Swing Trading Strategy:

Kicking off Earnings…

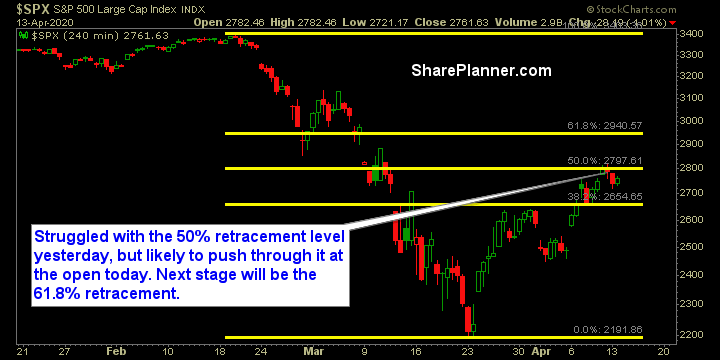

The earnings weren’t good at all from the banks, and while no one really expected them to be, they were even worse than expected. JPM’s EPS came in at $0.78/share despite analysts expecting $2.16/share. However the market was not phased by this at all. The market right now is sitting at 50% retracement levels. This is similar to retracements found in 2001, 2007, and if we really want to go back in time – 1929. That means the market is at a dangerous crossroad here, and that should certainly be respected.

As the month unfolds, more and more companies will report their earnings, and will provide a better flavor for how this market intends to digest the news. For now, the market is simply buying as fast as it can and without a care in the world.

Indicators

- Volatility Index (VIX) – After peaking during the lunch hour, it spent the rest of the day giving up its gains and finishing lower on the day while the bulls bought the dip in equities, finishing at 41.17, and 1.2% lower.

- T2108 (% of stocks trading above their 40-day moving average): An 18% decline yesterday, following an 80% rally the previous trading session. Currently sitting at 20% overall.

- Moving averages (SPX): Tested the 5-day MA yesterday and immediately bounced off of it. Currently above the 5, 10 and 20-day MA’s, with the potential for a 50-day MA test.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology practically kept the market from falling apart singlehandedly yesterday, as the only sector to finish in the green. Real Estate, continues to lead market direction, and yesterday it was to the downside. Energy held up well following the oil production cuts agreed upon over the weekend.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.