PLTR stock price has dropped dramatically Using technical analysis, I provide the best areas of where to potentially buy the stock and whether it is the right time to buy the dip. Overall, Palantir Technologies (PLTR) has risen dramatically over the course of the past six months and considered overvalued with a 477 P/E ratio.

PLTR is up 530% over the last past and another 23% today alone! Tech bubble is getting more exaggerated.

Episode Overview Emotional trading will destroy one's portfolio. Aiming to hit home runs with every trade is a sure sign that the trader is overly emotional and only cares about fast money. In this podcast episode Ryan explains how chasing after stocks like MicroStrategy (MSTR) without a plan for managing the risk can ultimately ruin

Episode Overview How to trade a stock split: in this podcast episode Ryan talks about the impact of what an announced forward stock split means for a stock that you are considering swing trading, or may already be trading. Also covered are the risks, and the strategy behind stock splits for investors and traders alike.

T-Mobile (TMUS) breaking out of a bull flag yesterday, with follow-through today. Strong volume as well. MedPace (MEDP) ascending triangle breakout, right after the opening bell. ZipRecruiter (ZIP) head and shoulders confirmed, continuation triangle pattern forming with a break to the downside today. Palantir Technologies (PLTR) holding the channel breakout from last month, and now

Tesla (TSLA) broke declining trend-line, but also holding the rising trend-line off of recent lows. Room to run as high as $206. Break back below declining trend-line would spell trouble. Upper channel band on Palantir Technologies (PLTR) in play. Why I never swing trade earnings: Snap (SNAP)

Ideal entry on Viper Energy Partners (VNOM) would be a bounce off of its lower channel band. Palantir Technologies (PLTR) heavy fade back to the lower channel band. With earnings today, it becomes a high-risk trade to paly any bounce. Bear flag on Tesla (TSLA) confirming to the downside, with additional continuation today.

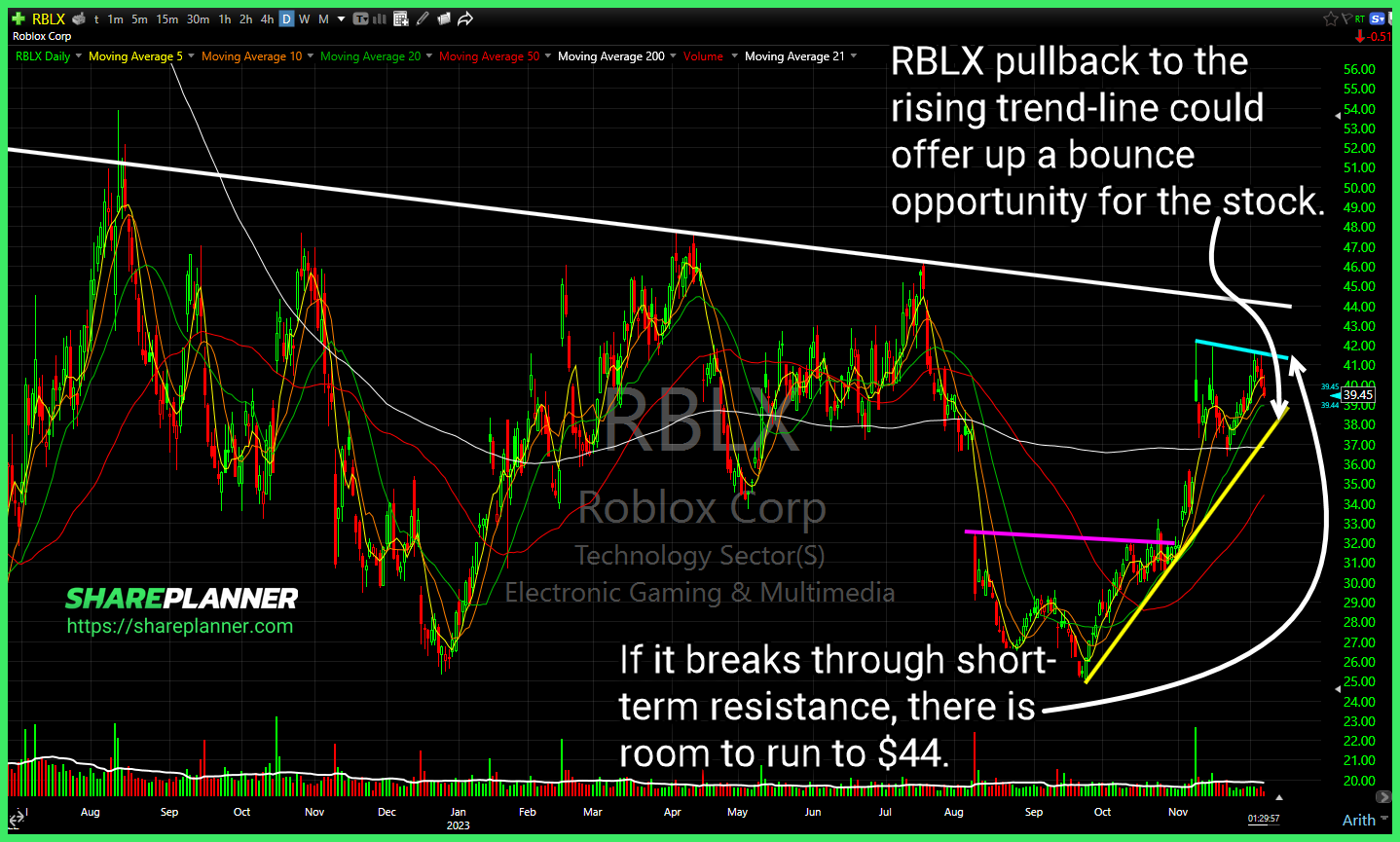

Roblox (RBLX) pullback to the rising trend-line could offer up a bounce opportunity for the stock. Darling Ingredients (Dar) breaking out of its base with room to run to $51 before encountering much resistance. Chewy (CHWY) Hard bounce off of support following a large gap lower this morning. Some support attempting to be found for

$PLTR - major gap still left unfilled, and a pullback to one of the two support levels underneath would be the best opportunity to me. $XHB consolidation prior to the the break through resistance, sets up well for higher prices with tight risk management. $IWM two hard rejections off of the 200-day moving average Heavy