$COIN basing well over the last two months, and may finally be nearing a breakout.

Episode Overview How do you control the emotions and anger that comes with bad trades or simply missed profit opportunities? Ryan talks about his journey conquering his anger as it pertains to swing trading the stock market. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Don’t get mad at your stocksRyan tackles

$BIG with heavy resistance overhead with price level and trend-line resistance.

Episode Overview What are some essential tips when it comes to scanning for stocks and how do avoid being stopped out so quickly in a volatile stock market? 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan introduces the episode and shares Bear’s background and questions as a new trader looking to

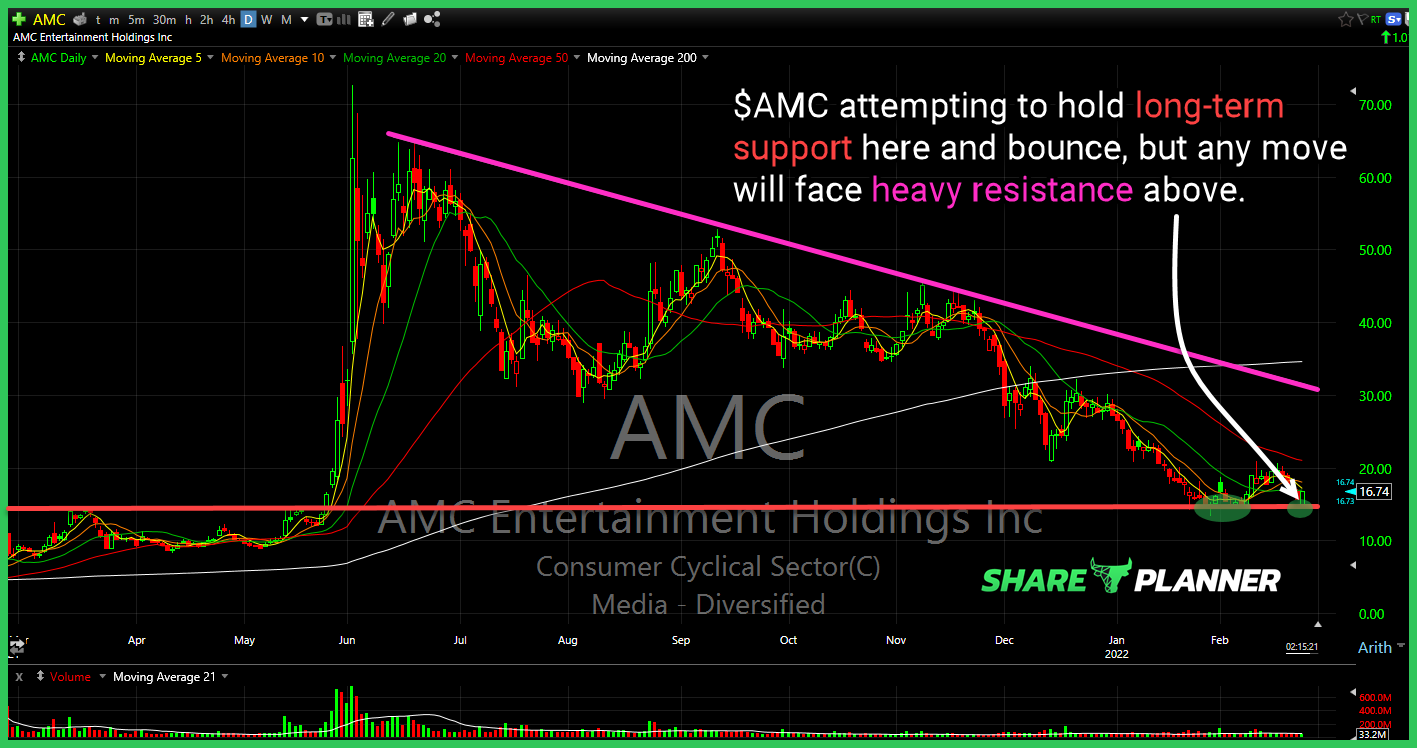

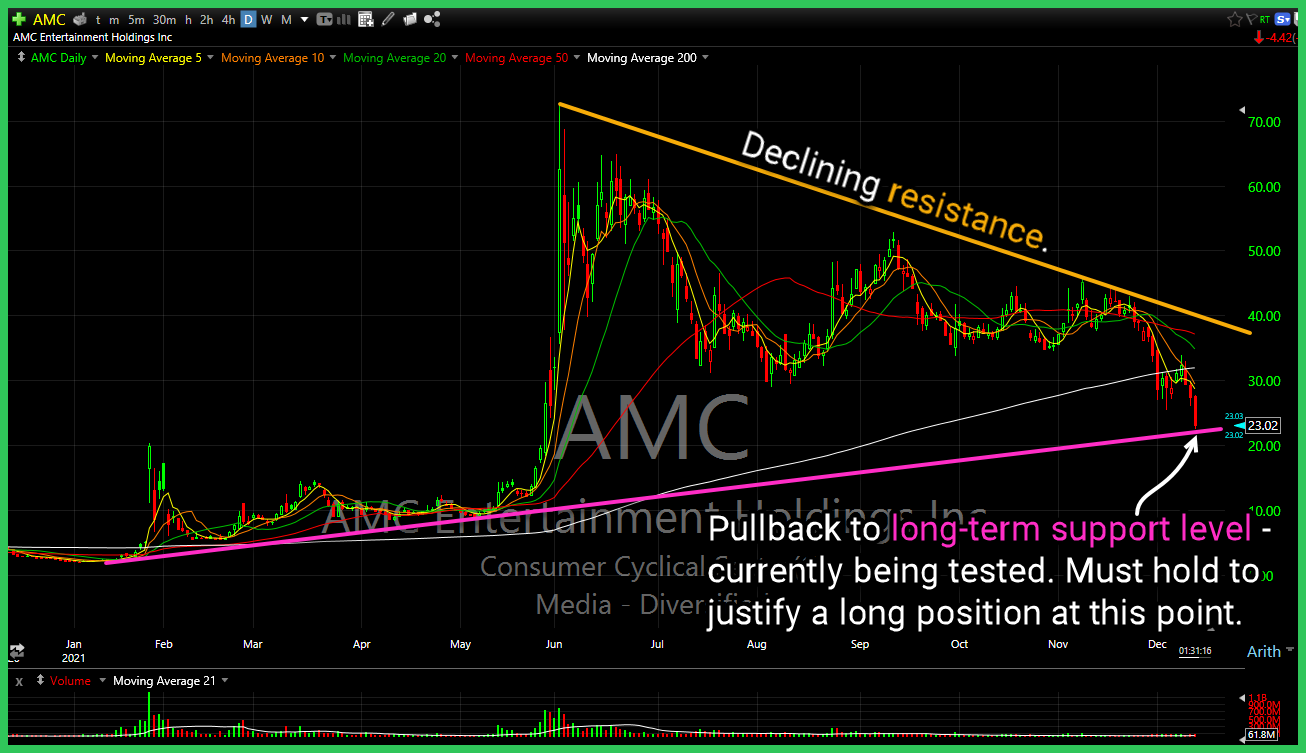

$AMC testing major support here.

$DKNG with a lovely rally today, but it is going to have to break through declining resistance that it is quickly approaching.

