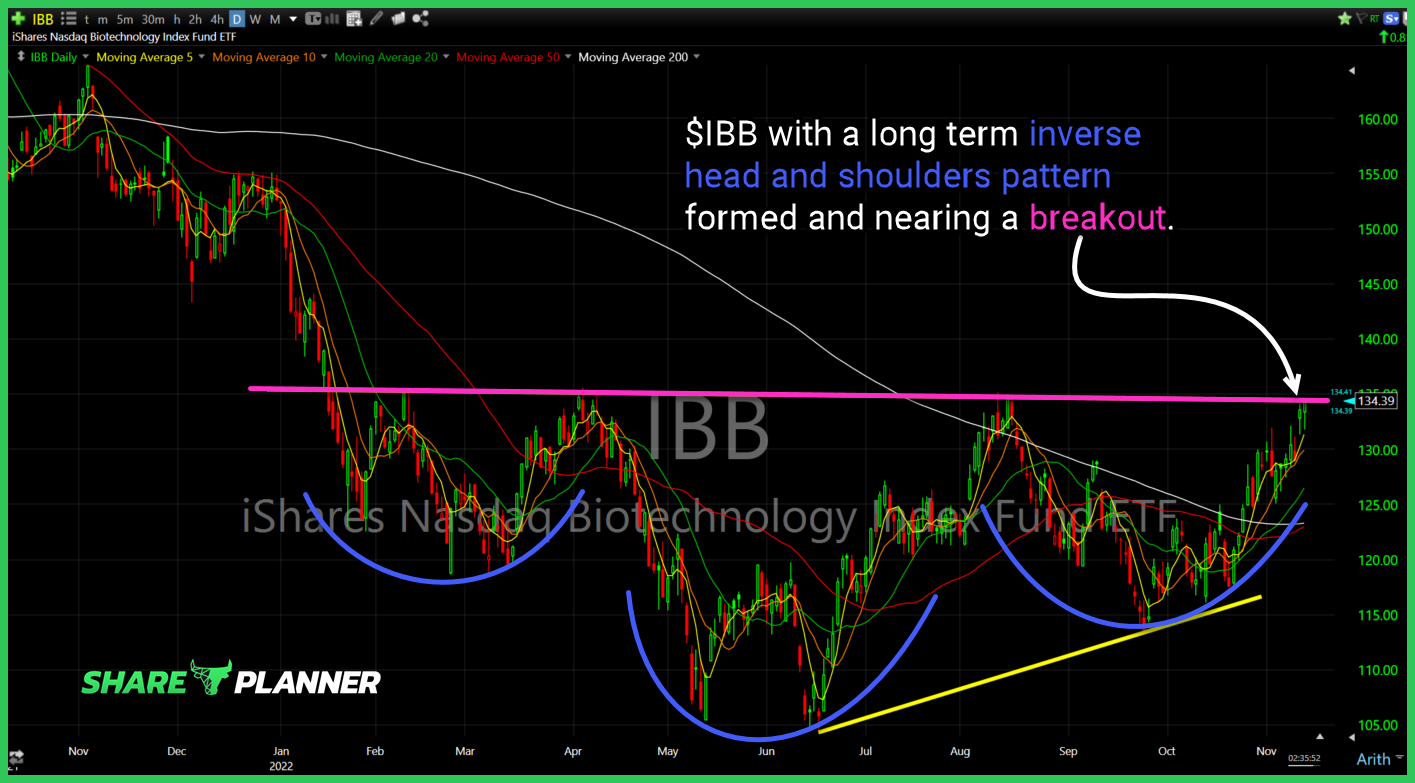

$IBB with a long term inverse head and shoulders pattern formed and nearing a breakout.

$TH toying with major support on a descending triangle pattern. If Broken, could quickly see single digits.

The mother of all head and shoulders patterns is forming on $TSLA.

$XOM attempting the breakout of the triangle here.

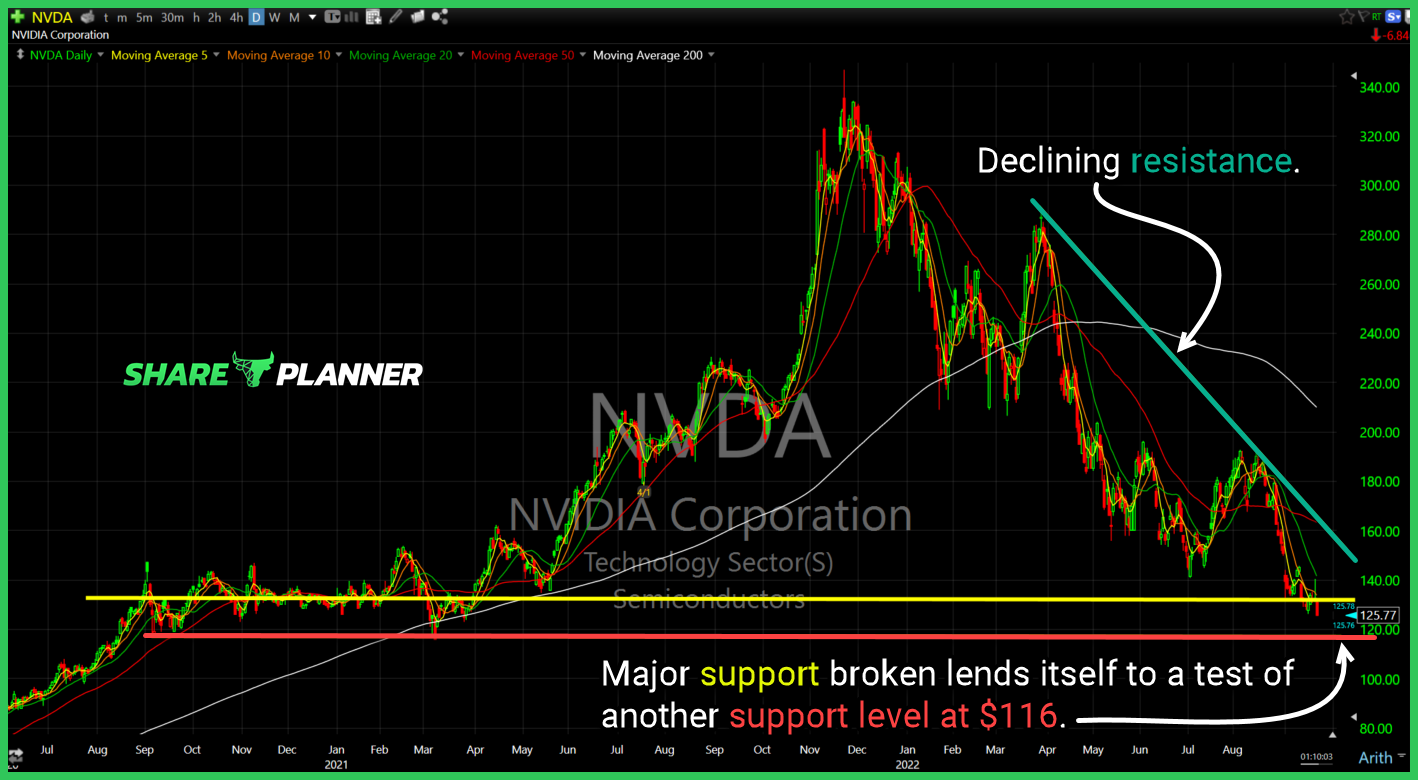

$NVDA major support broken lends itself to a test of another support level at $116.

Do or Die for $GLD. Double top pattern, followed by two years of price level support and a 4 year trend-line that has converged. If they break, I expect $GLD to see $136.

Even if $AMD breaks out of bull flag pattern there are multiple layers of resistance overhead that could cause problems for price.

$TSLA noticably down on the week despite rising 4 out of the last 5 days.

$EVH fading its breakout of resistance today, but may become a nice bounce play off if it can hold the breakout level.