If $AMD breaks short-term support, I would be looking for the next leg lower to start on the stock. $SPY is trading in the gap now. Nice pullback for $BYD to the lower channel band, but my big concern here is the fact that it has now made to consecutive lower-highs following a bounce. $DWAC

$PFE attempting to put in a double bottom at the lows for May. $AMD filling that gap, with little support underneath.

$BTC.X nearing a breakout through year-long resistance. $SOFI coming up on a key support level at the 38.2% retracement level that it will need to bounce from, otherwise, likely looking at a 50% retracement in the $7.30's. $PAYC rejected at the declining trend-line, now retesting support at the breakout. Watch to see if it can

$ENVX inverse head and shoulders trying to hold the breakout into the close. $AMD with a potential retest of short-term support, that if broken, likely leads to a gap fill. $HOOD holding up well following its triple bottom breakout this week.

$AMD double top forming, and would confirm if it gets back into the gap. Still some ways to go before confirming, but worth keeping an eye on. Heavy layer of resistance for $AMC should it continue to push higher that has rejected price on four previous occasions. $XLB with a Decisive break of the declining

$XLK fighting a major resistance level that goes back for the past year.

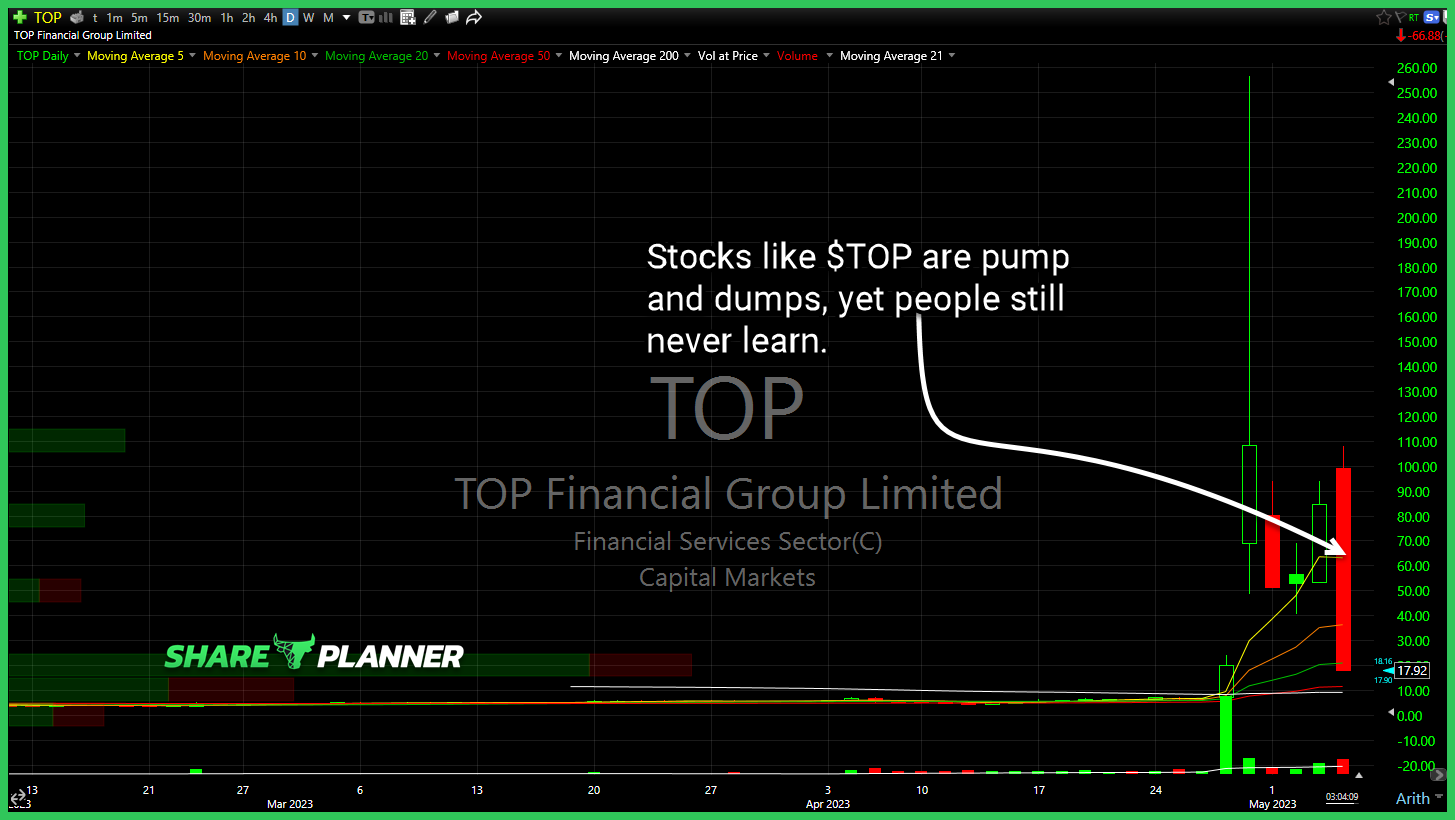

Stocks like TOP Financial Group (TOP) are pump and dumps, yet people still never learn. They still have to chase and then blame the boogeyman when it doesn't work out. Bearish Big move out of Advanced Micro Devices (AMD) on Microsoft (MSFT) news, but still within the short-term declining channel. Considering there hasn't been a

