading Strategy: Choppiness and indecision Yesterday was riddled by reversals and choppiness, as it changed course multiple times throughout the day. While it feels good for the bulls to rally the market 56 points, the breadth is anything but there. For every 17 advancing stocks, there were 13 declining, and that was with a market