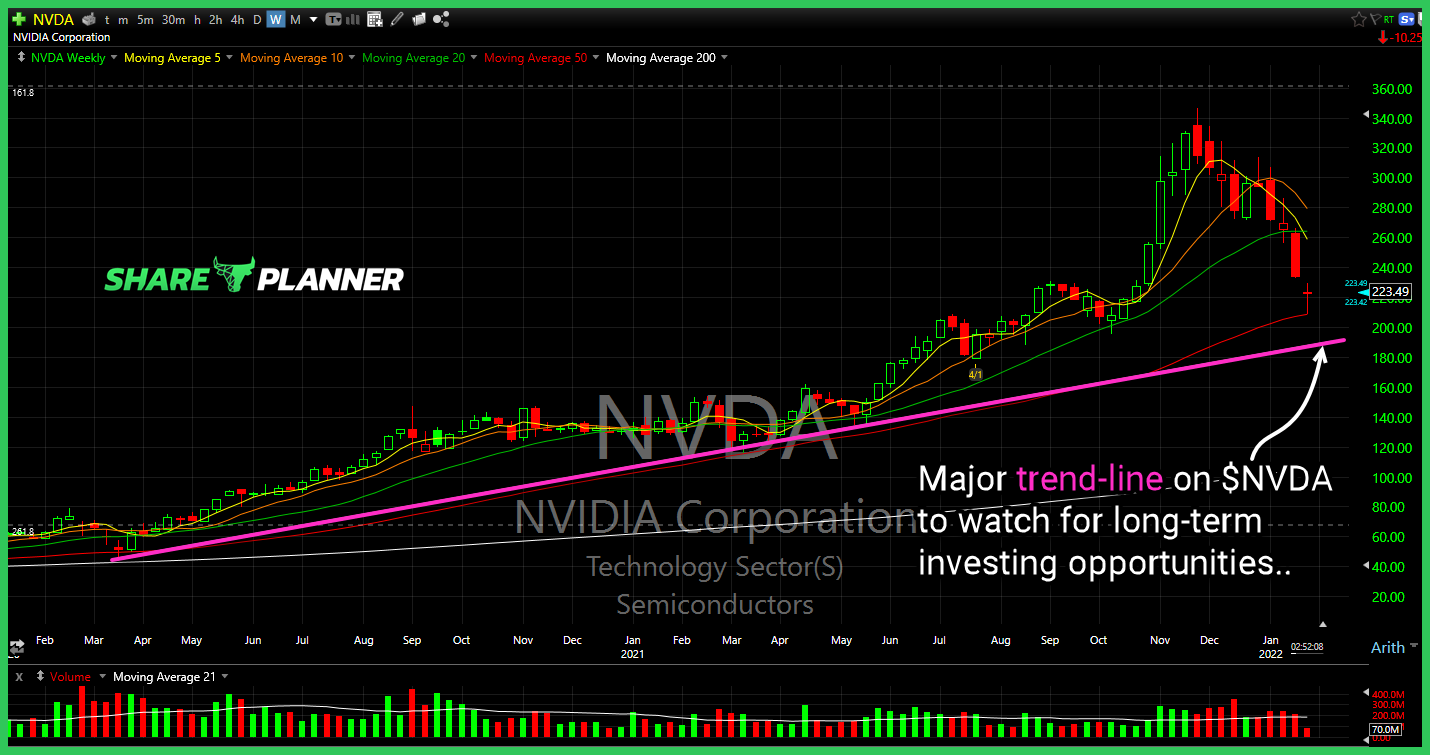

$NVDA long-term trend-line to watch for future long-term investment. A break of the trend-line and then it becomes the $160’s.

Episode Overview What kind of time frame should a trader have for booking profits? How does one determine how long it will take to make their desired amount of profits on the trade. Ryan provides his take on how he determines this and his methods for taking profits on a trade. 🎧 Listen Now: Available

