My Swing Trading Approach

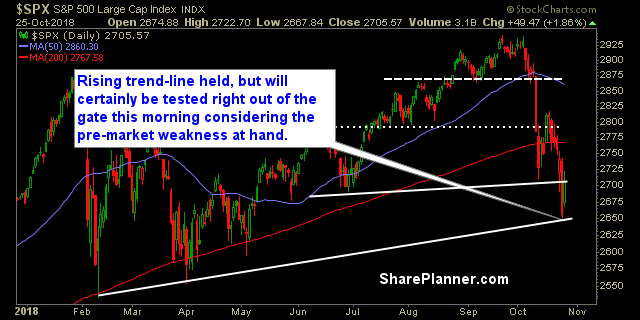

This is a tough market, too oversold to short, but not enouch conviction for a sustained bounce. In fact, there hasn’t been a single day of back-to-back gains since September 20th. That’s incredible really. Despite the huge, negative earnings reaction out of AMZN yesterday, and the market’s weakness today, either it bounces back, or this market will get far more bearish. The latter scenario seems difficult to me without some kind of sustained bounce first. But crazier things have happened before.

Indicators

- Volatility Index (VIX) – Looking at an open of over 26, but still yet to break the intraday highs from October 11th, so a slight bullish divergence there, but nothing to hang your hat on.

- T2108 (% of stocks trading above their 40-day moving average): I suspect that the opening bell will print a reading in the single digits for the second time this month. Almost always signifies an intraday bounce.

- Moving averages (SPX): Unable to break through the 5-day moving average yesterday. 10-day MA interestingly enough is trying to turn higher, but will need help today in order to keep that alive.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I did a write up of all the sectors yesterday with detailed analysis for each – highly suggest reading it here.

My Market Sentiment

SPX at extreme oversold levels, and while it can certainly get more extreme, joining the bear party at this juncture seems a bit foolish. I am still looking for an upside bounce in the coming days, beyond what we saw yesterday.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.