Pre-market update (updated 8:30am eastern):

- European markets are trading 0.2% higher.

- Asian markets finished 1.0% higher on the day.

- US futures are trading slightly above break-even.

Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Housing Starts (8:30am), Existing Home Sales (10am), EIA Petroleum STatus Report (10:30am)

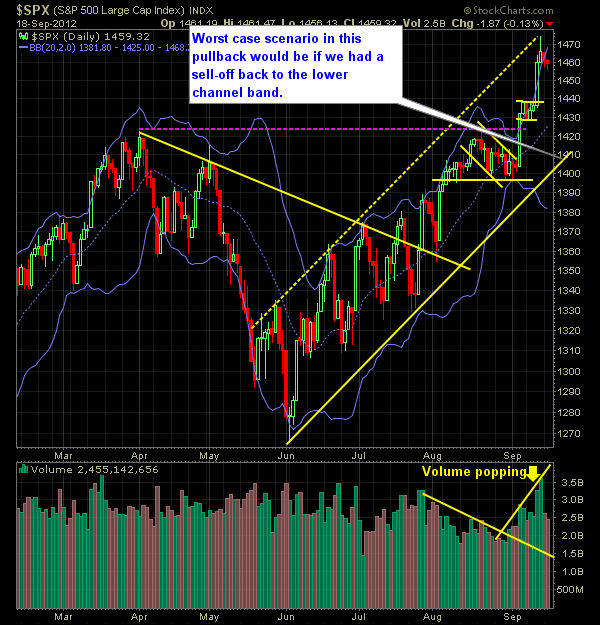

Technical Outlook (SPX):

- Day #2 on the market pullback. Overall there was no sign of panic or change in behavior for the market.

- Volume on SPX over the past two days during the sell-off has been incredibly low, which further validates that this pullback is temporary.

- We are also no longer short-term overbought as we had been in recent days.

- 30-minute chart of SPX shows a very nice bull-flag that has been formed this week.

- Last two days have seen buying power emerge in the afternoon, which shows us that there is underlying buying strength in this market still.

- Price action pulled back inside of the upper bollinger-band.

- Fed’s QE3 launch is going to add a lot of buying power to this market and drive more people out of interest-bearing assets and into equities in search of some kind of return.

- Going back years, there really is little in the way of resistance for the markets until it tests 1500.

- Resistance at 1437 and 1440 was broken with little problem and now becomes support.

- Upward trend-line off of the 6/4 lows has rising support at 1405.

- SharePlanner Reversal Indicator confirmed the move higher this past week.

- VIX dropped despite the market finishing higher yesterday .Rests at 14.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- If another sell-off were to ensue, watch for a break and close below 1396 for a new lower-low in the market.

My Opinions & Trades:

- Covered position in PRGO at $114.68 for a -1.3% loss.

- Stopped out of GMCR at $30.39 for a -4.3% loss.

- Bought SHLD at $61.10.

- Current stop-losses have been adjusted across the board.

- ALXN stop-loss moved up to $110.00

- Stop-loss for NLSN at $29.30.

- Stop-Loss for WYNN increased to $110.50.

- Stop-Loss for BEAV adjusted to $40.90.

- Remain long GTAT at $6.73, BEAV at $40.75, WYNN at $107.47, NLSN at $28.70, and ALXN at $102.53

- Track my portfolio RealTime here.

Charts: