Swing Trading Strategy:

Best week since 1938…

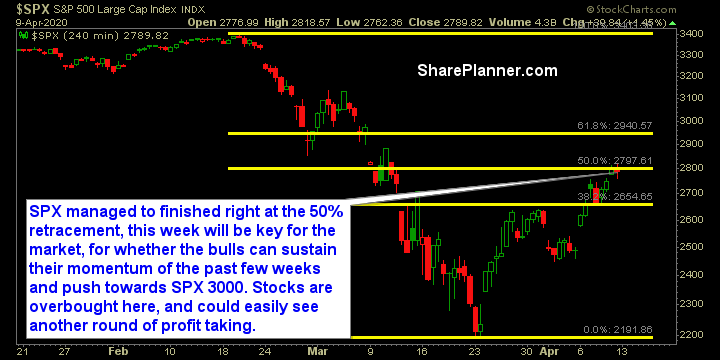

Last week’s shortened trading week capped off the best week for the Dow since 1938. A truly impressive week for the bulls despite a number of wild swings intraday.

You have to be incredibly cautious in this market here. A lot of people are trading full tilt to the long side assuming and hoping that a bottom is in for the market. While that certainly could be the case, the risk in doing so and being wrong is incredibly high and the loss, extremely steep. So it is important that whether you are bullish or bearish, that you are only trading an amount that you are comfortable with, as it pertains to risk and being able to manage it.

In the Trading Block on Thursday, I added a short position to the portfolio and that is the only position currently in it.

While, I’m not opposed to adding long positions to the portfolio, and certainly not a permabear by any means, I am going to be cautious about doing so, as the market is extremely overbought from the past three weeks, and even if a bottom is in, a good chance of a pullback here remains high.

Indicators

- Volatility Index (VIX) – Of course the VIX has come way off of its recent highs, but nonetheless, the VIX remains at a high reading of 41.67 – in fact still higher than any reading seen during the 2018 sell-off. Also worth noting is the slope of the downtrend from the last three weeks isn’t overly steep in the decline.

- T2108 (% of stocks trading above their 40-day moving average): An 80% increase on Thursday which was absolutely staggering, and puts 24% of stocks back above the 40-day moving average. The highest such reading since February 24th.

- Moving averages (SPX): Currently setting up for a potential test of the declining 50-day moving average this week.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy was the lone sector to finish in the red on Thursday, while Real Estate continues to outpace all other sectors, but still an extremely depressed sector. During this past week’s rally, the one thing that stuck out to me was how laggy the Technology sector has been. That is not typical for a market rebound, and usually you see Tech names leading the market higher once the bottom is in. There was also a strong rally in Discretionary as a lot of investors have been buying up the retail stocks hammered by the COVID-19.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.