Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

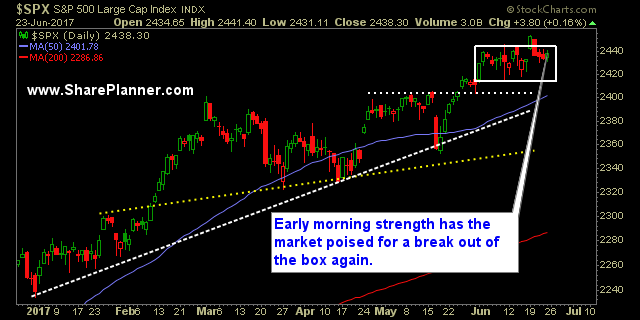

Buy Machines Continue to Bounce following One Day Sell-offs If the premarket is any sign of what looms for the market today, it will be yet another hard bounce following a one-day sell-off.

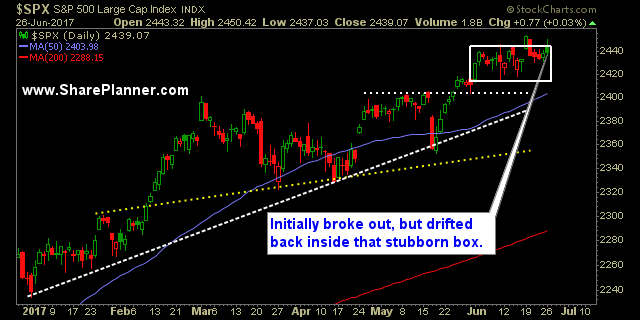

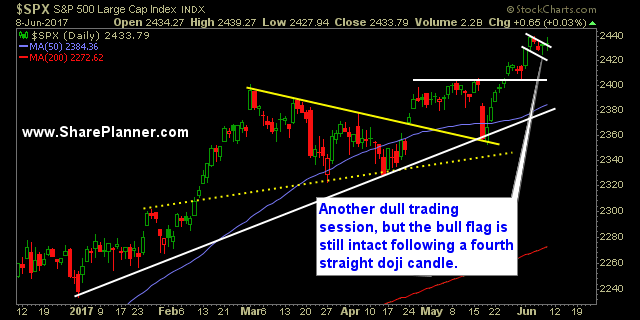

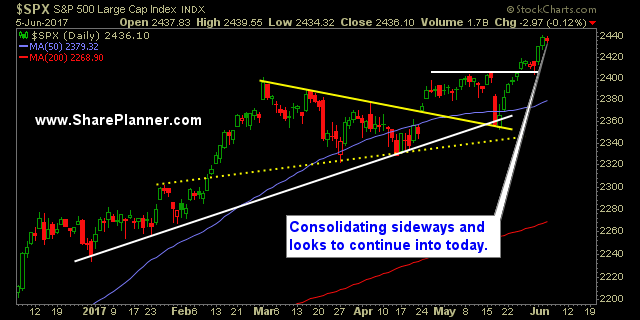

Stocks and Indices continue to trend sideways Outside the first trading day of the month, the market has absolutely gone nowhere. Stock trends in general have been totally sideways or in more technical terms, “consolidating”.

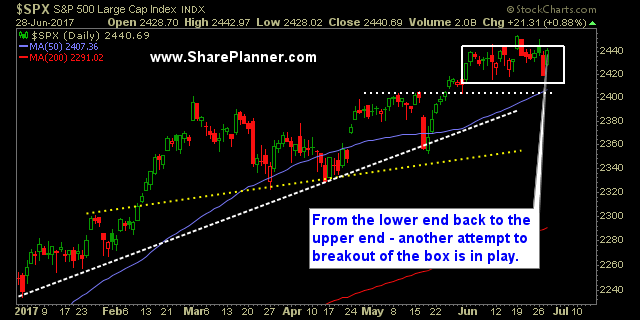

Prepare for the funds to start window dressing their quarterly and 6 month reports This is one of those points in the year, where the funds become very concerned by their performance. So much so, that they’ll start what is commonly known as ‘window-dressing’ their portfolios with all the right stocks so that they can

It was another great May swing trading performance in the stock market for members of the Trading Block As you know by now, I am a huge proponent about swing trading transparency when it comes to my stock market performance. There are so few traders out there that actually show their results, much less go

James Comey done talking, Dodd-Frank Repealed in House, and Bristish Snap Election Surprise Only the James Comey hearing seemed to matter to the talking heads today, but key Dodd Frank regulations being repealed by the House, and Theresa May possibly being ousted after surprise gains by the Labour party crippled her majority. Futures have been busy

Comey and the markets collide Ultimately, I don’t expect much from this testimony. Comey prepared with the special counsel, Robert Mueller. For one, I don’t think he wants Comey’s testimony blowing up his investigation, and much of what could hurt Trump is already out there in the remarks yesterday. Politics aside, the market is only

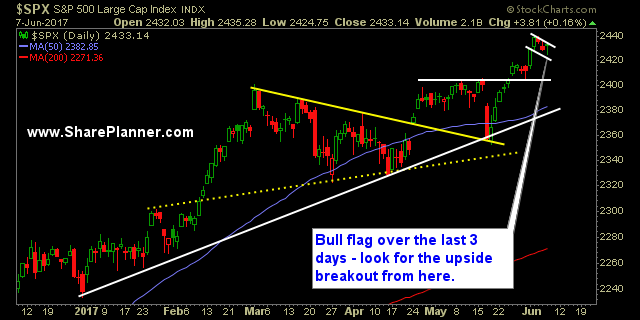

The ugly sideways price action is likely to persist I think that we are likely to see more of the same price behaviors yet again today. Yesterday’s price action started off typical, open lower, and then spend the rest of the day rallying back towards break even on the day.

Barely a sell-off yesterday, market cooling off now When you can get a 3 point sell-off these days on the S&P 500, you might want to consider it a generational buying opportunity as stocks rarely do anything but go up these days.

Swing Trading Results for April were solid – this despite an unmovable and dull stock market The month of April finished higher for the month with some really good swing trading profits but it wasn’t until April 24th, when the market finally decided to gap higher in a big way, did the S&P 500 break