As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

I'm here to provide you with a stock market bubble update. Is the stock market in a bubble and if so, is there going to be a stock market crash in 2021? There are a lot of fears of a stock market bubble burst, and what I'm here to do is provide you with insight

Get 3 swing trading setups to start the new year, broken down in simplest of terms for stock market beginners. The fear of a stock market crash is real in 2021, and one of the reasons I always focus on how to manage the risk with every trade. The stock market for beginners can be

The stock market continues to rise ahead of the 2020 election, and there is plenty of concern among investors in deciding will the election affect the stock market. Stock market analysis during election years has shown, historically, to perform well, and it isn't normal for even contentious presidential elections to cause a stock market crash before

The Stock Market Crash 2020 might seem long forgotten, as Tesla stock is now all the rage, but with a major earnings week coming up, and the FOMC Statement as well, there is the potential for a resumption of the stock market crash if all does not go well. You already see a lot of

Investing in silver has become all the rage, and following a huge silver price move, traders want to know 'should I buy silver now?' Or is it too late? Robinhood SLV ETF traders are popping up, and buying silver and related silver stocks are seeing a huge influx of volume. In this video I show

I don’t have any issues with any of the sectors right now except for Energy. Energy is seriously the most unpredictable and untradeable sector right now. Nothing holds to the upside, and just when you think a stock is breaking out, it reverses course and breaks down on you.

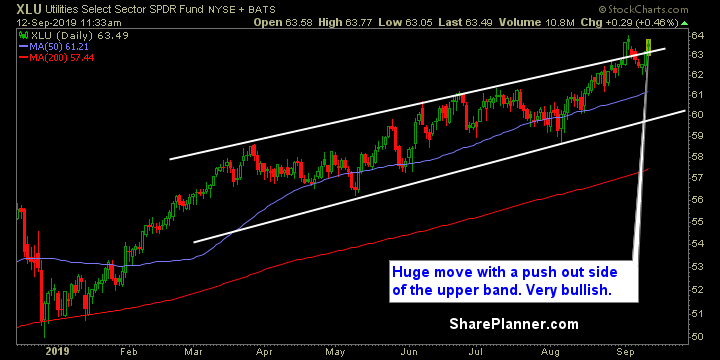

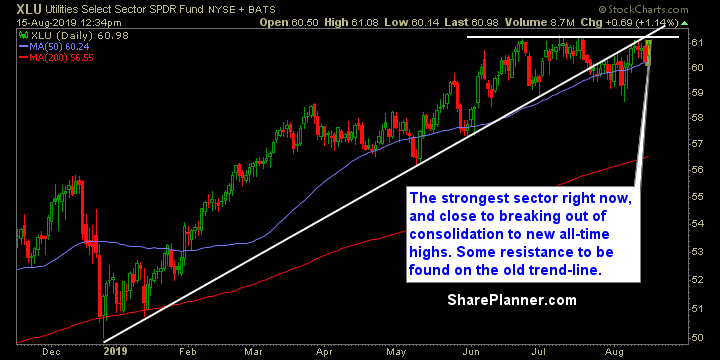

A lot of trend-lines breaks and topping patterns are forming The safe sectors is where big money is putting its capital. Utilities are practically on the brink of new all-time highs. I’d also like to add stocks supporting the military or have big dollars in the Pentagon defense budget are also holding up well and

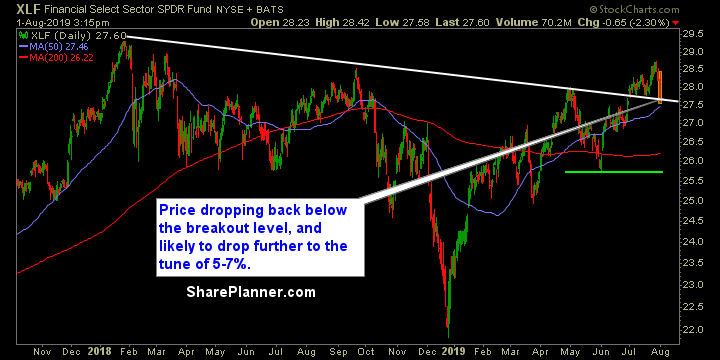

The market is shedding its bullish act, and taking on a much more bearish tone. Jerome Powell’s circus yesterday, coupled with Trump’s untimely Chinese tariffs tweets today, has instantly put this market into a tale-spin. Short -term support levels are being violated across the board, and traders are being whip-lashed all over the board. The

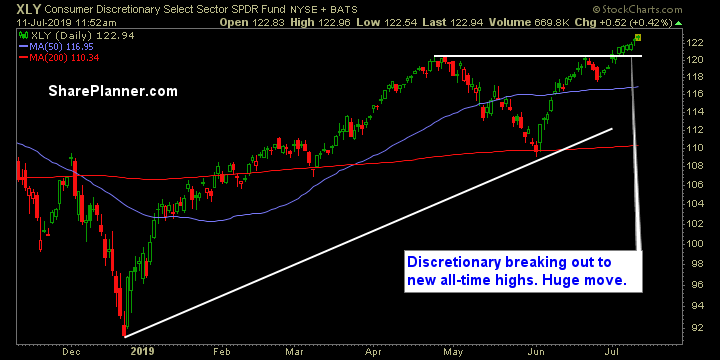

Very bullish look to the market. Maybe some pullbacks to existing trend-lines in order. I can’t find much to say that is negative about this market. Trade War headlines have died down and the Fed (for reasons beyond any reason) are still wanting to lower rates even though the market is at all time highs.