Technical Outlook:

- Quiet move in the market on Friday that led to another nice gain for the bulls.

- Slight uptick in volume on Friday but well below recent volume averages.

- This market has all the makings of a market the wants to continue to move higher, however, there are numerous resistance levels overhead between the current price and new all-time highs.

- You are also entering into the summer months, where Brexit is a concern and the FOMC is more than likely at some point to raise interest rates.

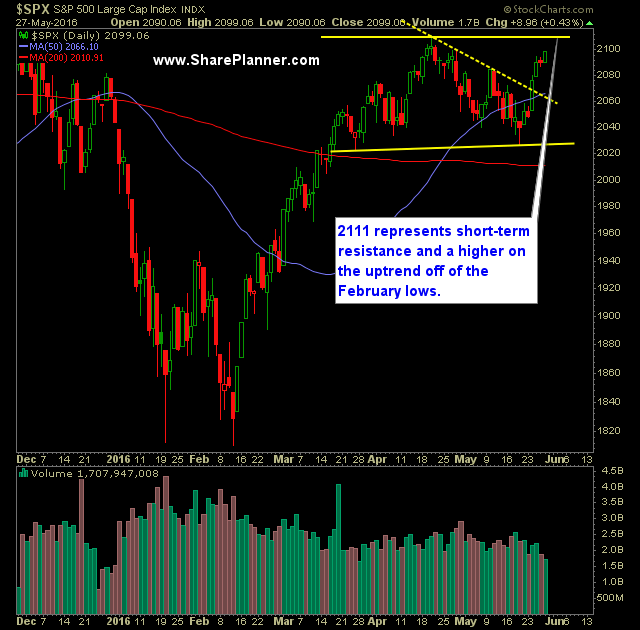

- The next objective for the market is to push through 2100 and over and above 2111 which would establish a new higher-high on the current trend-line off of the May lows.

- Above 2111 is 2116 and then after that, all-time highs are on watch.

- Much of last week’s rally since last Tuesday, felt, in large part, to be because of the short-sellers covering positions.

- VIX back into the low 13’s and this is where over the past two years, stocks have really struggled to do anything below 13.

- SPX 30 minute chart continues to rally followed by sideways consolidation followed by another breakout.

- Coming off of a three day, holiday weekend, I would suspect price action to be tight and the volume to be light again.

- Crude, for the most part has traded sideways over the last three days.

- The strength of all the moving averages are currently beneath price action.

- Almost comical, you now have a massive inverse head and shoulders pattern that is forming over the past seven months. A move around ~2103 would confirm the pattern.

- The longer-term head and shoulders pattern on the weekly chart going back two years would be nullified on a move back above 2116.

- There is a lot at play here and a lot of potential to change the scope and shape of the market should this market continue rallying higher.

- 2040-2138 price range on SPX continues to show just how difficult this price range is for trading, and over the last two years the price action has spent its time trading in it.

- I believe at this point, profits have to be taken aggressively, and avoid the tendency to let the profits run – the market is in a very choppy range that has mired stock price for the past two years. Unless it breaks out of it and onto new all-time highs, then taking profits aggressively is absolutely important.

My Trades:

- Sold TSLA on Friday at $221.36 for a 0.2% profit.

- Added one new long position on Friday.

- Currently 30% Long / 70% Cash

- Remain long: AMZN $709.01, MSFT at $51.74 and one other position

- I will look to add 1-2 new long positions to the portfolio today. May also hedge the portfolio if we start to see signs of weakness start to creep into the market.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.