Advanced Micro Devices (AMD) struggling with the upper channel band resistance. Rising trend-line on Albertsons (ACI) remains intact. As long as it holds, the stock remains bullish. 3M (MMM) breakout above the inverse head and shoulders neckline.

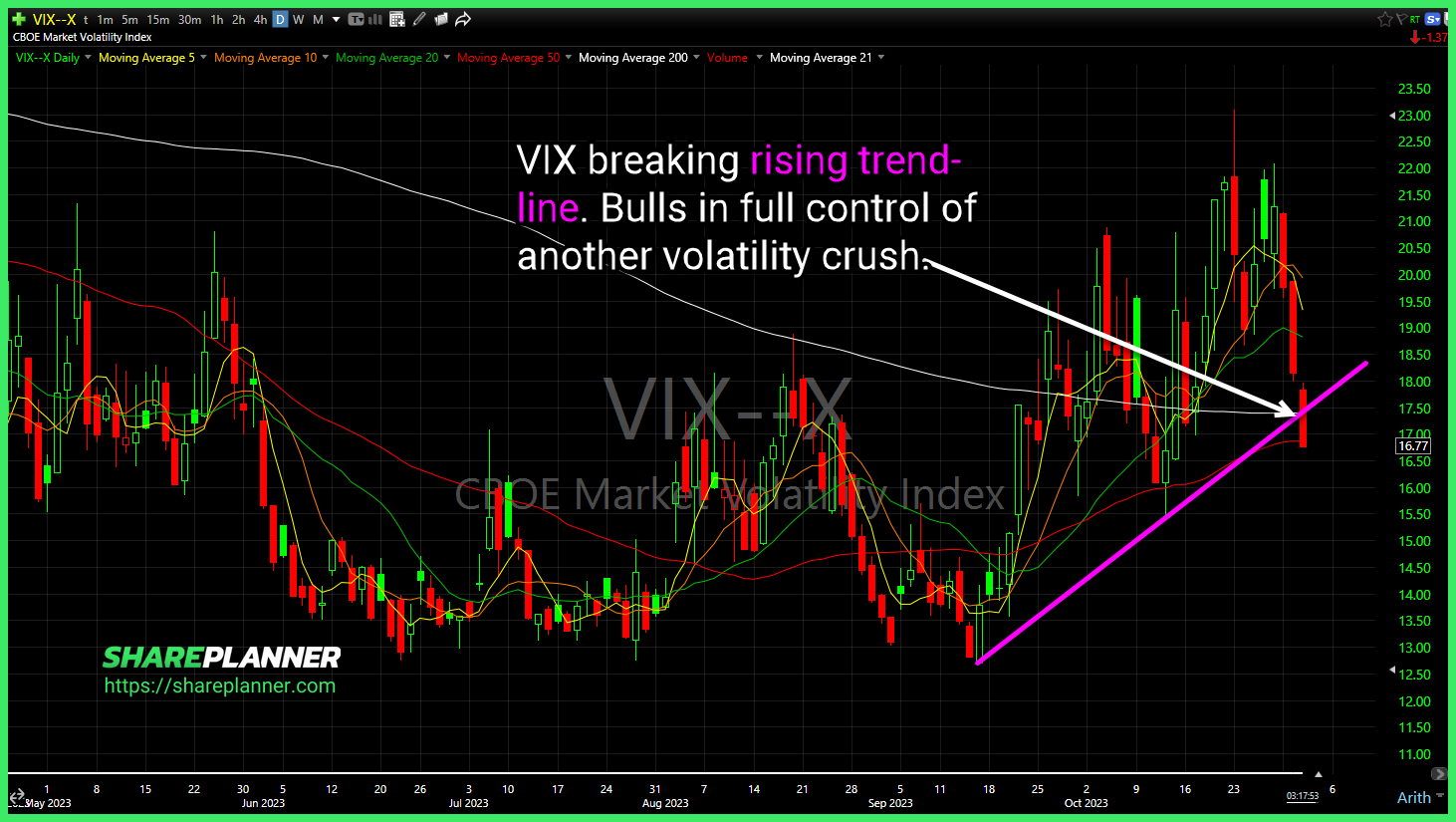

CBOE Market Volatility Index (VIX) breaking rising trend-line. Bears in full control of another volatility crush. Declining resistance on Boeing (BA) broken today. Declining channel in Advanced Micro Devices (AMD). Room to run, but watch for a potential reversal around the 106-107 area. Roku (ROKU) with a bullish wedge. Watch for the potential

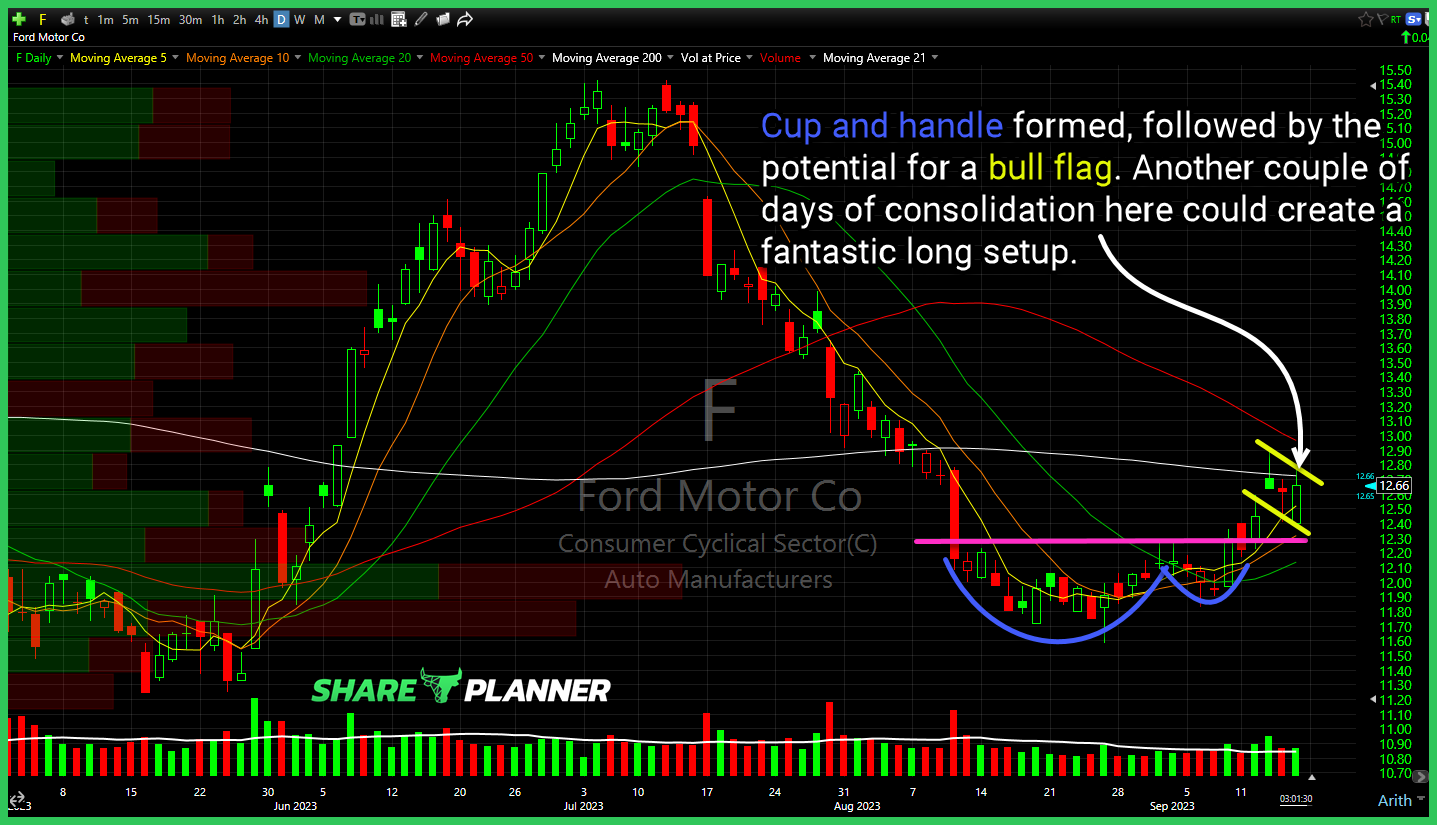

Ford Motor (F) Cup and handle formed, followed by the potential for a bull flag. Another couple of days of consolidation here could create a fantastic long setup. CBOE Market Volatility Index (VIX) hard bounce off price level support, now testing declining resistance. Advanced Micro Devices (AMD) breaking below its rising trend-line that goes back

Advanced Micro Devices (AMD) breaking out of the declining channel. Incredible strength despite a difficult tape today. The play for Baker Hughes (BKR) is playing the bounce off of the rising trend-line. Gapping today above breakout resistance, watch for a pullback to the breakout to try getting long. Celanese (CE) resistance getting tested as price

$CRWD sideways trading for the past 3 months, and forming a topping pattern on the verge of a breakdown here at support. $AMD clinging to the trend-line, but getting very little bounce/separation so far. Discretionary/Retail is a key sector $XLY to be watching here. Trying to hold that rising trend-line but not getting much lift

Alphabet (GOOGL) pullback to the bull flag breakout today. Will need to hold this or risk this being a failed breakout. Advanced Micro Devices (AMD) pulling back to its rising trend-line off the January lows, after failing to break out of the bull flag this morning. With today's fade off the highs of

I'm watching to see if $AMD pulls back to the rising trend-line from the Nanuary lows. If that Holds it could create a nice bounce opportunity. $NFLX attempting to finish off this head and shoulders topping pattern. Watch for $SOFI to retest year long support. If it can hold this level, it could provide a

AMD earnings report is out! Here's a technical analysis breakdown for what to expect from the stock going forward. https://youtu.be/kaPQULlJkFM I've also provided a breakdown on the SBUX earnings as well... https://youtu.be/ZX9d39gkyQM

Watch the $ORCL bullish wedge for a potential upside breakout. $NCLH potential bounce area for the stock following a sharp earnings sell-off today. Anybody want to address the elephant in the room? $TLT $AMD nearing a breakout of the bull flag pattern that has been forming since June. Pushing through the $117's into the 118's

$AMD double top may not be done with price confirming a bear flag breakdown. $GD reports earnings on 7/26 so not worth trading before then, but certainly a nice cup and handle that is forming. $UAL pushing through some serious resistance here, going back to 2021. Move below $53, would nullify the trade. $CVNA headed