Rough day in the markets for the bulls today, has a lot of people trying to lessen their risk exposure and climb in some more defensive plays like the ones below, that trade with low betas and have managed to keep a healthy chart over the past few months. They also payout some pretty solid

Unlike any of my other screens, this screen focuses on stocks trading under $10/share, and has a market cap under $1 billion, too. As for the variables that I used in the screen, I focused on fundamentals, particularly companies that have a healthy balance sheet with little debt to speak of, with a strong prospect

What we have below is a handful of stocks that are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. As I thumbed through the different charts I noticed stocks trading at its peak and finally showing some vulnerability, and on

The screen below are for those stocks that have been on a solid uptrend of late, but are starting to show signs of breaking down along with a loss of interest by the street as a whole. So if you are looking to short this market, use the list below as bit of a primer

Here’s this month’s Best and Worst Industry performance. Despite the strong performance of the broader market, there was a few industries that put in a really nast performance – namely Home Health Care and Toy & Hobby Stores, the latter of which is consistently on either the best or worst performers list, month in and

Here’s one of your more traditional “Buffett-like” stock screens where you are essentially looking for companies selling well below their book value. Many of these stocks lately have been getting knocked down pretty hard and even some of the more well managed companies are getting extremely cheap relative to their book-price (the value of the

The market is just about as unpredictable as it can possibly be right now, and where it goes ultimately is anyone’s guess. Despite the bi-polar personality that Mr. Market has been exhibiting lately, the stocks listed below remain on a firm uptrend, and any storm that comes its way, it weathers quite nicely. So if

Here are 9 stocks that the street is continuing to get more and more bearish on since the beginning of this year. Their short interest has continued to rapidly increase against their historical norms, and should be the leaders to the downside in any surprising bearish behavior that we might get out of this market

Below are a list of small-cap stocks that have been heavily shorted by the street, and should the market or the individual stock start rallying, could really see its share price launch into the stratosphere because of the bears being forced to cover their short positions in the stock. Over the past couple of weeks

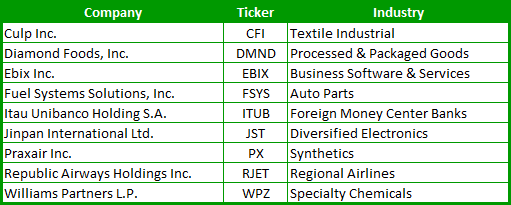

Below is a list of 9 potential takeover targets based on value and the ability to acquire the company. I do try to limit the size of the company so that there isn’t anything like a Wal-Mart or Microsoft included. But all of the companies are ‘acquirable’ and have solid financials that would make them