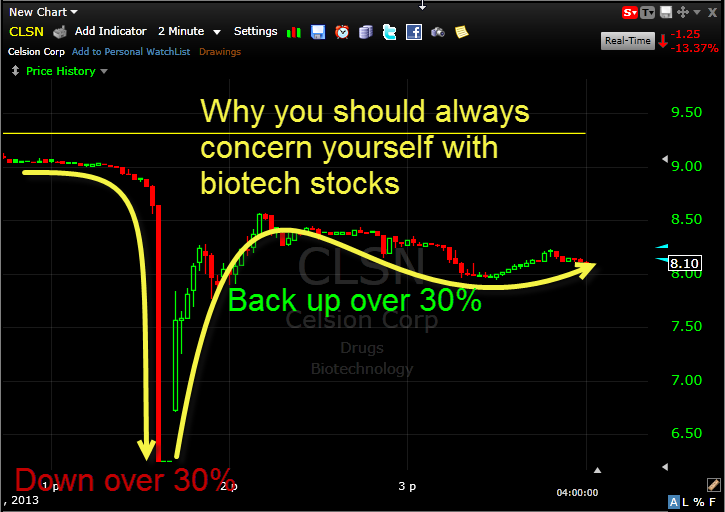

Be weary of cheap-o bio-tech stocks… Quick Glance at the Market Heat Map and Industries Notables: For a market that finished higher today, the only stocks that really looks good were banks, AAPL and HPQ Utilities and Industrials weighed on the market Despite the Nasdaq finishing higher, telecom , GOOG, and

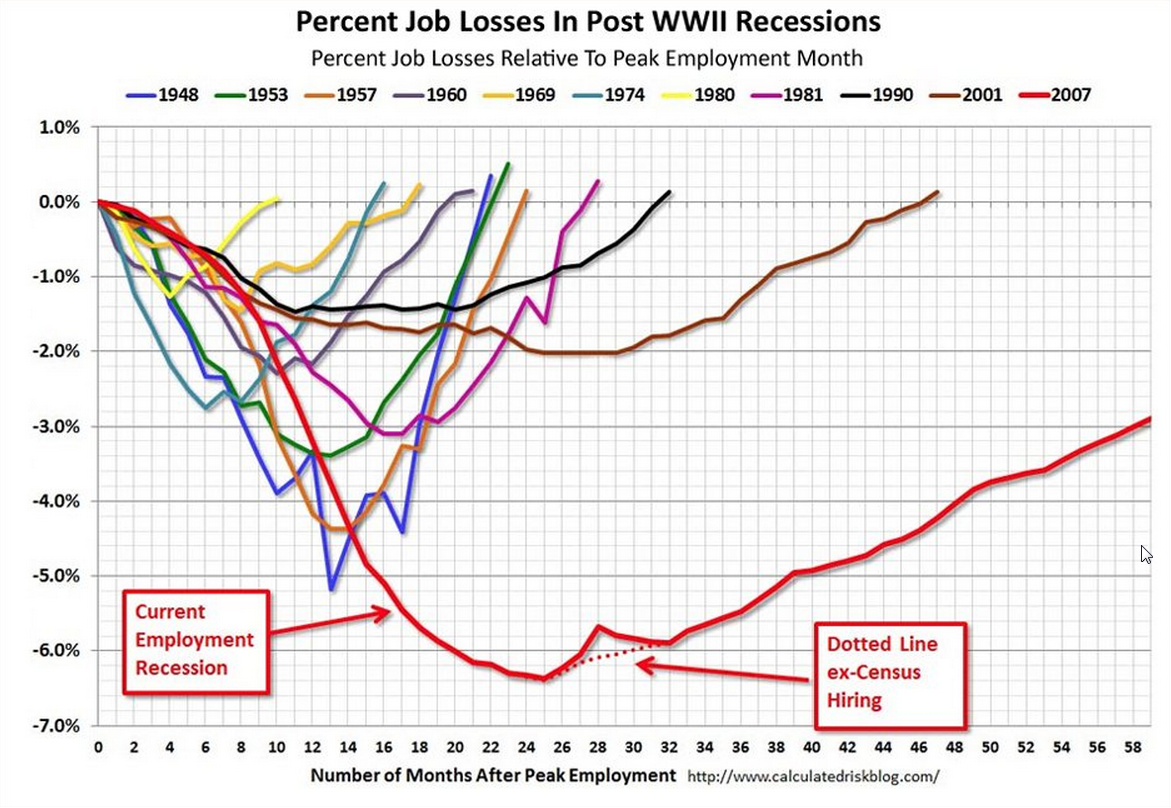

Scariest Employment Chart To Date… Quick Glance at the Market Heat Map and Industries Notables: Apple (AAPL) weighed on tech for a second straight day, as did Microsoft (MSFT). Banks, Utilities, and Materials led the way. Services showed patches of weakness. Be sure to check out my latest swing trades and overall

I recently saw the movie, “Moneyball”, which starred Brad Pitt playing the roll of Billy Beane (General Manager of the Oakland A’s). I must say it was one of the best movies I have seen in years. And there wasn’t even anything that belew up during the two-hour movie. Nonetheless, that movie was riviting, and

It’s time for the weekly momentum gainers that you need to be keeping a close eye on. In particular, I would watch Microsoft (MSFT) which is putting in a nice double-bottom, and at current prices makes for an appealing trade with the opportunity to see it move as high as $28.00. I also like

Current Long Positions (stop-losses in parentheses): QID (10.49), GLD (128.65), SDS (22.29) Current Short Positions (stop-losses in parentheses): PII (75.36), T (28.74) BIAS: 21% Short (counting QID and SDS as shorts) Economic Reports Due Out (Times are EST): None My Observations and What to Expect: Futures are flat to slightly negative heading into

Current Long Positions (stop-losses in parentheses): TICC (9.62), BRKR (13.92), CVX (80.67), DAL (11.12), ELY (6.78), ITW (46.40), SSO (38.70), QQQQ (48.19), FRG (6.99), URS (37.12), TIE (19.52), BEAV (29.54) Current Short Positions (stop-losses in parentheses): None BIAS: 76% Long Economic Reports Due Out (Times are EST): Jobless Claims (8:30am), EIA Natural Gas

Recently I have tried to provide readers on the weekend with the most interesting article from the past week. The article below comes from MarketFolly.com. It details the most popular stocks among hedge fund's top-ten holdings. Perhaps you may be able to find a trading idea or two as a result. Given our focus on

As I said yesterday, today will no doubt be pretty crazy in regards to the number of variables out there influencing the market’s direction today. Not the least, you have the affects of yesterday’s FOMC Statement being further digested – in fact I have seen it at times, where the following day of its release, do a

The mood is is much better than yesterday heading into the open, as futures are somewhat mixed with the Dow down 2 points, the Nasdaq at break-even and the S&P up 0.5. We have a few reports coming out today, but nothing major with the MBA Purchase Applications at 7am ET, followed by the Beige

Markets are looking pretty sluggish out there today. Overnight we saw pretty significant declines from the Asian markets with losses ranging between 1.4% and 1.8%. The European markets aren’t fairing much better down about 1.2%. Currently US futures sees the Dow down 52 points, while the NASDAQ and S&P are each down 5.75 and 6.5 points respectively. We