The Chart of the Day… Trades Made Today: 1. Bought GFA at $4.48 2. Shorted ACTV at $12.17 3. Shorted INVN at $12.14 Quick Glance at the Market Heat Map and Industries Notables: Quirky day – Technology still lagging But Financials and Basic Material led the way – which is typically very bullish. Consumer

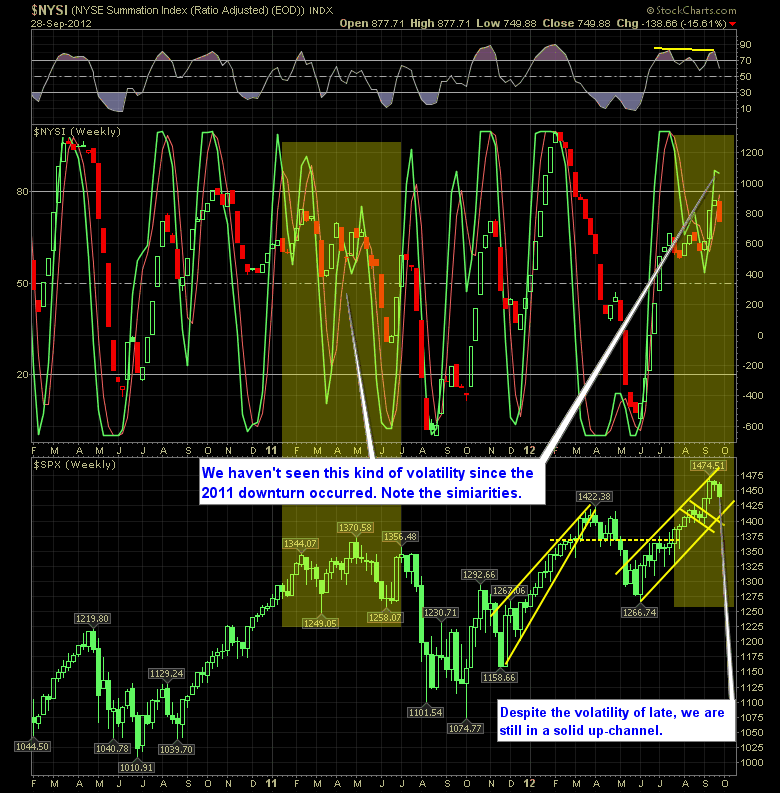

Despite the unexpected twists & turns from the SharePlanner Reversal Indicator of late, it is important to note that this kind of volatility hasn’t happened since the 2011 topping process that led to a huge sell-off in equities. Perhaps this is another early warning sign like 2011 that began forming the topping process to a

The Chart of the Day… From SocialTrade Trades Made Today: 1.Sold WYNN at $114.90 for a 6.9% gain 2. Added GRPN long at $4.88 3. Shorted INVN at $12.14 4. Re-added WYNN long at $115.42 5. Added TTM long at $25.50 Quick Glance at the Market Heat Map and Industries Notables: Despite a respectable

The Chart of the Day… A back drop against an Apple chart of the shipments flooding FedEx is enough to bridge the gap between fundamental and technical analysis Quick Glance at the Market Heat Map and Industries Notables: Technology and Basic Materials dragged the market lower today. Utilities and Health Care were flights to safety

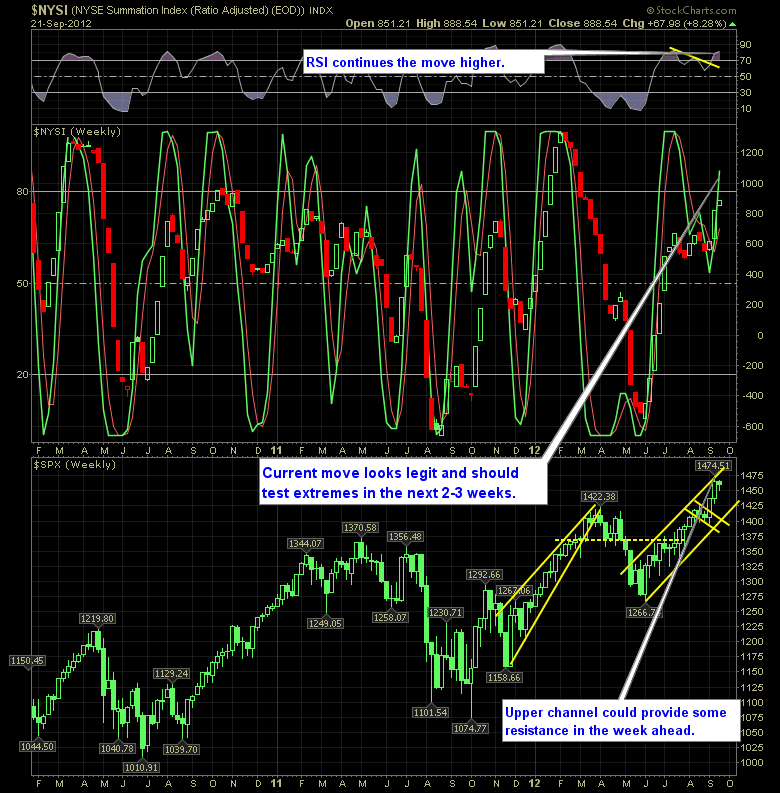

Nothing short of a dull week, the market did absolutely nothing after having a breakout the week prior that completely changed the tone of the market in the bull’s favor. So with about five days of consolidation behind us, it would be logical to surmise that we are likely to see a move in the

The Chart of the Day… Not the first time nor the last time this will happen. Still made 4.3% on the trade. Quick Glance at the Market Heat Map and Industries Notables: Spots of weakness in each of the sectors. Oil showing some signs of bottoming. Financials though still having a rough go of it

The Chart of the Day… Not trying to be political here… but geez…in trading terms we’d call that a “Sell-Off”. Quick Glance at the Market Heat Map and Industries Notables: Technology still having a rough go of it. Financials led the way downward. Oil improved from recent days, but need to see more strength from

The Chart of the Day… Quick Glance at the Market Heat Map and Industries Notables: If this market is going to recover, then you can’t have the entire oil industries stinking it up. One too many leaders in Tech struggling today – like oil, this needs to change. Financials looked better today, and Services

Pre-market update (updated 8:30am eastern): European markets are trading 0.2% higher. Asian markets finished 1.0% higher on the day. US futures are trading slightly above break-even. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Housing Starts (8:30am), Existing Home Sales (10am), EIA Petroleum STatus Report (10:30am) Technical Outlook (SPX): Day #2

The Chart of the Day… This comes from yesterday’s market action, but I still wanted to show you this incredible action on the 1-minute chart and how quickly the commodity dropped. It also shows the importance for stop-losses at all times. Quick Glance at the Market Heat Map and Industries Notables: Some of the