Swing Trading Strategy:

Jobless Claims Bad, But Fed Trumps All…

While people praise the actions of the Fed for their intervention in the economy to provide some stabilization, I have to say, it has certainly kept the selling at bay of late. However, this is such a dangerous move as the Fed is simply printing trillions upon trillions of dollars as it is no doubt going to spur inflation down the road. Maybe I’m just a Debbie-Downer here, and I should be showering them with praise like most others are, but their behavior, in my opinion, is nothing short of rash, just like the economic shutdown, in itself, was rash. Nonetheless, the stock market faces a 3-day weekend, do you buy and hold through it, or wait to see how the dust settles during the extended weekend? I’m on the side that says, hold off and see how the weekend behaves and then reconsider new long positions on Monday.

Indicators

- Volatility Index (VIX) – A 7% decline yesterday to bring it down to 43.35. Very good chance we see the 30’s here either today or sometime next week.

- T2108 (% of stocks trading above their 40-day moving average): Finally finished in double digits at 14%, following a monster 67% rally yesterday.

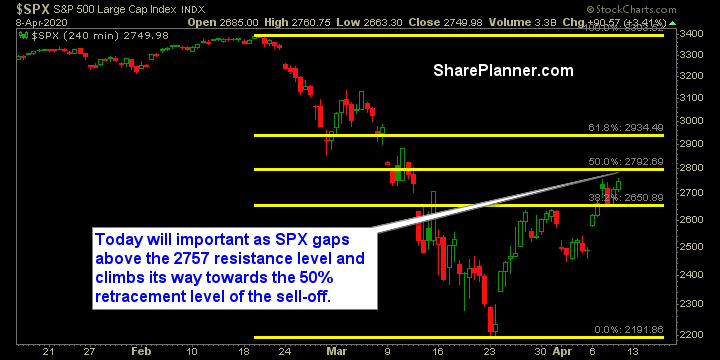

- Moving averages (SPX): The 5-day moving average is pretty much parabolic at this juncture, and price on SPX looks ready for a test of the 50-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All 11 sectors finished in positive territory, lead higher by Real Estate, as has been the usual of late. Still seeing Technology and Discretion not really assert itself as market leaders during this time. Instead the focus has been Real Estate and Energy.

My Market Sentiment