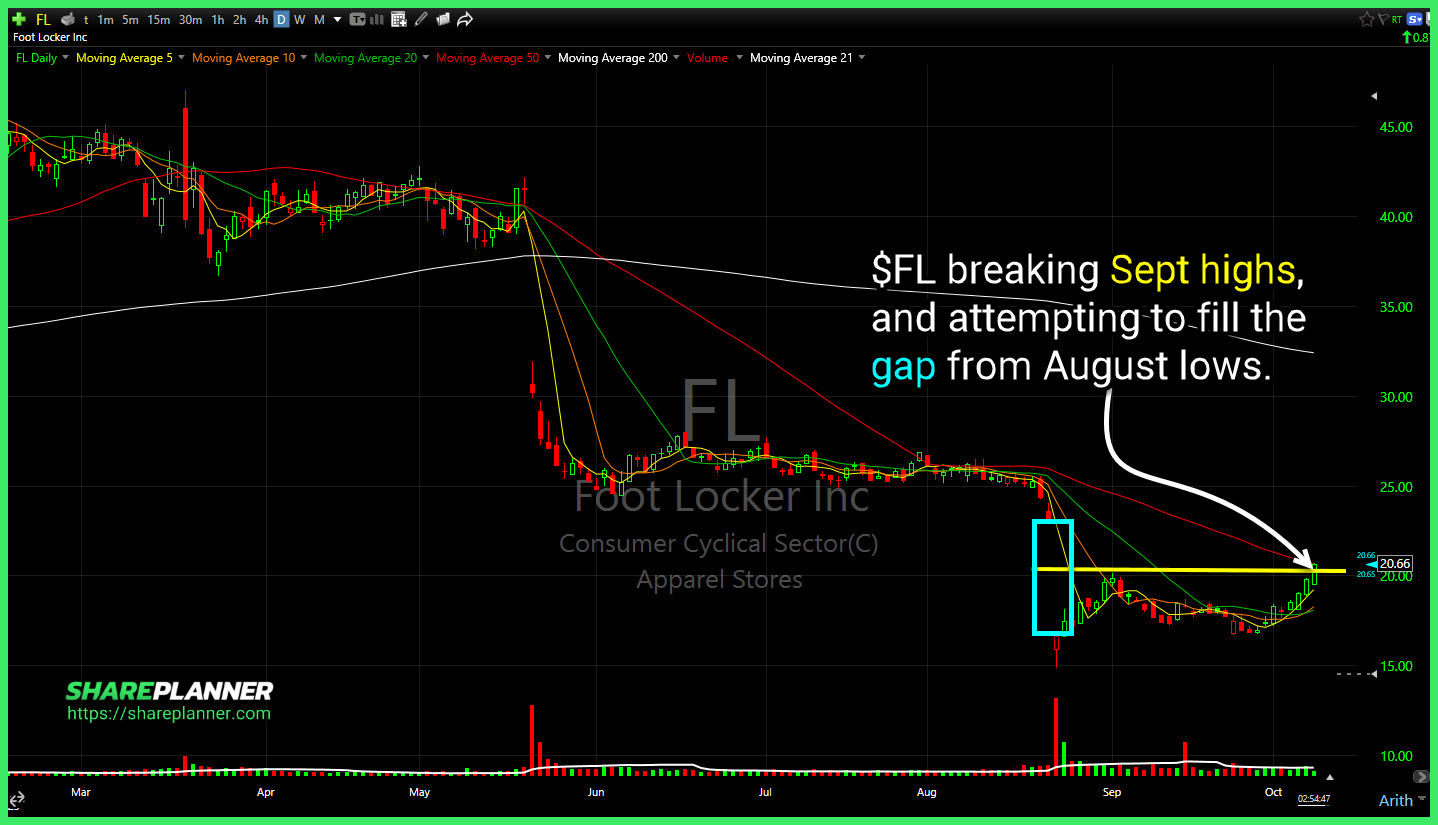

$FL breaking Sept highs, and attempting to fill the gap from August lows. Hard fade in $VIX today, with the lower-channel band getting tested again. A break to the downside would likely signify more upside for equities. $LMT declining resistance and price level resistance overhead to watch. If US gets involved, or provides aide, likely