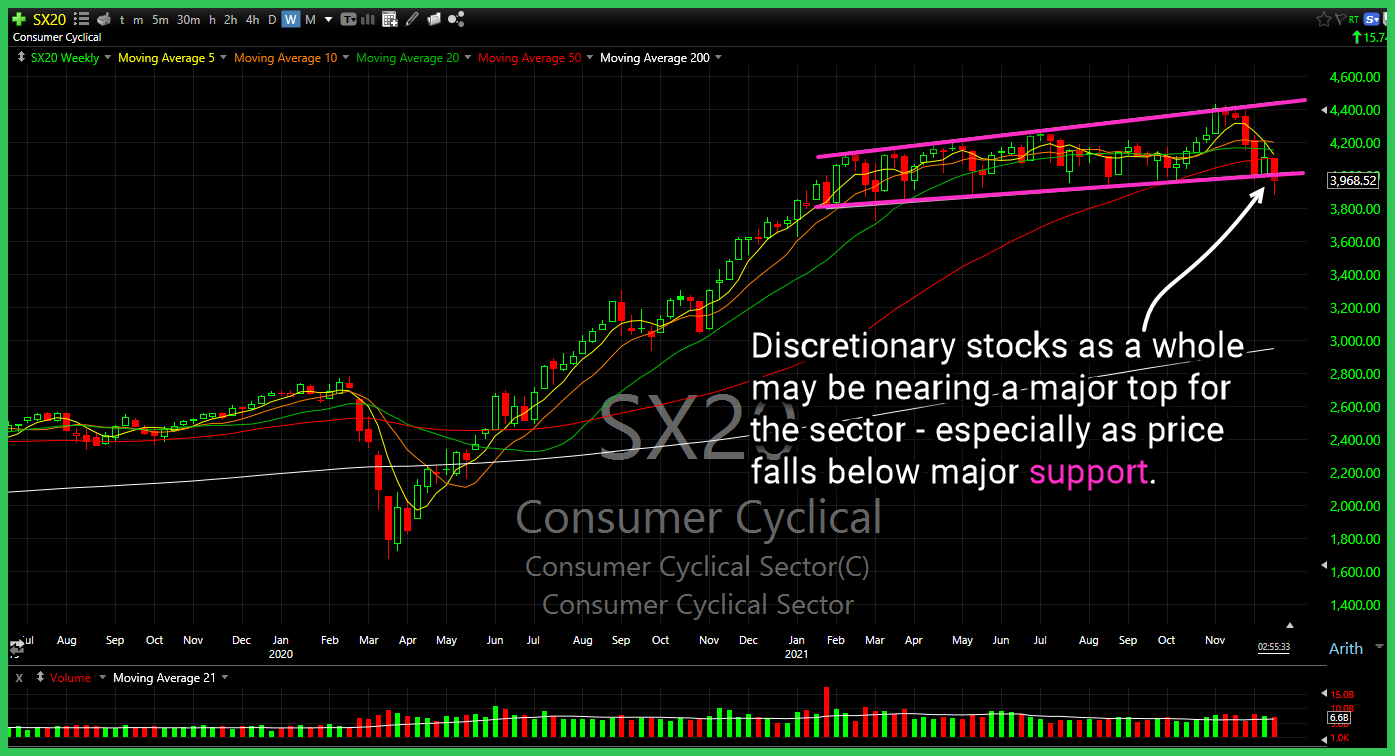

Discretionary as a whole, looking very vulnerable on the daily and weekly charts. Close to breaking major support here. $XLY

AMC Entertainment (AMC) pulling back to its long-term trend-line. Bulls are in a do-or-die moment here for the stock, as a move below $10 becomes much more likely, if the trend-line fails to hold. Discretionary ETF (XLY) with a double top trying to confirm. Target (TGT) Textbook double top forming, but shorting it here, could