Multiple support levels on Airbnb (ABNB) breaking yesterday and today. Potential for a sub-100 move from here. Alphabet (GOOGL) breakout above resistance was a big one today. Anheuser-Busch (BUD) with bull flag pattern forming, following an impressive rally off the March lows. I'm watching for Charles Schwab (SCHW) to retest the rising trend-line for '12

Salesforce (CRM) sneaking into the gap for the attempted fill. Heavy resistance starting to mount for Apple (AAPL). CBOE 10 year Treasury Yield Index (TNX) attempting to hold support at its breakout level. Advanced Micro Devices (AMD) breaking out above short-term declining resistance. Snap (SNAP) heading towards a major layer of resistance around $12.50. Loving

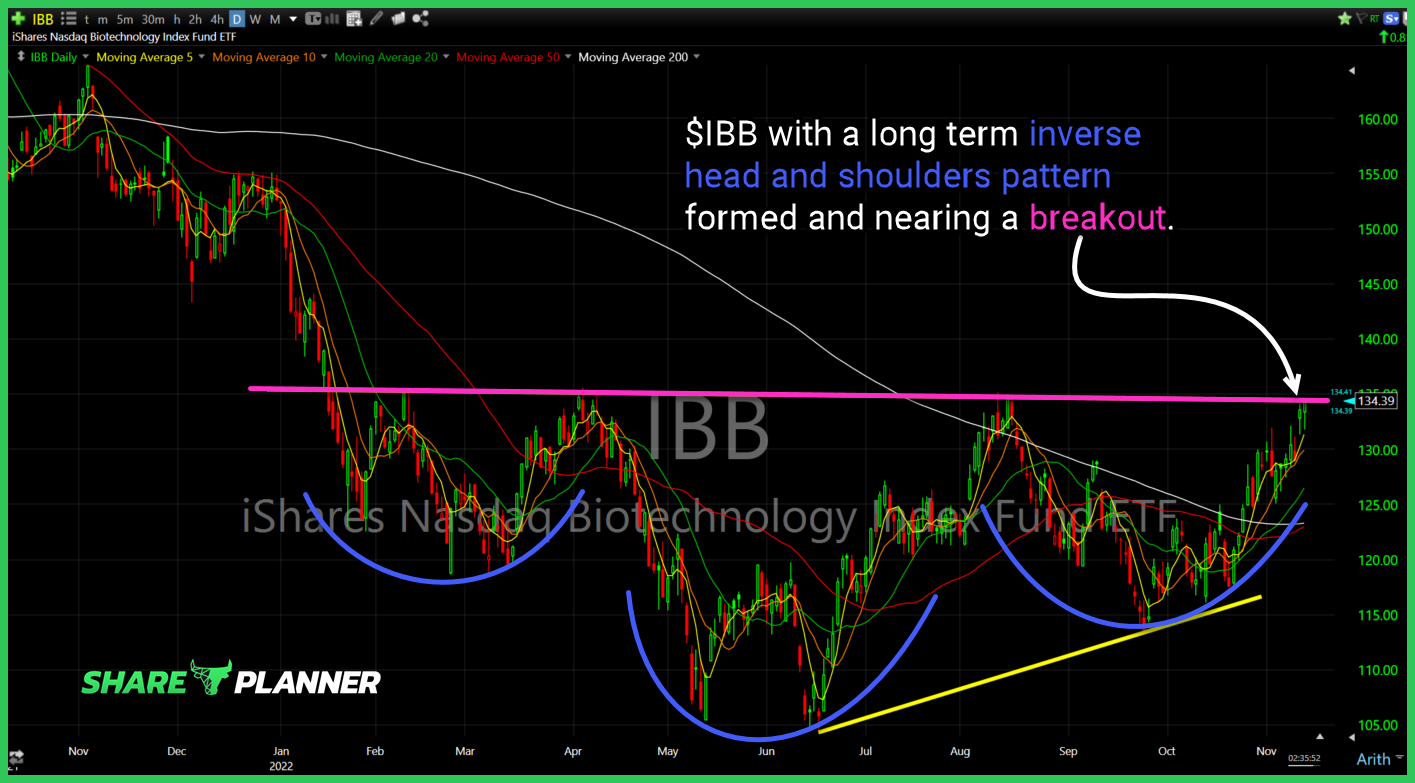

$IBB with a long term inverse head and shoulders pattern formed and nearing a breakout.