Swing Trade Approach:

Whoa! That was quite a day for the stock market. I was stopped out of a few positions right at the open. The big ones being Universal Display Corp (OLED) and Delta (DAL) for a -6.8% loss and -5.7% loss (Those loser trades don’t deserve being highlighted in bold, I hate those things, and you only get the bold treatment when the stock can pull in some profits – call me bitter, but that’s how it works at SharePlanner!). Black and Decker (SWK) was also another loser stock where i took a -3.5% loss.

But hey, I managed to close out a few winners along the way too. I closed out CGI Group (GIB) for a +3% profit and the second half of my Shake Shack (SHAK) trade for +6%. The first half netted me a +12% profit.

Then you have my Walt Disney (DIS) Short where I closed half of that position for a +5% profit.

I also added a couple of shorts that didn’t really do too much today, but I did buy SpaceX (SPCE) on the dip today and I’m currently up +6%

Tomorrow, if the market can show signs it wants to bounce, and the hysteria over the Coronavirus has subsided, I will probably look to add a few more positions to the portfolio.

Indicators

- Volatility Index (VIX) – VIX rocketed higher today – in a very impressive fashion. Up 25% today and held much of the day’s gains. The highest close since October 9th of last year. Declining resistance off of the February 2018 highs looms at 24 currently.

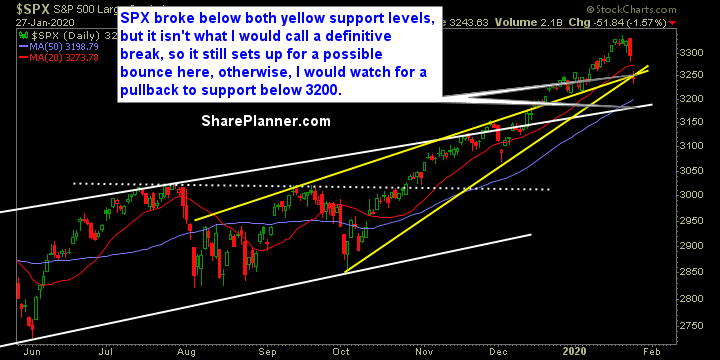

- T2108 (% of stocks trading above their 40-day moving average): The lowest print since the October 10th reading. T2108 dropped 13% down to 45%. Very poor reading, but may signal a bounce in the coming days following six straight days of lower readings on this indicator.

- Moving averages (SPX): Gap below and stayed below the 20-day moving average today. Another day like today, and SPX will be pushing through the 50-day MA as well.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy, Materials and Technology weighed heavy on this market. Energy is at a place where you may see a significant bounce with it testing the rising trend-line off of the August lows. If you want some risk in your portfolio, consider the bounce in Energy. It may not work, but if it does, the reward will be a doozy.

My Market Sentiment

Massive drop today that gave SPX its first move of over 1% in over seventy trading sessions. So you can reset those counters! Also the move in SPX over the last two trading sessions has taken SPX below the year’s opening print on the year. That means most of the gains are gone. A move below 3230 would completely erase those yearly gains. If the bulls cannot bounce this market, then 3192 looks like the next area for a possible bounce.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

The percentage amount for your stop-losses and where to put them at when trading the stock market can be very difficult to determine. In this podcast episode, Ryan talks about times when it works using tight stop-losses versus very wide stop-losses and the tricks that you can use to narrow the stop-loss even further.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.