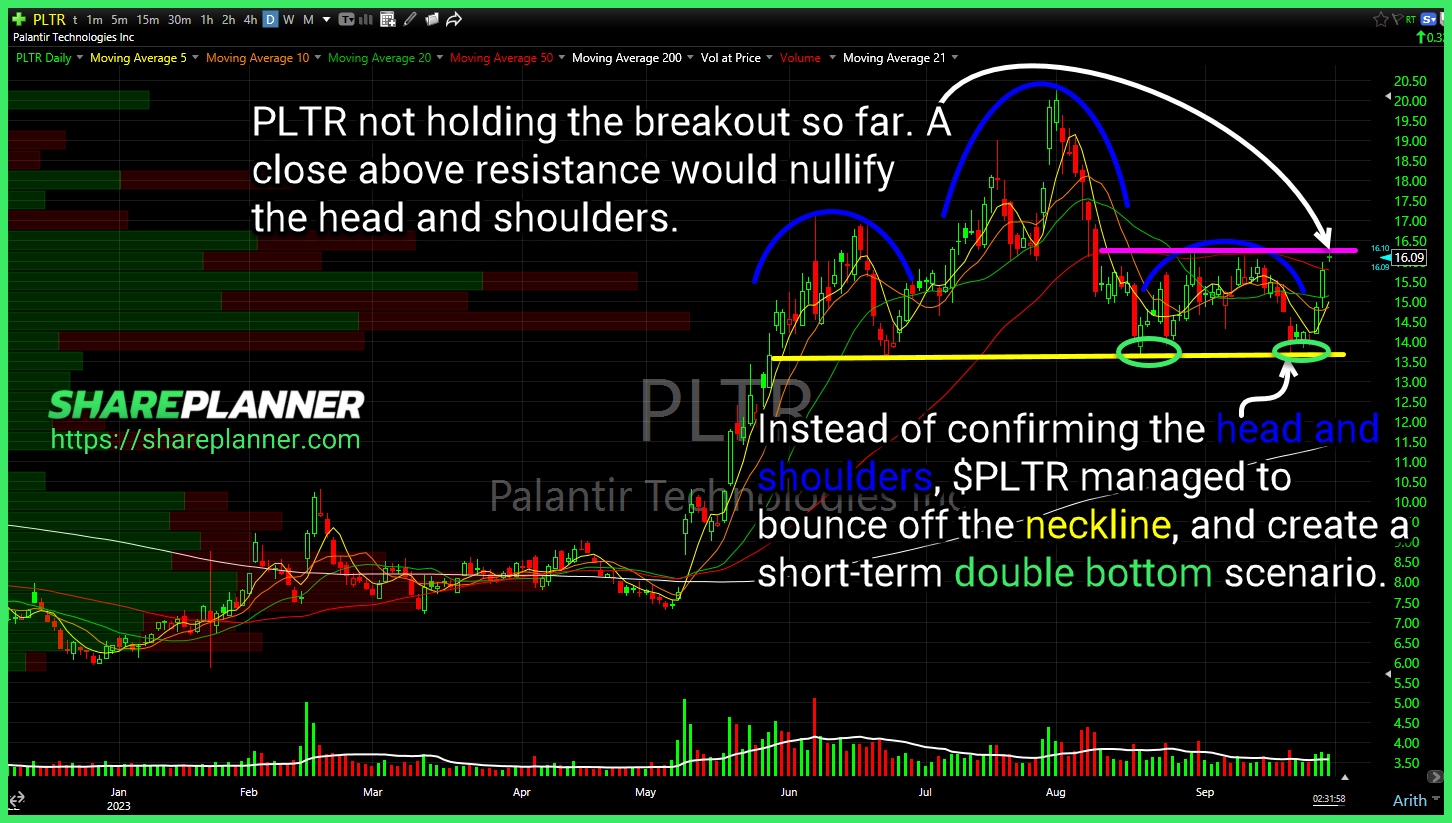

Instead of confirming the head and shoulders, $PLTR managed to bounce off the neckline, and create a short-term double bottom scenario. $F has a promising setup if it can break through short-term consolidation, but it is also dealing with heavy rejection at the 200-day moving average. $CCL needs to hold key support here at $13.70,

Palantir Technologies (PLTR) Rising trend-line off of May lows tested and held so far today. Attempting to bounce from here. CBOE Market Volatility Index (VIX) pulling back some today, but still hovering just below a significant base breakout level here. Moderna (MRNA) was a one trick pony, and not one worth ever buying

$VIX back below key support, after falling off a cliff, post CPI.

Multi-year support level on $AMZN getting tested here.

Healthcare looks like there’s more room to the downside.

$PLTR breaking its long-term trend-line.

$GS Double topping, but far from confirming.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of