The last two days of trading has been quite a head-scratcher. Yesterday we sold off on news that there would be an increased chance of further rate hikes this year, today, prior to the FOMC Minutes being released we rallied on the same news, banks in particular. Following the FOMC Minutes that priced in a

Yesterday, during an interview with CNBC, Donald Trump said that he would most likely replace Janet Yellen, stating: “She is not a Republican, When her time is up, I would most likely replace her because of the fact that I think it would be appropriate.” That would be when Yellen’s term as chairwoman ends in

Information received since the Federal Open Market Committee met in March indicates that labor market conditions have improved further even as growth in economic activity appears to have slowed. Growth in household spending has moderated, although households’ real income has risen at a solid rate and consumer sentiment remains high. Since the beginning of

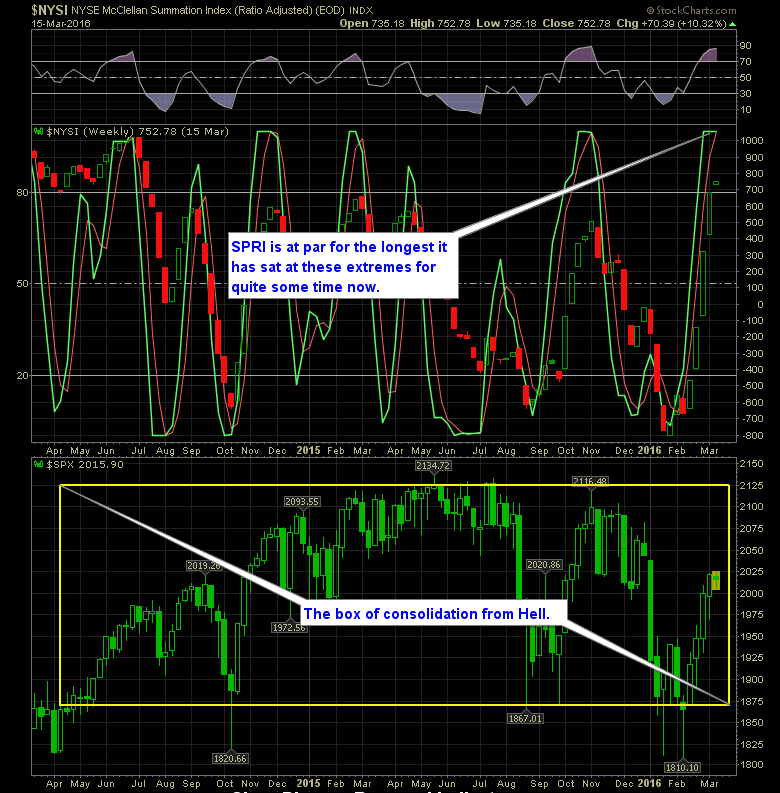

The bearish reversal signal that the SharePlanner Reversal Indicator flashed earlier this month seemed a bit premature as it has reversed back up and stopping the reversal from ever starting. When you get that quick of a reversal following another reversal, it is safe to say that the original reversal never actually reversed (say that

Technical Outlook: Another morning sell-off, another afternoon rally. The bears are not holding on to their shorts for long, and the dip buyers are patiently waiting for the afternoon to roll around before jump starting their long positions. Yesterday saw a 10 point pop off of the lows of the day, and 5 points in

Technical Outlook: SPX had a solid day yesterday following dovish remarks about future rate increases from Janet Yellen. Her dovish outlook as it pertains to rate hikes has been, in large part, the reason for the massive rally off of the February lows. Volume yesterday on the SPY was notably higher than recent days,

Information received since the Federal Open Market Committee met in January suggests that economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months. Household spending has been increasing at a moderate rate, and the housing sector has improved further; however, business fixed investment and net exports

Alright folks. This market isn’t giving and it isn’t taking away either. The bears find motivation overnight only to see it quickly dissipated within the first 30 minutes of each trading session. The bulls make a nice comeback, but there’s nothing being added to the recent gains the market has put together. Instead it just

Technical Outlook: Another low volume and tight trading range for SPX yesterday. Volume was on par with yesterday’s light reading and well below recent averages. Price closed below the declining trend-line as well as below the 200-day moving average for SPX. Market behavior over the last two trading sessions and a few others before

FOMC Statements in 2016 So the question is what dates are the best for raising rates in 2016? January 26th: No change March 16th: Best opportunity to raise rates, though most are not expecting it. Market up +8% off of the February lows.