Swing Trading Strategy:

Futures are rocketing…

Perhaps it is because New York is seeing a drop in the number of deaths, or maybe it is because Trump said a few optimistic words at a press conference yesterday. Either way, the stock market is attempting one of its biggest rallies ever this morning with a monstrous gap higher.

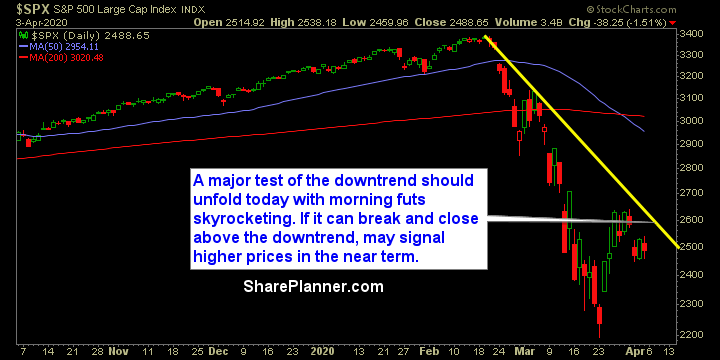

In the meantime, you have a huge downtrend that is in play for the bulls that started at the all-time highs back in February and they will need to break through and close above if this rally should be taken serious going forward (check out my chart below). By the way, the choppiness has to be mentioned here – The market sometimes manages to string together a few days in a row in the same direction, but most of the time it is back and forth price action in a huge daily price range that continues to make this one of the more challenging markets to trade.

Also you have plunging oil from last night that has managed to rebound some, but not having any effect on equities at the moment. The gap up feels good for the bulls, and may repair some of the technical damage of late, but it is very dangerous to put any faith in this market while the economy remains shut down and no real idea when the economy will restart and how that will even look. For me, being primarily in cash right now is the best situation and only testing the waters with small positions continues to be my approach going forward.

Indicators

- Volatility Index (VIX) – VIX is set to drop 5-6% at the open and the lowest reading since March 6th. The indicator continues its free fall after +80 readings last month.

- T2108 (% of stocks trading above their 40-day moving average): Down 4% on Friday, which is essentially a flat day, the indicator sits at 4.5%. Today it should see a big boost with a potential triple digit gap higher.

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All 11 sectors finished in the red on Friday, with Utilities seeing the most selling out of them all. Relative strength was found in the defensive stocks like Staples and Telecom. Financials, Real Estate and Materials are the biggest concern for the market right now as all of them look like they eventually want to retest their recent lows.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.