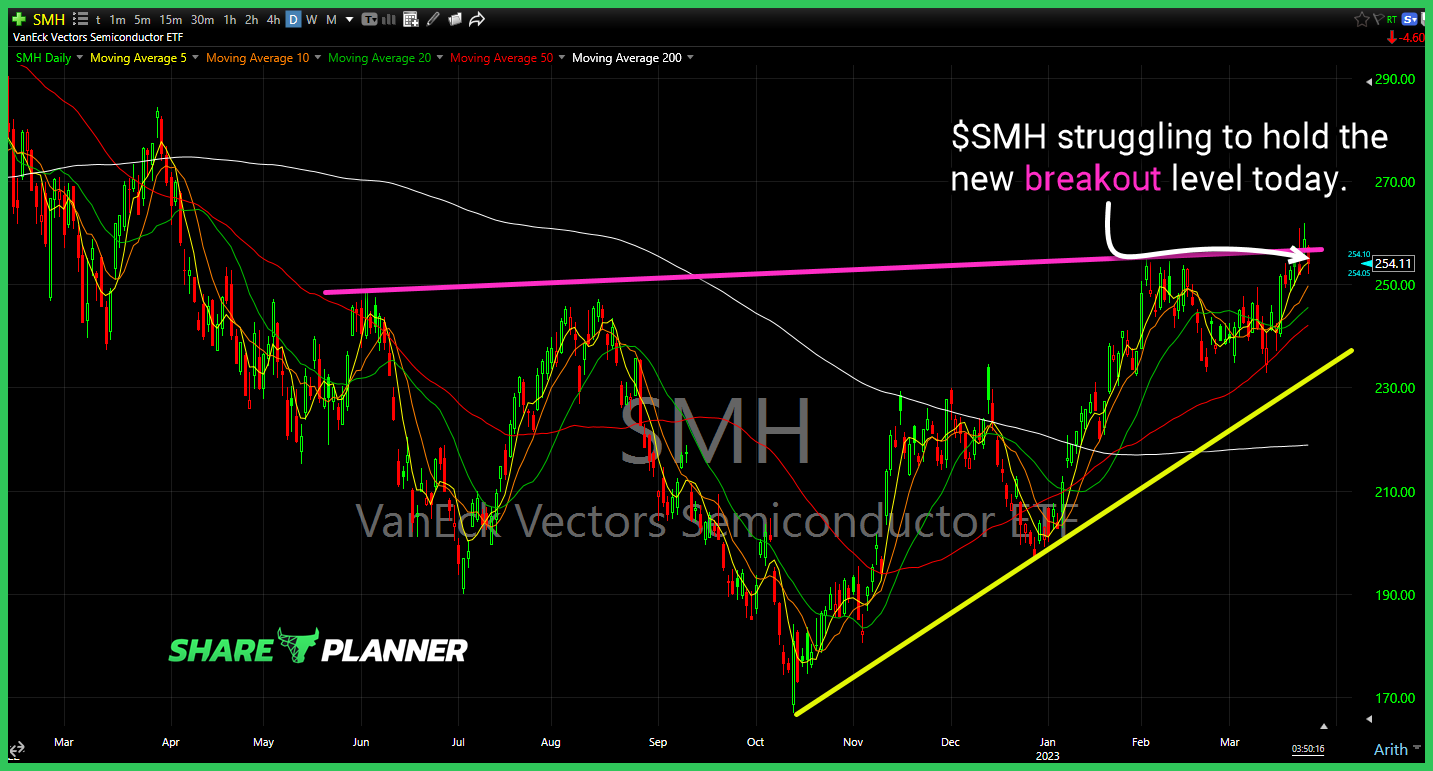

Semiconductors ETF (SMH) struggling to hold the new breakout level today. Nice basing pattern in Intel (INTC) worth watching in the week ahead. Could see a breakout AMC Entertainment (AMC) up 4 of the last 5 days, but despite that, a bear flag has been forming. Robinhood Markets (HOOD) nearing a test of its rising

$NIO key long-term support getting a major test today. So important that it bounces right here.

Workday (WDAY) price action attempting to hold the breakout level. Watch for whether it can bounce here. Pfizer (PFE) head and shoulders pattern confirmed, breaking through neckline. Ocular Therapeutix (OCUL) bull flag right beneath major double bottom breakout resistance. AMC Entertainment (AMC) nearing a multi-month base breakout. A high risk stock with a

Careful with Luminar Technologies (LAZR) despite the monster rally today that places price right at declining resistance. Adobe (ADBE) on watch for whether it attempts to bounce off of support. Semiconductors ETF (SMH) looking like it may try pulling back to its rising trend-line. AMC Entertainment (AMC) headed towards a test of major resistance. A

$AMC running hot into heavy layers of resistance. Just like previous runs, its a sucker’s rally that will cost traders a lot of their capital…again.

