My Swing Trading Strategy Profits were booked in Regions Financial (RF) for a +3.1% profit. I also closed out Square (SQ) at just a shade above break even due to the earnings and market pressures. That became a mute point for the stock though. I added one position yesterday, and will look to add one more today too.

My Swing Trading Strategy I booked profits in Nvidia (NVDA) yesterday for +4%. Looking back, I was very aggressive about taking profits at the open, but I did so, because I was not overly confident that it could hold on to the premarket strength, and seemed like a solid candidate for a gap and fade

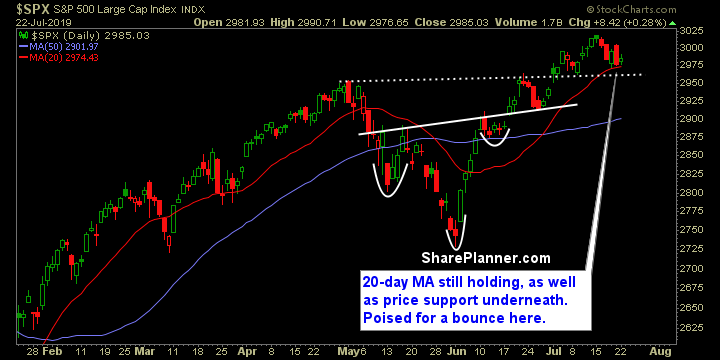

My Swing Trading Strategy I added some financial exposure yesterday, and will consider adding more long exposure today, should the market conditions warrant it. Indicators Volatility Index (VIX) – VIX sold for two straight days, and 6.8% yesterday alone, with the potential to see a retest of 12.00 in the very near future. However, with

My Swing Trading Strategy I closed out one of my trades yesterday that simply wasn’t doing anything for me and was simply wavering far too much due to the low volume, summer trading. However, I added one additional trade to the portfolio and looking to ride my two positions that I currently have, to higher

My Swing Trading Strategy The market decided to throw a temper-tantrum on Friday, with above average volume, and sell-off that wiped out one of my long positions. Should the market want to shake off the sell-off, I am more than open to adding a new long position, however, I am also poised to short this

My Swing Trading Strategy I was stopped out of my Disney (DIS) trade yesterday, primarily due to the heavy influence from the Netflix (NFLX) earnings miss. However, I added two additional trades following the stop-out, and will consider adding a third position if the early morning strength can hold. Indicators Volatility Index (VIX) –

My Swing Trading Strategy I booked some profits yesterday with a +2.4% profit in Nike (NKE) and +2.1% in Twitter (TWTR). I had a day-trade in Square (SQ) that started out great, but couldn’t hold the gains into the close, so sold it for a small profit of +0.3%. I only have one position coming into today, so

My Swing Trading Strategy Closed out two trades yesterday, but managed to keep and raise the stops on three other positions. I’ll look to add 1-2 new trades to the portfolio today if the market decides to bounce. Momentum plays took a hit yesterday, so there’ll be plenty of them ready to bounce today. Indicators

My Swing Trading Strategy No new positions yesterday – at this point the market is getting a bit stretched, the volume is very light, and price action very contained, and a pullback here is very possible to work off the overbought conditions this market is currently experiencing. Right now my portfolio has some very solid

My Swing Trading Strategy I took profits in Facebook (FB) on Friday for a +3% profit. I also added one other position too. I’ll be more inclined to let my current positions go to work for me this morning, and not over-extend my long exposure. Indicators Volatility Index (VIX) – VIX dropped hard for a third straight