This is one of the relatively new stocks screens that I have rolled out over the past month or so, which is useful for finding those stocks starting to catch some momentum to the upside. This is similar to its sister-screen that I call “Stocks That Are Breaking Down”. With earnings season in full-swing, you

Below are a list of small-cap stocks that have been heavily shorted by the street, and should the market continue to rally, these stocks could see their share price launch into the stratosphere (if they haven’t begun so already) because of the bears being forced to cover their short positions in the stock. Based on

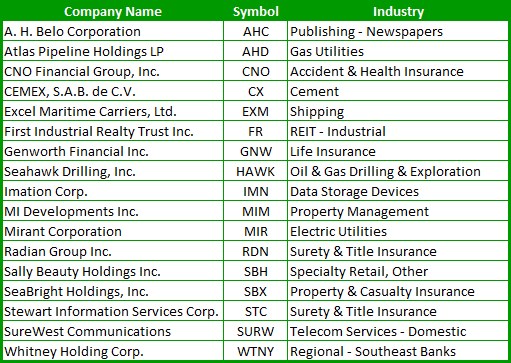

Here’s one of your more traditional “Buffett-like” stock screens where I am essentially looking for companies selling well below their book value. With the market hovering in overbought territory lately, it would be nice to find those stocks that are still considered under-valued. The stocks below represent those companies that are trading at less than

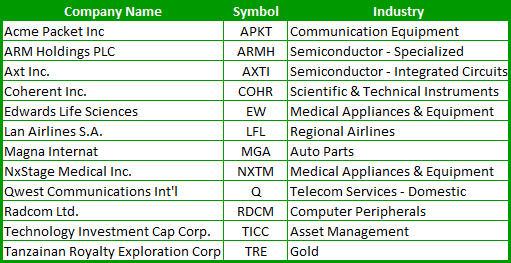

This is by far, one of my favorite stocks screens that I run. I have probably found more winning stocks (and big % ones at that) off of this screen, than any other one that I run. In fact, TICC, mentioned below, is one that appeared on this screen about two months ago, and I

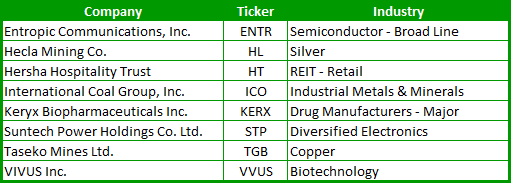

Unlike any of my other screens, this screen focuses on stocks trading under $10/share, and has a market cap of around $1 billion or less. As for the variables that I used in the screen, I focused on fundamentals, particularly companies that have a healthy balance sheet with little debt to speak of, with a

The market has become a bit choppy over the past couple of sessions, some are calling for a top, while others believe that it is just a hiccup before staging the next leg up in this impressive rally. No one knows for certain. But you might be one of those looking for stocks that doesn’t see

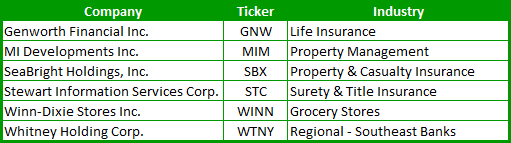

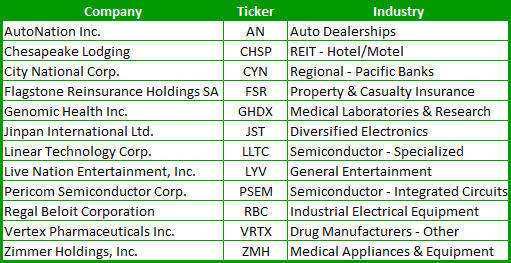

Below is a list of 6 potential takeover targets based on value and the ability to acquire the company. I do try to limit the size of the company so that there isn’t anything like a Wal-Mart or Microsoft included. But all of the companies are ‘acquirable’ and have solid financials that would make them

The market is acting like a hired assassin this morning and I for one am not enjoying it the least bit. I was stopped out of a number of positions at the market open, which stinks, but I’ll just have to learn from it and move on. I got knocked out of ANN, QQQQ, BRKR,

This is one of the relatively new stocks screens that I have rolled out over the past month, which is useful for finding those stocks starting to catch some momentum to the upside. This is similar to its sister-screen that I call “Stocks That Are Breaking Down”. With earnings season in full-swing, you will want

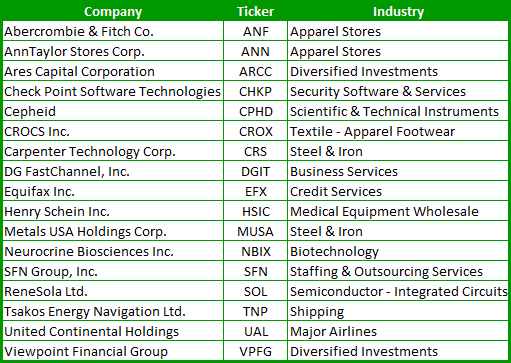

By far one of my best screens in determining who is buying what on the street! What you will find are those stocks that, among other variables that I use, 1) Gaining an increased amount of coverage by brokerage firms and analysts, and 2) Being upgraded on a regular basis. This is a good screen to