My Swing Trading Strategy

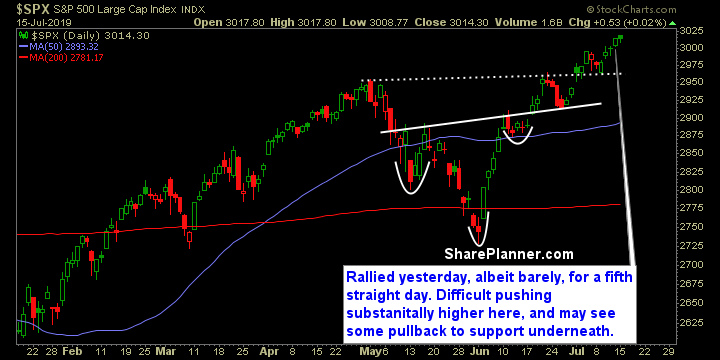

No new positions yesterday – at this point the market is getting a bit stretched, the volume is very light, and price action very contained, and a pullback here is very possible to work off the overbought conditions this market is currently experiencing. Right now my portfolio has some very solid trades working, and will use a pullback to add to it.

Indicators

- Volatility Index (VIX) – Broke a 3-day losing streak, by popping 2.3% yesterday to 12.68. Still poised for a pop back up to the declining trend-line off of the May highs.

- T2108 (% of stocks trading above their 40-day moving average): A 2% decline but still holding the 67% level. Consolidating the past two weeks. Could see this break down in the near future.

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Materials and Technology led the market higher yesterday, but between the two, tech is by far the strongest. The healthcare sector saw some strength yesterday, and overall, I don’t like the sector with the headline risk of late and choppiness over the past month. Staples coming out of a bull flag at all-time highs. The strength seen in Energy last week, is now in question following yesterday’s hard sell-off. I’ve put together a full sector analysis report that you can access by clicking here.

My Market Sentiment

Another record close, but c’mon, we’re talking about a +0.02% day for the bulls. Not much to get excited about. I don’t have huge expectations for the market here. Wanting to get bullish at these levels isn’t the best idea. Far better off waiting for some kind of pullback first.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.