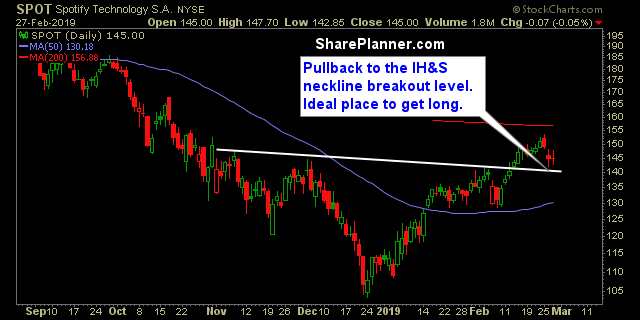

Thursday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Spotify Technology (SPOT)

Position sizing is so incredibly important when it comes to successful trading in the stock market. But at times, you can have too many positions at once and it leads to horrible consequences to your portfolio. Having the right approach is so key to insuring consistent and sustainable profit generation from the stock market. Position

My Swing Trading Approach I added one additional lon position yesterday and will likely hold off here before adding anything else to the portfolio. Indicators Volatility Index (VIX) – A push into the close, kept the VIX near its highs of the day. Potential for another test of the 20-day moving average today, which has resulted

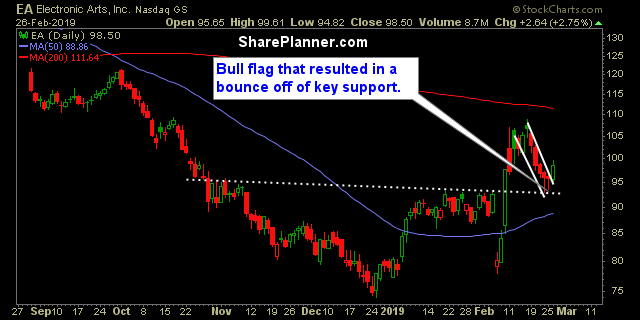

Wednesday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Electronic Arts (EA)

Here are the short setups that are in play here. I don’t have any of them to speak of, and until this market can hold a sell-off beyond the opening bell, I don’t see any real or meaningful reason to be short at this juncture.

My Swing Trading Approach I booked profits in Alibaba (BABA) yesterday at $183.29 for a +7.8% profit, along with Advanced Micro Devices (AMD) at $24.98 for a +3.7% profit. I added one additional position yesterday, but overall reduced my overall long exposure. Indicators Volatility Index (VIX) – A much bigger pop than what we

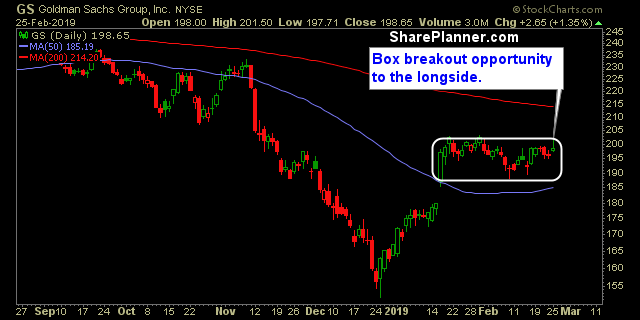

Tuesday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Goldman Sachs (GS)

Stock market is searching every crevice for more buyers. The bulls started the week off on a strong note, but once the market settled in, you started to see some profit-taking and since then, the bulls have squandered 13 points off the highs of the day. I booked profits in Advanced Micro Devices (AMD)

My Swing Trading Approach I did not sell any of my positions ahead of the bell on Friday, and I added one more long as well. I may add one additional trade to the portfolio today. I do plan to further tighten my stops on existing trades as well. Indicators Volatility Index (VIX) – VIX is

My Swing Trading Approach I sold Schlumberger (SLB) yesterday for a +1.1% profit. I’ll be looking to add another 1-2 new positions to the portfolio today, on top of the one I added yesterday. Indicators Volatility Index (VIX) – Popped about 10% yesterday but by the time the close rolled around, most of the gains