$ARMH 2 Hour Chart – Seems to be holding well the 41 level. Gaping higher today. The gap still puts the stock in the middle of two Fibonacci Levels.

$ARNA Daily Chart – Mild gap but put it very close to yesterday’s highs. Could be a runner today.

$BBRY Daily Chart – Talk about a drama queen. There is simply no indication that this will be a good play today. I think it will be sold again and will finally re-test that 13.33 Level.

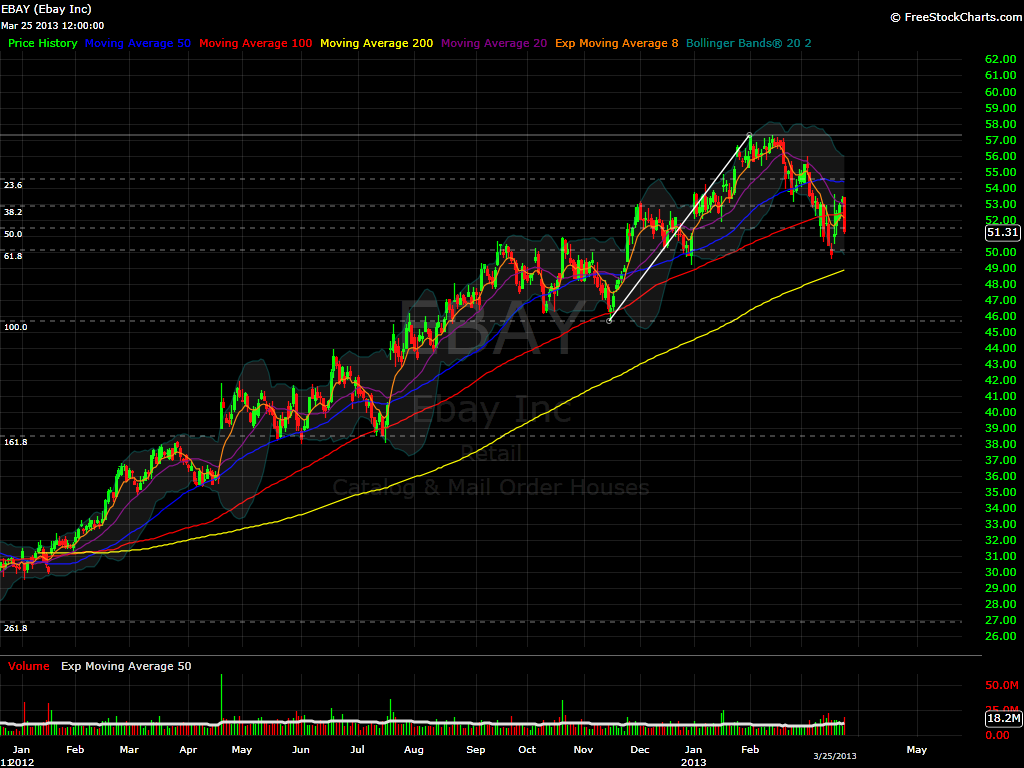

$EBAY Daily Chart – Making a come back so far, and above the 51.47 spot it could start making it’s way back to 52.83.

$GILD Hourly Chart – Opening just under the 61.8% Fibonacci level which is represented by the 45.39 price. If it can go over, I think it is poised to make new highs in the upcoming days. Or it can fail drastically as the market is clearly selling the pops.

$GLUU Daily Chart – Not convinced until it reaches above the 3.33 level. I think this is see 2.82 eventually before it goes any higher.

$NFLX 2 Day Chart – It has been defending the 179.08 level which pretty much is the fence as i like to call the 50% Fibonacci level. I think it won’t be long before it gets thrown over the negative side of this fence.

$RFMD 2 Day Chart – Popping above the 4.99 spot which is represented by the 50% Fibonacci Level. If it can stay above that level it could run to 5.36.

$WIN Daily Chart – There is no biz in this name until it reaches over 8.62.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.