Episode Overview Ryan takes on a question from a listener in Australia about the gambling aspects of trading in the stock market (or crypto, forex, or any other trading vehicle for that manner) and whether it may in fact be a moral hazard to engage in. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

Multi-year support level on $AMZN getting tested here.

Episode Overview If you find you didn't make much this year, but lived to tell about this Bear Market of 2022, should you just quit and consider swing trading not to be your forte? In this podcast, Ryan offers up some encouragement and retrospection on the year that was one of the craziest on record.

Episode Overview Ryan Mallory talks about the importance of trading without conviction in his stocks and in the stock market, and instead focusing on his conviction for risk management, and the manner in which he swing trades the stock market. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan sets the stage

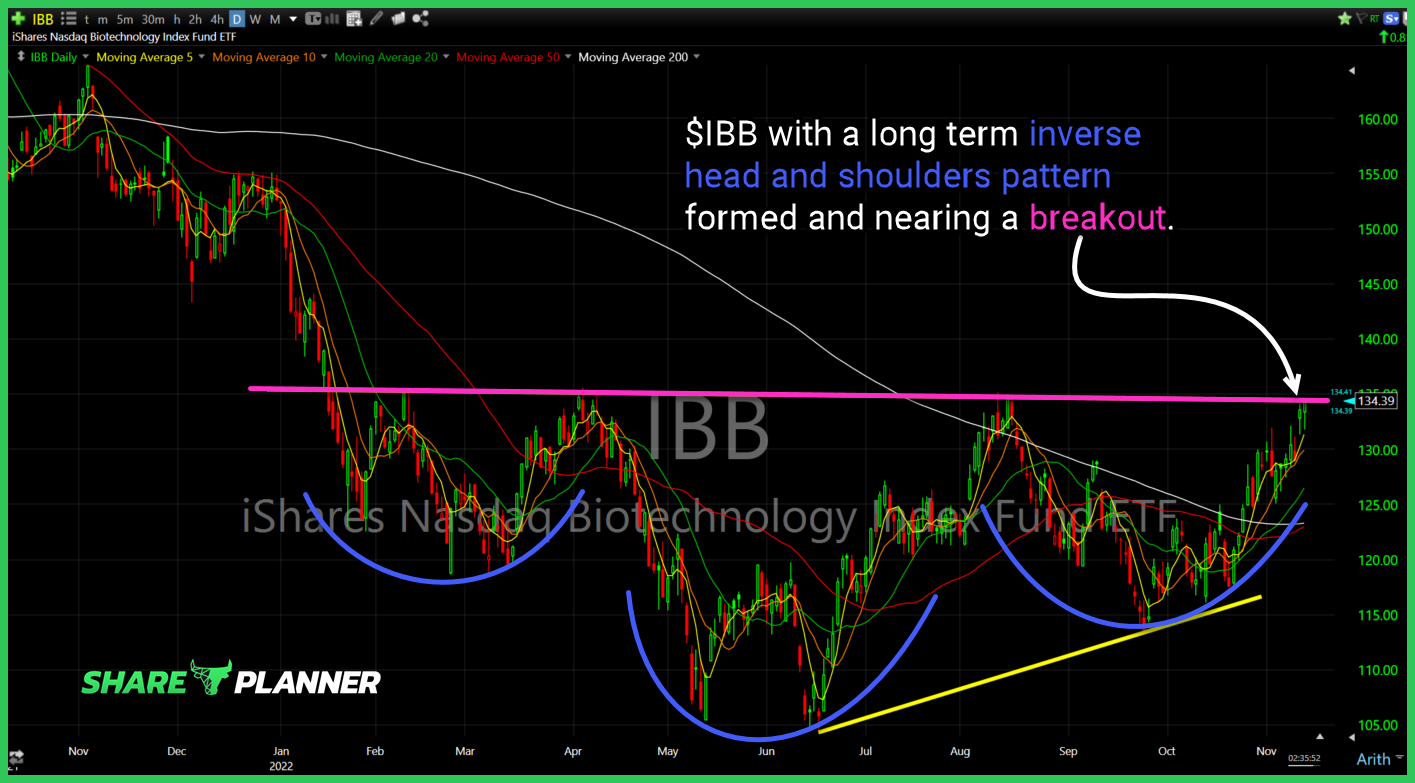

$IBB with a long term inverse head and shoulders pattern formed and nearing a breakout.