As I always try to do, when we are selling a bit of heavy selling, I’ve provided for you a handful of stocks that are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its

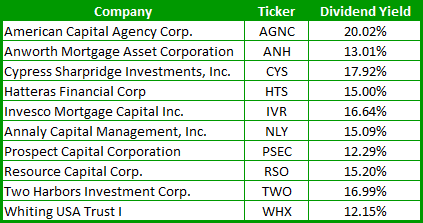

You’ll find that the stocks below are sporting some pretty nice dividends, but don’t just dive into one of the stocks listed below without doing first the necessary due diligence required. With the recent market rally, a lot of dividends have been diluted due to price appreciation, so the best strategy going forward is to

Below are a list of small-cap stocks that have been heavily shorted by the street, and should the market continue to rally, these stocks could see their share price launch into the stratosphere (if they haven’t begun so already) because of the bears being forced to cover their short positions in the stock. Based on

This is by far, one of my favorite stocks screens that I run. I have probably found more winning stocks (and big % ones at that) off of this screen, than any other one that I run. In fact, TICC, mentioned below, is one that appeared on this screen about a month and a half

Here’s one of your more traditional “Buffett-like” stock screens where I am essentially looking for companies selling well below their book value. With the market being as overbought as it currently is, it would be nice to find those stocks that are still considered under-valued. The stocks below represent those companies that are trading at

This market has been on one heck of a rally, and recently, as of yesterday, broke through some pretty significant resistance levels. I’m sure though that there are some out there that are a bit hesitant about getting to aggressive with their long positions. As a result you might be looking for those stocks that

This is one of the relatively new stocks screens that I have rolled out in the past month, which is a good way to find those stocks starting to catch some momentum to the upside. use to you in finding stocks that should start catching a bid. This is similar to its sister-screen that I

There are some bearish divergences out there indicating that this market could reverse course and allow for us to see a pullback of sorts in the very near future. While I don’t rule that out, I think the odds are we move higher, and I have positioned my portfolio accordingly. Below you will find a handful

From a market standpoint, we didn’t move much last week, but on a day-to-day basis the whipsaws the market experienced was something to marvel at. Examining the market as a whole, there still really isn’t much reason to be bearish on this market, and after Friday’s decent rally, there still seems to be a lot

By far one of my best screens in determining who is buying what on the street! What you will find are those stocks that, among other variables that I use, 1) Gaining an increased amount of coverage by brokerage firms and analysts, and 2) Being upgraded on a regular basis. This is a good screen to