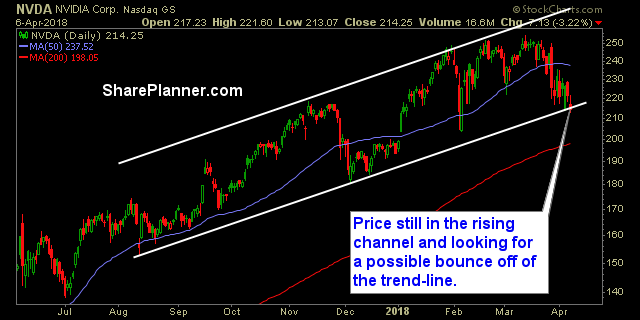

The charts on the Semiconductors simply look BAD! There is nothing redeeming about them here, and there are plenty of more earnings reports to come out on them still, including the big names like Advanced Micro Devices (AMD), Nvidia (NVDA) and Intel (INTC).

My Swing Trading Approach Still net short, but in there with some long exposure. I’ll need to see a move from the market today, whether up or down, to convince me to add more trades to the portfolio. Sideways price action won’t lure me into making another trade. Indicators

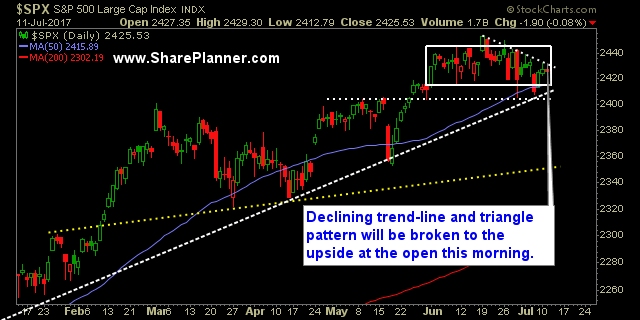

Stocks ready to bust a move despite yesterday’s freakout That was a fast, hard, sell-off that came out of nowhere yesterday and looked like it was going to really bring down the market in a big way, until the Senate announced that they were going to do their job and actually work and not take

The rally took stocks right up to the 20-day moving average before selling off at the close For the past couple of weeks that 20-day moving average has been an absolute pest to the S&P 500 and traders as a whole. Today it kissed the MA and then sold off hard right thereafter into the

I would have loved to of seen a greater pullback in the market And maybe we still get it right here, but Friday’s bounce was highly problematic for the bears. Simply put, they had the market, as they have had time and time again, on the ropes, with a breakdown in key support. All that

Yesterday's sell off provides bears with a new opportunity At the midpoint yesterday it looked as if the market was going to enjoy another one of its intraday "V" shaped bounces that we have become accustomed to. But just as it was about to rally back to green, the market went on a massive sell-off

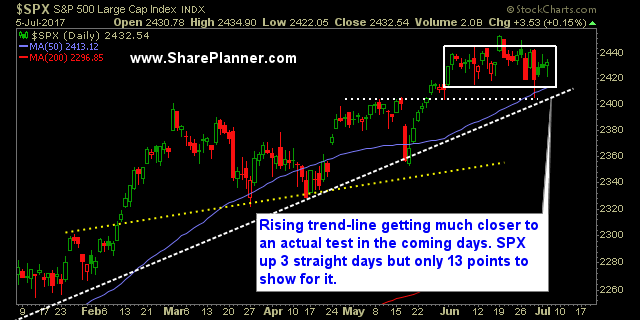

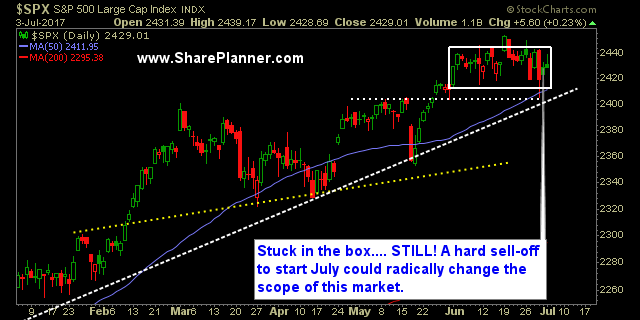

It was just last Thursday when the S&P 500 was on the cusp of a breakdown. Since then, it has been up, up, up. But only 13 points to show for the 3-day rally in the stock market. And each rally has been of mixed signals, with the Nasdaq down the first two days of

I suspect that the holiday volume will persist into the week. Anytime you have a week where there are only 3.5 trading sessions in total, you can expect that much of Wall Street will take the week off and enjoy an extended vacation.

Futures are surprisingly making a move in the premarket Whether it holds will be a whole other question. Gap highers tend to be shakey business of late. Even Friday, where the market was solid all day long, chose to sell off in the final 10 minutes of trading and wipe out about 80% of the

Stock market is on shaky ground That doesn't mean the market is simply going straight down from here - if it were only that easy. That's because, despite the sudden bearishness that has been prevalent throughout this week, there is still that pesky dip buying mentality of the stock market that won't let the 8